Region:Middle East

Author(s):Rebecca

Product Code:KRAD5019

Pages:89

Published On:December 2025

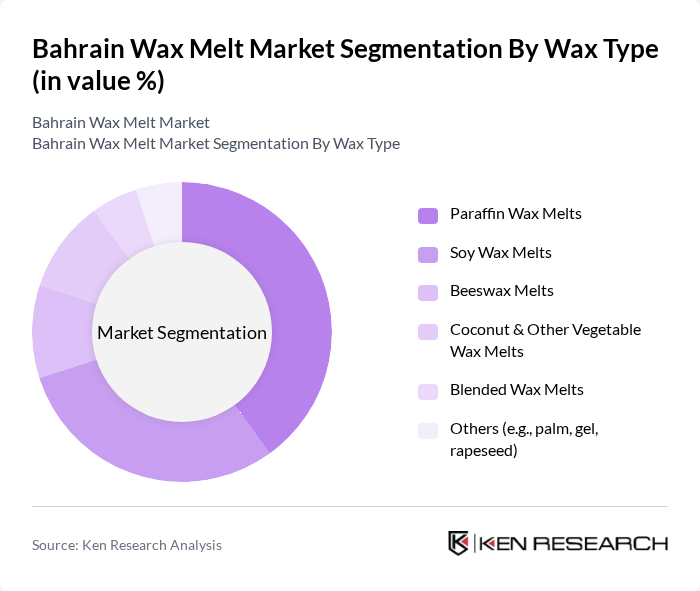

By Wax Type:The wax type segmentation includes various subsegments such as Paraffin Wax Melts, Soy Wax Melts, Beeswax Melts, Coconut & Other Vegetable Wax Melts, Blended Wax Melts, and Others (e.g., palm, gel, rapeseed). Paraffin wax remains widely used in the region due to its cost?effectiveness and availability through petroleum?derived paraffin imports into Bahrain and neighboring GCC markets. Among these, Soy Wax Melts and other vegetable?based waxes are gaining popularity in premium and artisanal offerings due to their eco?friendly positioning, lower soot, and clean?burning properties, appealing to environmentally conscious consumers and aligning with broader EMEA trends toward natural waxes. Paraffin Wax Melts, while still dominant in mass?market and value segments, are facing growing competition as consumers shift towards more sustainable options and as global brands introduce soy, coconut, and blended?wax formulations.

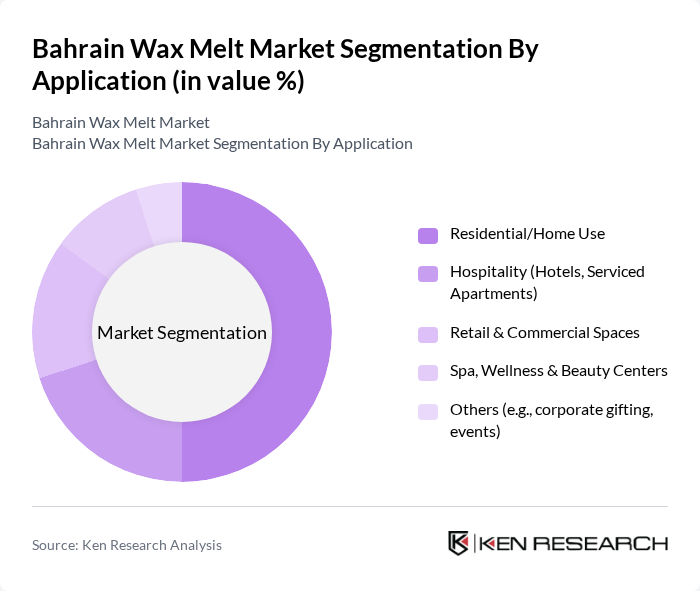

By Application:The application segmentation encompasses Residential/Home Use, Hospitality (Hotels, Serviced Apartments), Retail & Commercial Spaces, Spa, Wellness & Beauty Centers, and Others (e.g., corporate gifting, events). The Residential/Home Use segment is the largest, driven by the increasing penetration of home fragrance products, diffuser and wax?warmer usage, and the trend of spending more time at home, which has boosted demand for room?enhancing and mood?enhancing fragrances. The hospitality sector is also significant, as hotels, serviced apartments, and premium cafés increasingly deploy signature scents and ambient fragrance solutions to create inviting atmospheres for guests, mirroring wider EMEA adoption of wax melts and flameless fragrance systems in commercial environments.

