Region:Middle East

Author(s):Rebecca

Product Code:KRAD5071

Pages:84

Published On:December 2025

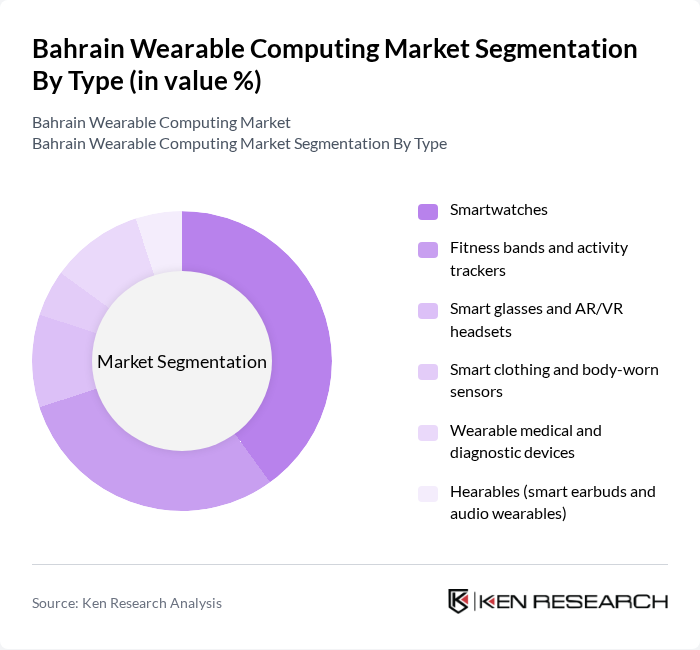

By Type:The wearable computing market can be segmented into various types, including smartwatches, fitness bands and activity trackers, smart glasses and AR/VR headsets, smart clothing and body-worn sensors, wearable medical and diagnostic devices, and hearables (smart earbuds and audio wearables). Among these, smartwatches and fitness bands are the most popular due to their multifunctionality, integration with smartphones, and health-tracking features such as heart-rate, SpO?, sleep, and activity monitoring, which appeal to a broad consumer base focused on fitness and preventive healthcare.

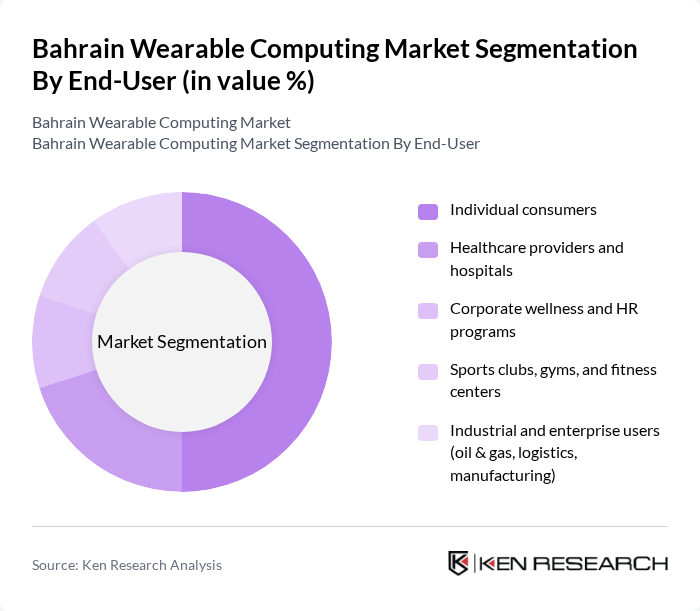

By End-User:The end-user segmentation includes individual consumers, healthcare providers and hospitals, corporate wellness and HR programs, sports clubs, gyms, and fitness centers, and industrial and enterprise users (oil and gas, logistics, manufacturing). Individual consumers dominate the market, driven by increasing health consciousness, broader smartphone and internet penetration, and the desire for personal fitness and wellness tracking, while healthcare providers increasingly adopt wearable medical and diagnostic devices for remote patient monitoring and chronic disease management.

The Bahrain Wearable Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Xiaomi Corporation, Garmin Ltd., Fitbit LLC (Google LLC), Google LLC (including Pixel Watch), Fossil Group, Inc., Sony Group Corporation, Amazfit (Zepp Health Corporation), Polar Electro Oy, Suunto Oy, Jabra (GN Audio A/S), Huawei Consumer Business Group – Middle East & Africa, Batelco (Bahrain Telecommunications Company) – local wearable distribution partner contribute to innovation, geographic expansion, and service delivery in this space, with distribution through telecom operators, electronics retail, and e?commerce channels across Bahrain.

The Bahrain wearable computing market is poised for dynamic growth, driven by technological innovations and increasing health awareness. As consumers become more health-conscious, the demand for advanced wearable devices is expected to rise significantly. Additionally, the integration of artificial intelligence and IoT technologies will enhance user experiences, making wearables more functional and appealing. However, addressing data privacy concerns and reducing device costs will be crucial for sustaining this growth trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartwatches Fitness bands and activity trackers Smart glasses and AR/VR headsets Smart clothing and body-worn sensors Wearable medical and diagnostic devices Hearables (smart earbuds and audio wearables) |

| By End-User | Individual consumers Healthcare providers and hospitals Corporate wellness and HR programs Sports clubs, gyms, and fitness centers Industrial and enterprise users (oil & gas, logistics, manufacturing) |

| By Application | Health monitoring and chronic disease management Fitness and wellness tracking Navigation and location-based services Communication and notifications Enterprise productivity and safety (e.g., industrial wearables, AR support) |

| By Distribution Channel | Online retail and marketplaces Offline consumer electronics and telecom retailers Direct sales through telecom operators Enterprise and B2B channel partners OEM brand stores and regional distributors |

| By Price Range | Entry-level and budget wearables (< USD 100) Mid-range wearables (USD 100–300) Premium wearables (USD 300–600) Luxury and designer wearables (> USD 600) |

| By Technology | Bluetooth-enabled devices Wi?Fi-enabled devices Cellular-enabled devices (4G/5G eSIM) NFC and contactless payment-enabled devices GPS and GNSS-enabled devices |

| By User Demographics | Age group (Children, Youth, Adults, Seniors) Gender (Male, Female, Others) Income level (Mass, Affluent, High Net Worth) Lifestyle segment (Health-conscious, Tech?savvy, Professional, Sports/Outdoor) Nationality (Bahraini nationals, Expatriates) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Wearable Technology Adoption | 120 | Health-conscious Individuals, Tech-savvy Consumers |

| Healthcare Professionals' Insights | 90 | Doctors, Physiotherapists, Fitness Trainers |

| Retailer Perspectives on Wearable Sales | 70 | Store Managers, Sales Representatives |

| Corporate Wellness Program Implementers | 60 | HR Managers, Corporate Wellness Coordinators |

| Technology Enthusiasts and Influencers | 50 | Bloggers, Social Media Influencers, Tech Reviewers |

The Bahrain Wearable Computing Market is valued at approximately USD 40 million, reflecting a five-year historical analysis and recent assessments of the IoT wearable and wearable medical device sectors in Bahrain.