Region:Middle East

Author(s):Shubham

Product Code:KRAD1027

Pages:94

Published On:November 2025

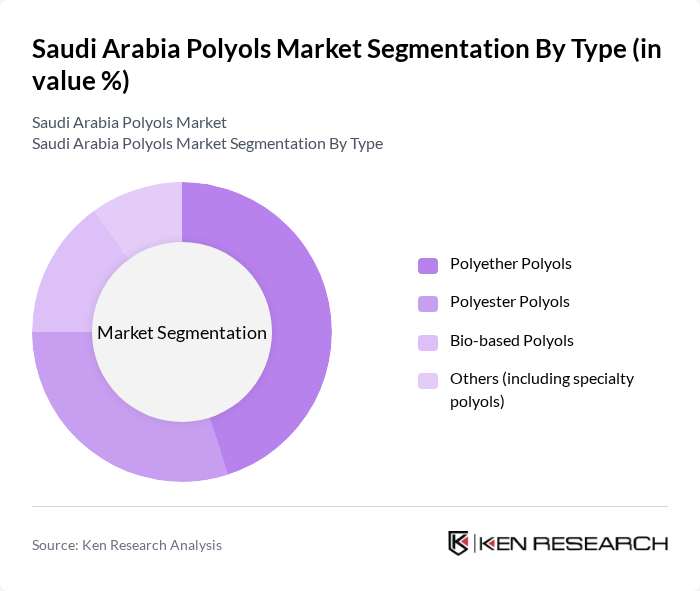

By Type:The polyols market can be segmented into four main types: Polyether Polyols, Polyester Polyols, Bio-based Polyols, and Others (including specialty polyols). Polyether polyols are widely used due to their versatility and cost-effectiveness, while polyester polyols are favored for their superior mechanical properties. Bio-based polyols are gaining traction as sustainability becomes a priority for manufacturers .

Among these,Polyether Polyolsdominate the market due to their extensive application in the production of flexible polyurethane foams, which are widely used in furniture, automotive seating, and insulation. The versatility and cost-effectiveness of polyether polyols make them a preferred choice for manufacturers, driving their market share significantly. The increasing demand for lightweight and durable materials in various industries further solidifies their leading position .

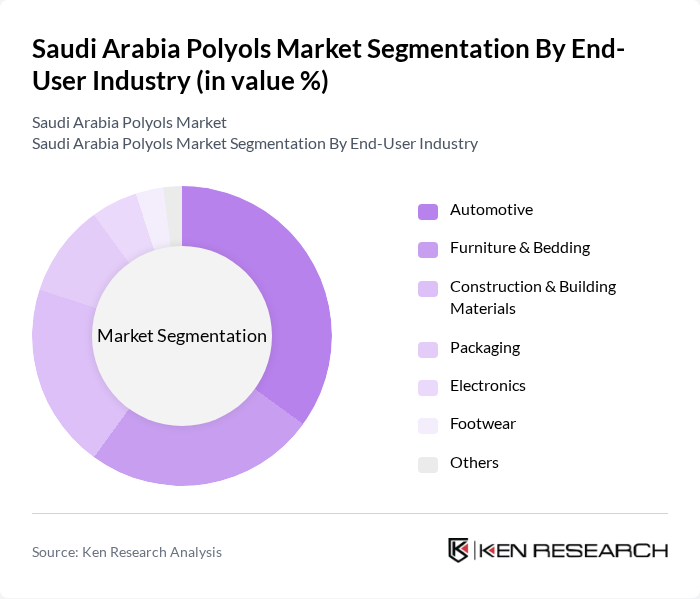

By End-User Industry:The end-user industries for polyols include Automotive, Furniture & Bedding, Construction & Building Materials, Packaging, Electronics, Footwear, and Others. The automotive sector is a significant consumer of polyols, utilizing them in various applications such as seating and insulation materials .

TheAutomotive industryis the leading end-user of polyols, primarily due to the increasing demand for lightweight materials that enhance fuel efficiency and performance. The use of polyols in manufacturing seating, dashboards, and insulation materials has significantly contributed to their market dominance. Additionally, the growing trend towards electric vehicles and the expansion of domestic automotive manufacturing are expected to further boost the demand for polyols in this sector .

The Saudi Arabia Polyols Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Polyols Company, SABIC (Saudi Basic Industries Corporation), BASF Saudi Arabia, Dow Chemical Company, Aramco, Huntsman Corporation, Covestro AG, Repsol, Shell Chemicals, INEOS, LG Chem, Mitsubishi Chemical Corporation, Evonik Industries, Kraton Corporation, Perstorp, Celanese Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia polyols market is poised for significant growth, driven by increasing demand for sustainable materials and the expansion of key industries such as construction and automotive. As companies invest in innovative production technologies and bio-based alternatives, the market is expected to evolve rapidly. Additionally, strategic partnerships and collaborations will likely enhance market competitiveness, enabling firms to better navigate regulatory challenges and capitalize on emerging opportunities in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyether Polyols Polyester Polyols Bio-based Polyols Others (including specialty polyols) |

| By End-User Industry | Automotive Furniture & Bedding Construction & Building Materials Packaging Electronics Footwear Others |

| By Application | Flexible Polyurethane Foam Rigid Polyurethane Foam CASE (Coatings, Adhesives, Sealants, Elastomers) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Others |

| By Product Form | Liquid Polyols Solid Polyols Others |

| By Customer Type | OEMs (Original Equipment Manufacturers) End-users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Polyol Applications | 100 | Product Development Managers, Procurement Specialists |

| Construction Industry Polyol Usage | 80 | Project Managers, Materials Engineers |

| Consumer Goods Polyol Integration | 70 | Brand Managers, R&D Directors |

| Polyol Supply Chain Dynamics | 90 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends and Innovations | 75 | Industry Analysts, Market Researchers |

The Saudi Arabia Polyols Market is valued at approximately USD 265 million, reflecting a five-year historical analysis. This growth is driven by increasing demand in various applications, including flexible and rigid foams, and the rising adoption of bio-based products.