Region:Middle East

Author(s):Rebecca

Product Code:KRAA2138

Pages:93

Published On:August 2025

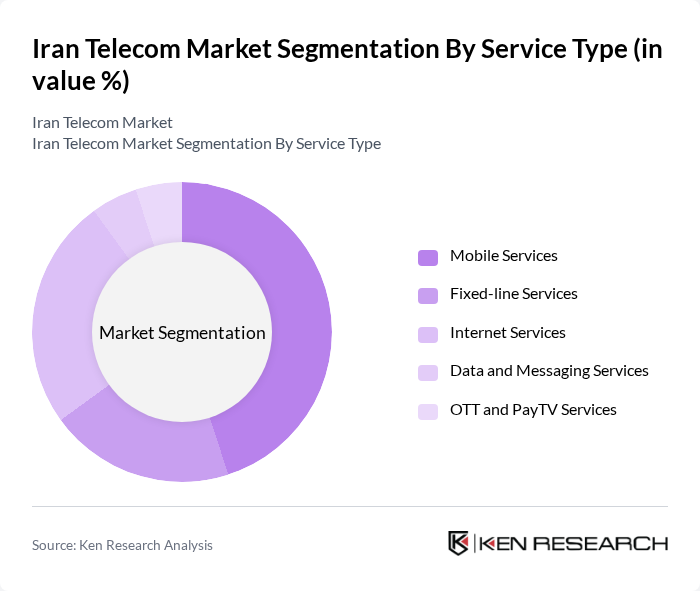

By Service Type:The service type segmentation includes offerings that cater to the diverse needs of consumers and businesses. The primary subsegments are mobile services, fixed-line services, internet services, data and messaging services, and OTT and PayTV services. Mobile services dominate the market, driven by widespread smartphone adoption and reliance on mobile internet for communication and entertainment. Internet services are also significant, reflecting the growing demand for high-speed connectivity and the expansion of fiber-to-the-home (FTTH) initiatives. OTT and PayTV services are gaining traction as digital media consumption rises among younger demographics.

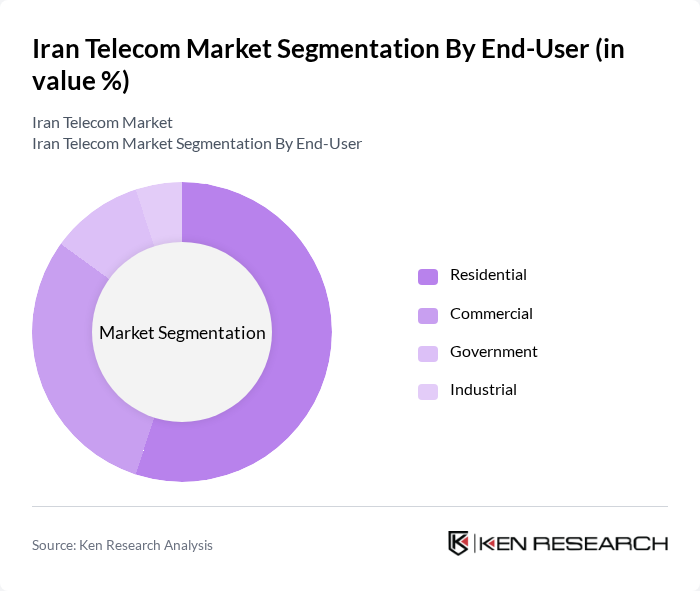

By End-User:The end-user segmentation encompasses residential, commercial, government, and industrial users. Residential users represent the largest segment, driven by the increasing number of households acquiring mobile and internet services and the shift to remote work and digital entertainment. Commercial users follow closely, as businesses seek reliable communication solutions to enhance productivity and digital transformation. Government and industrial users also contribute significantly, particularly in sectors requiring robust telecom infrastructure for automation and secure data exchange.

The Iran Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mobile Telecommunication Company of Iran (MCI) – Hamrah-e Aval, MTN Irancell, Rightel, Taliya, Telecommunication Company of Iran (TCI), Pars Online, Shatel, Asiatech, HiWeb, Sabanet, Afranet, Pishgaman, Fanap Telecom, MobinNet, Aria Shatel contribute to innovation, geographic expansion, and service delivery in this space. These operators are actively investing in expanding network coverage, upgrading to 5G, and diversifying service offerings to address evolving consumer and business needs.

The future of the Iranian telecom market appears promising, driven by increasing smartphone adoption and government support for digital initiatives. As infrastructure improves, the demand for high-speed internet and data services is expected to rise significantly. However, challenges such as regulatory constraints and economic sanctions may impede growth. The market is likely to see innovations in mobile payment systems and IoT solutions, which could enhance service offerings and customer engagement in future.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Mobile Services Fixed-line Services Internet Services Data and Messaging Services OTT and PayTV Services |

| By End-User | Residential Commercial Government Industrial |

| By Application | Voice Communication Data Communication Video Communication Digital Content |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Others |

| By Pricing Model | Subscription-based Pay-as-you-go Bundled Services |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Enterprises |

| By Payment Method | Prepaid Services Postpaid Services Corporate Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 100 | Consumers aged 18-45, Urban Residents |

| Fixed-line Service Subscribers | 60 | Households with internet access, Middle-income brackets |

| Broadband Internet Users | 80 | Small Business Owners, Tech-savvy Consumers |

| Telecom Industry Experts | 40 | Regulatory Officials, Telecom Analysts |

| Corporate Telecom Managers | 50 | IT Managers, Procurement Officers in Corporates |

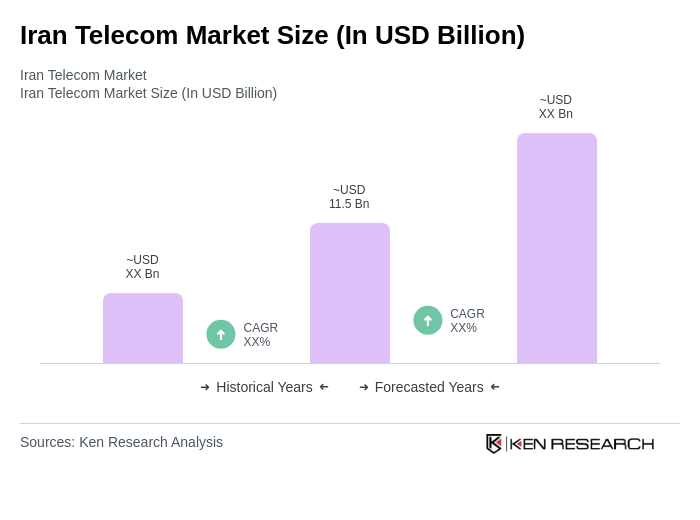

The Iran Telecom Market is valued at approximately USD 11.5 billion, driven by the increasing demand for mobile and internet services, digital infrastructure expansion, and the rise of content-rich applications and video streaming.