The Bahrain Wax Melt Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bath & Body Works (Middle East/Bahrain), The Body Shop Bahrain, Al Hawaj Group (Distributor of International Home Fragrance Brands), Marks & Spencer Bahrain, IKEA Bahrain, Home Centre (Landmark Group, Bahrain), Daiso Japan Bahrain, Bahrain Duty Free Shop Complex, Arabian Oud, Abdul Samad Al Qurashi, Rasasi Perfumes, Asgharali Perfumes, Ajmal Perfumes, Victoria’s Secret & Victoria’s Secret PINK (Home Fragrance Lines), Local & Artisanal Home?Fragrance Brands in Bahrain (e.g., boutique candle and wax melt makers) contribute to innovation, geographic expansion, and service delivery in this space, leveraging strong regional demand for home fragrance and gifting products.

The Bahrain wax melt market is poised for significant growth, driven by evolving consumer preferences and increasing disposable incomes. As more consumers seek personalized and eco-friendly fragrance options, brands that innovate and adapt to these trends will likely thrive. Additionally, the rise of e-commerce will continue to enhance product accessibility, allowing for greater market penetration. Companies that effectively leverage social media for marketing will also capture the attention of younger demographics, further expanding their customer base.

| Segment | Sub-Segments |

|---|---|

| By Wax Type | Paraffin Wax Melts Soy Wax Melts Beeswax Melts Coconut & Other Vegetable Wax Melts Blended Wax Melts Others (e.g., palm, gel, rapeseed) |

| By Application | Residential/Home Use Hospitality (Hotels, Serviced Apartments) Retail & Commercial Spaces Spa, Wellness & Beauty Centers Others (e.g., corporate gifting, events) |

| By Distribution Channel | Online Retail (Marketplaces & Brand Webshops) Supermarkets/Hypermarkets Specialty Home Fragrance & Gift Stores Department Stores & Lifestyle Concept Stores Others (e.g., pop?ups, fairs, direct selling) |

| By Fragrance Family | Floral Fruity Spicy & Oriental Fresh & Citrus Oud, Amber & Woody Others (e.g., gourmand, marine) |

| By Pack Format | Clamshells & Segment Bars Jars & Pots Tins Pouches/Bags Others (e.g., loose pieces, sampler sets) |

| By Price Band | Economy Mass/Standard Premium Luxury Private Label & Promotional |

| By Consumer Profile | Brand?Loyal Consumers Value & Price?Sensitive Consumers Trend?Driven & Experimenting Consumers Expatriate vs Local Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Wax Melts | 100 | Store Managers, Product Buyers |

| Consumer Preferences for Home Fragrance | 120 | Homeowners, Young Adults |

| Distribution Channels for Wax Melts | 80 | Distributors, Wholesalers |

| Market Trends in Home Fragrance | 70 | Market Analysts, Industry Experts |

| Product Development Insights | 60 | Product Managers, R&D Specialists |

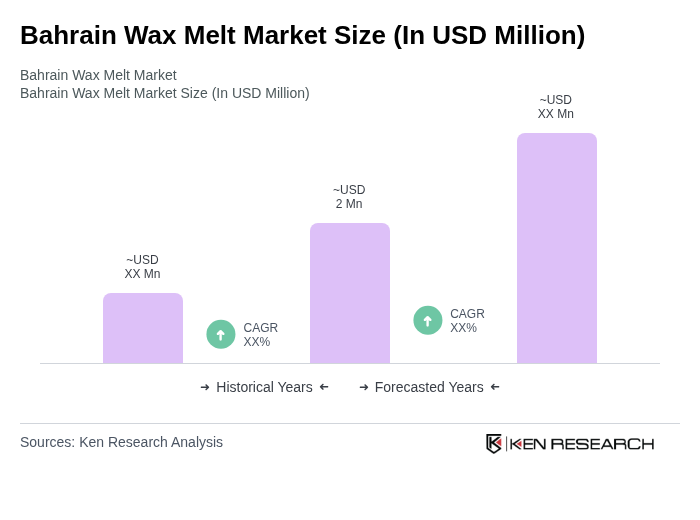

The Bahrain Wax Melt Market is valued at approximately USD 2 million, contributing to the broader Middle East wax melt market, which is estimated at around USD 105 million. This growth is driven by increasing consumer interest in home fragrance products.