Region:Asia

Author(s):Shubham

Product Code:KRAA1738

Pages:94

Published On:August 2025

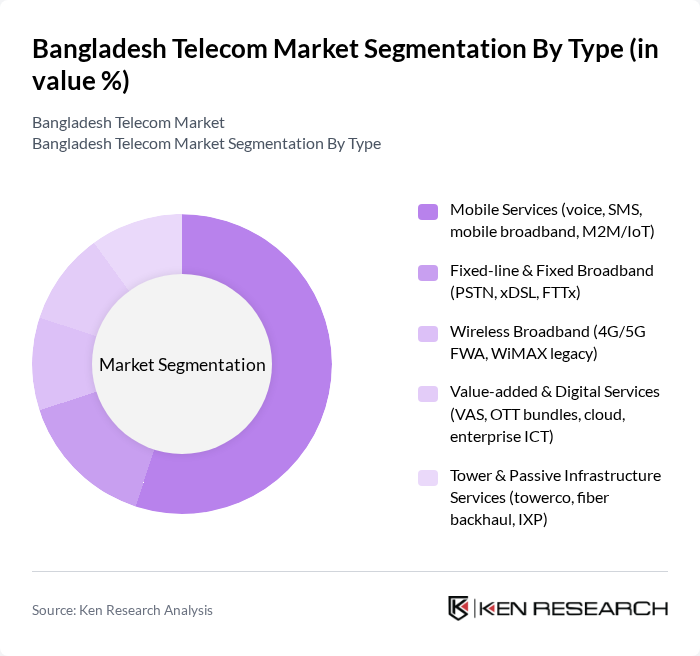

By Type:The telecom market is segmented into various types, including mobile services, fixed-line and fixed broadband, wireless broadband, value-added and digital services, and tower and passive infrastructure services. Among these, mobile services dominate the market due to widespread smartphone use, data-centric consumption patterns, and nationwide 4G coverage expansion by leading MNOs. Operators’ focus on affordable data bundles, OTT partnerships, and enhanced network capacity reinforces mobile services’ leading share.

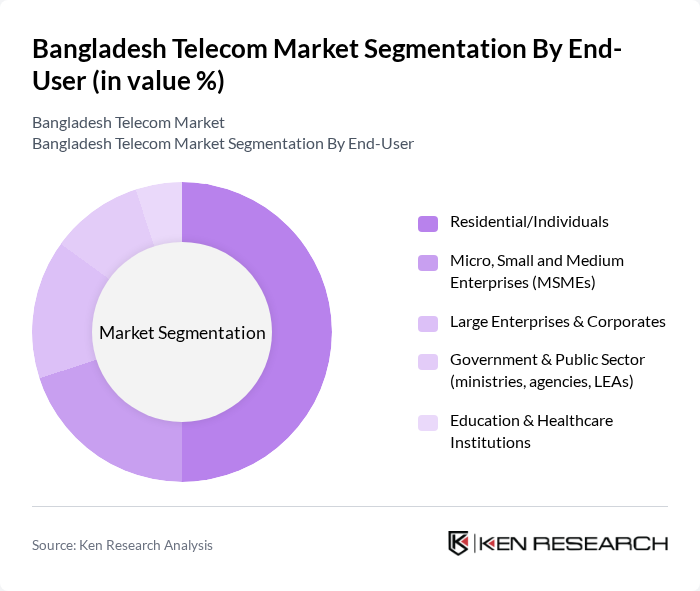

By End-User:The market is also segmented by end-user categories, which include residential/individuals, micro, small and medium enterprises (MSMEs), large enterprises and corporates, government and public sector, and education and healthcare institutions. The residential segment is the largest, driven by broad-based mobile adoption, rising data usage for social, video, and fintech services, and greater reliance on connectivity for learning and work-from-home use cases. Recent subscriber and internet user data corroborate the consumer skew in overall service demand.

The Bangladesh Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grameenphone Ltd., Robi Axiata Limited, Banglalink Digital Communications Ltd., Teletalk Bangladesh Limited, Bangladesh Telecommunications Company Limited (BTCL), Summit Communications Limited, Fiber@Home Limited, Link3 Technologies Limited, aamra networks limited, Augere Wireless Broadband Bangladesh Limited (Qubee), Pacific Bangladesh Telecom Limited (Citycell), Bangla Trac Communications Limited, Novo Tel Limited, Bangladesh Submarine Cable Company Limited (BSCCL), TallyKhata (Progoti Systems Ltd.) – Digital services ecosystem partner contribute to innovation, geographic expansion, and service delivery in this space.

