Region:Asia

Author(s):Dev

Product Code:KRAA2201

Pages:96

Published On:August 2025

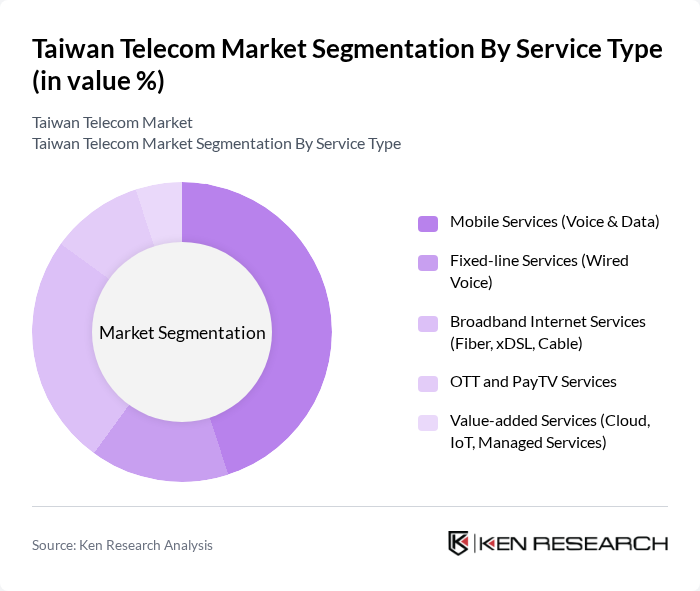

By Service Type:The service type segmentation includes mobile services, fixed-line services, broadband internet services, OTT and PayTV services, and value-added services. Mobile services remain the most dominant, driven by the widespread use of smartphones, high mobile broadband penetration, and the shift towards data-centric usage. The ongoing rollout of 5G networks and the proliferation of digital platforms have accelerated demand for mobile data, making this segment critical in the telecom landscape. Broadband internet, especially fiber, is also a major growth area, while OTT and PayTV services are expanding as consumers increasingly access content online .

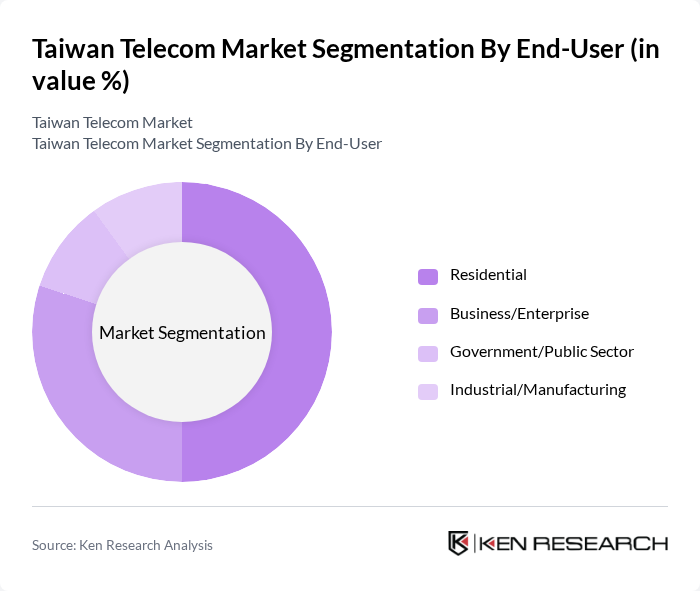

By End-User:The end-user segmentation includes residential, business/enterprise, government/public sector, and industrial/manufacturing users. The residential segment leads the market, driven by the high rate of household adoption of internet and mobile services. The shift to remote work, online education, and digital entertainment has further increased demand in this segment. Business and enterprise users are also a significant segment, with growing demand for cloud, IoT, and managed services as organizations digitize operations and adopt advanced connectivity solutions .

The Taiwan Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chunghwa Telecom Co., Ltd., Taiwan Mobile Co., Ltd., Far EasTone Telecommunications Co., Ltd., Taiwan Star Telecom Corporation Limited (T Star), Asia Pacific Telecom Co., Ltd. (APT), Vibo Telecom Inc., Kbro Co., Ltd., HiNet (Chunghwa Telecom broadband/ISP division), TWM Broadband Co., Ltd., Taiwan Fixed Network Co., Ltd. (TFN), New Century InfoComm Tech Co., Ltd. (NCIC, operator of So-net Taiwan), CNS (China Network Systems Co., Ltd.), Taiwan Broadband Communications (TBC), Asia Pacific Broadband Telecom Co., Ltd. (APBT), Seednet (a Chunghwa Telecom ISP brand) contribute to innovation, geographic expansion, and service delivery in this space.

The Taiwan telecom market is poised for transformative growth driven by technological advancements and evolving consumer preferences. The ongoing rollout of 5G networks will facilitate the development of innovative applications, particularly in IoT and smart city initiatives. Additionally, the increasing focus on customer experience and bundled service offerings will reshape competitive dynamics. As service providers adapt to these trends, they will likely explore strategic partnerships to enhance service delivery and expand their market reach, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Mobile Services (Voice & Data) Fixed-line Services (Wired Voice) Broadband Internet Services (Fiber, xDSL, Cable) OTT and PayTV Services Value-added Services (Cloud, IoT, Managed Services) |

| By End-User | Residential Business/Enterprise Government/Public Sector Industrial/Manufacturing |

| By Service Model | Subscription-based Pay-as-you-go Bundled Packages |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-65, diverse income levels |

| Broadband Subscribers | 80 | Households with internet access, varying service plans |

| SME Telecom Needs | 60 | Business owners, IT managers from small and medium enterprises |

| Regulatory Insights | 40 | Policy makers, telecom regulators, industry analysts |

| Consumer Behavior Trends | 100 | General consumers, segmented by age and tech-savviness |

The Taiwan Telecom Market is valued at approximately USD 10.6 billion, driven by increasing demand for mobile and broadband services, rapid adoption of 5G technology, and the expansion of IoT and cloud-based offerings.