Region:Middle East

Author(s):Shubham

Product Code:KRAC4371

Pages:96

Published On:January 2026

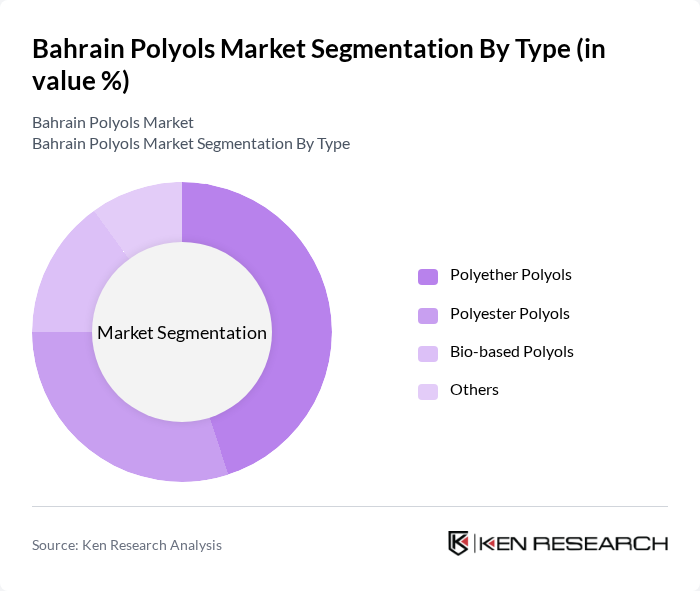

By Type:The market is segmented into various types of polyols, including Polyether Polyols, Polyester Polyols, Bio-based Polyols, and Others. Each type serves different applications and industries, with varying demand based on consumer preferences, regulatory trends, and technological advancements in polyurethane formulations.

The Polyether Polyols segment dominates the market due to its extensive use in flexible polyurethane foams, which are essential in the furniture, bedding, automotive seating, and packaging industries, consistent with the global polyols and polyurethane demand structure where polyether polyols hold the largest share. The increasing demand for lightweight, energy-efficient, and durable materials in automotive, construction, and appliance insulation has led to a surge in the consumption of polyether polyols. Additionally, advancements in production technologies and formulation know?how have improved the efficiency, consistency, and cost-effectiveness of these polyols, including low-VOC and higher-performance grades, further solidifying their market leadership in Bahrain in line with broader regional trends.

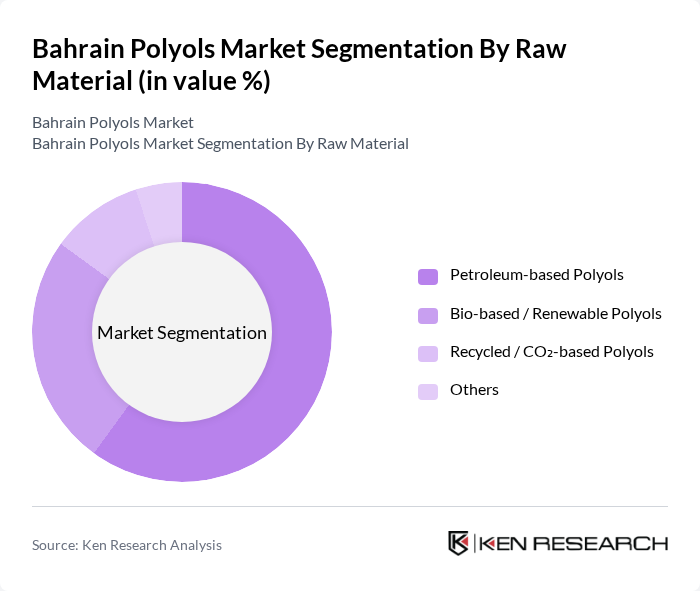

By Raw Material:The market is categorized based on the raw materials used, including Petroleum-based Polyols, Bio-based / Renewable Polyols, Recycled / CO?-based Polyols, and Others. This segmentation reflects the growing trend towards sustainability and the use of renewable or circular resources in polyol production, as seen in global and regional markets for green and bio-based polyols.