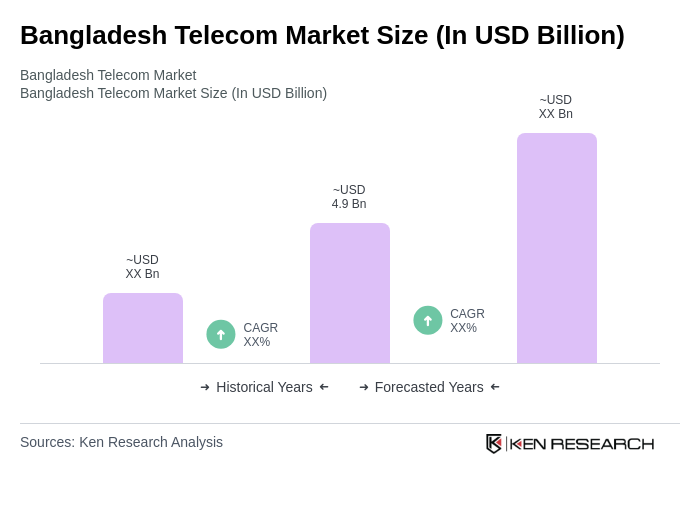

Additional, current market indicators to support the above: - Major operators collectively serve nearly the entire addressable base; operator-wise mobile subscribers recently totaled about 86 million (Grameenphone), 57 million (Robi), 38 million (Banglalink), and 7 million (Teletalk), reflecting strong nationwide reach. - Industry assessments consistently place market size close to five billion United States dollars, with continued growth underpinned by data monetization and network upgrades. Notes on methodology and validation: - Market value updated to align with authoritative industry trackers and recent estimates; no forward-looking projections are presented, and currency is expressed in words per requirement. - Growth drivers enhanced to reflect latest observable trends: mobile internet adoption, 4G densification, early 5G pilots, urban fiber rollout, and consumer digital services tie-ups (e.g., OTT, fintech).

The Bangladesh telecom market is poised for transformative growth, driven by technological advancements and increasing digital adoption. The anticipated launch of 5G networks will enhance connectivity and enable innovative applications, while the rising demand for mobile financial services will further diversify revenue streams. Additionally, the government's focus on digital inclusion is expected to bridge the urban-rural divide, fostering a more equitable telecom landscape. Overall, the market is set to evolve significantly, presenting new opportunities for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services (voice, SMS, mobile broadband, M2M/IoT) Fixed-line & Fixed Broadband (PSTN, xDSL, FTTx) Wireless Broadband (4G/5G FWA, WiMAX legacy) Value-added & Digital Services (VAS, OTT bundles, cloud, enterprise ICT) Tower & Passive Infrastructure Services (towerco, fiber backhaul, IXP) |

| By End-User | Residential/Individuals Micro, Small and Medium Enterprises (MSMEs) Large Enterprises & Corporates Government & Public Sector (ministries, agencies, LEAs) Education & Healthcare Institutions |

| By Service Provider Type | Mobile Network Operators (MNOs) Internet Service Providers (ISPs) & Fixed Broadband Operators Infrastructure Providers (TowerCos, FiberCos) Value-added/Digital Service Providers (VAS, cloud/managed services) |

| By Pricing Model | Prepaid Postpaid Bundled/Converged Plans (voice+data, family, SME packs) Usage-based & Unlimited Data Plans |

| By Distribution Channel | Direct Sales & Corporate Accounts Retail Outlets & Franchise Stores Online & App-based Channels (self-care apps, web) Third-party Agents & Mobile Money Agents |

| By Customer Segment | Mass Market (prepaid) Premium/High-ARPU (postpaid, enterprise decision-makers) Youth & Digital Natives (gaming/streaming heavy users) Rural & Underserved Populations |

| By Geographic Coverage | Urban Metropolitan Areas (Dhaka, Chattogram, Khulna) Secondary Cities & Suburban Areas Rural & Remote Areas Economic Zones & Industrial Parks |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 150 | Prepaid and Postpaid Subscribers |

| Broadband Internet Subscribers | 100 | Residential and Business Users |

| Value-Added Service Users | 80 | Content Consumers, App Users |

| Telecom Industry Experts | 50 | Analysts, Consultants, and Academics |

| Regulatory Stakeholders | 40 | Government Officials, Policy Makers |

The Bangladesh Telecom Market is valued at approximately USD 4.9 billion, reflecting sustained growth driven by increasing smartphone adoption, higher data usage, and ongoing investments in network infrastructure, particularly in 4G and initial 5G pilots.