The Petroleum-based Polyols segment holds a significant share of the market due to its established global production base, mature supply chains, and widespread application in rigid and flexible polyurethane foams, coatings, adhesives, sealants, and elastomers. However, the increasing focus on sustainability and carbon reduction, supported by the rapid growth of the green and bio polyols market worldwide, is driving the expansion of bio-based and recycled/CO?-based polyols, as consumers, brand owners, and manufacturers seek environmentally responsible alternatives and improved life?cycle footprints. This shift is expected to influence Bahrain’s polyols market dynamics, particularly in applications where OEMs and downstream users are aligning with global automotive, construction, and packaging sustainability commitments.

The Bahrain Polyols Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Huntsman Corporation, Covestro AG, Repsol S.A., Shell Chemicals, LG Chem Ltd., Mitsui Chemicals, Inc., Cargill, Incorporated, Perstorp Holding AB, INEOS Group Holdings S.A., SABIC, Eastman Chemical Company, Kraton Corporation, Celanese Corporation contribute to innovation, geographic expansion, and service delivery in this space, in line with their established roles in the global polyols and polyurethane industry.

The Bahrain polyols market is poised for significant growth, driven by increasing demand for sustainable materials and the expansion of key industries such as construction and automotive. As companies invest in research and development, technological advancements are expected to enhance production efficiency. Furthermore, the growing consumer awareness regarding product safety and environmental impact will likely shape market dynamics, pushing manufacturers to innovate and adopt eco-friendly practices. Strategic partnerships will also play a crucial role in navigating challenges and seizing opportunities in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyether Polyols Polyester Polyols Bio-based Polyols Others |

| By Raw Material | Petroleum-based Polyols Bio-based / Renewable Polyols Recycled / CO?-based Polyols Others |

| By Application | Flexible Polyurethane Foam Rigid Polyurethane Foam Coatings Adhesives & Sealants Elastomers Others |

| By End-Use Industry | Building & Construction Automotive & Transportation Furniture & Bedding Appliances & HVAC Packaging Others |

| By Distribution Channel | Direct Sales to OEMs Distributors / Traders Online / Digital Channels Others |

| By Customer Type | Polyurethane System Houses Formulators & Converters End-use Manufacturers Others |

| By Market Maturity / Adoption Stage | Conventional Petro-based Polyols Transitional (Blend / Hybrid) Polyols Advanced / Specialty & Bio-based Polyols |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Polyol Applications | 120 | Product Development Engineers, Procurement Managers |

| Construction Industry Usage | 90 | Construction Project Managers, Material Suppliers |

| Food & Beverage Sector Insights | 80 | Food Technologists, Quality Assurance Managers |

| Consumer Goods Manufacturing | 100 | Manufacturing Managers, R&D Specialists |

| Market Trends and Innovations | 60 | Industry Analysts, Market Research Professionals |

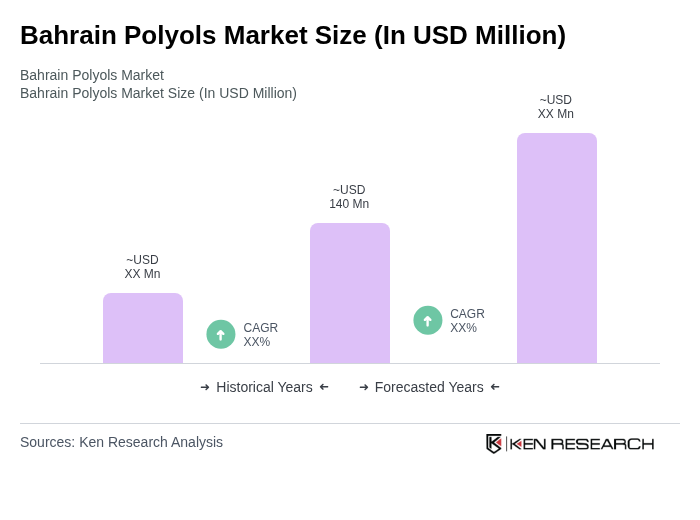

The Bahrain Polyols Market is valued at approximately USD 140 million, reflecting a historical analysis over five years. This valuation aligns with the growth trends observed in Bahrain's specialty polymer and elastomer markets.