Region:Global

Author(s):Rebecca

Product Code:KRAA2135

Pages:95

Published On:August 2025

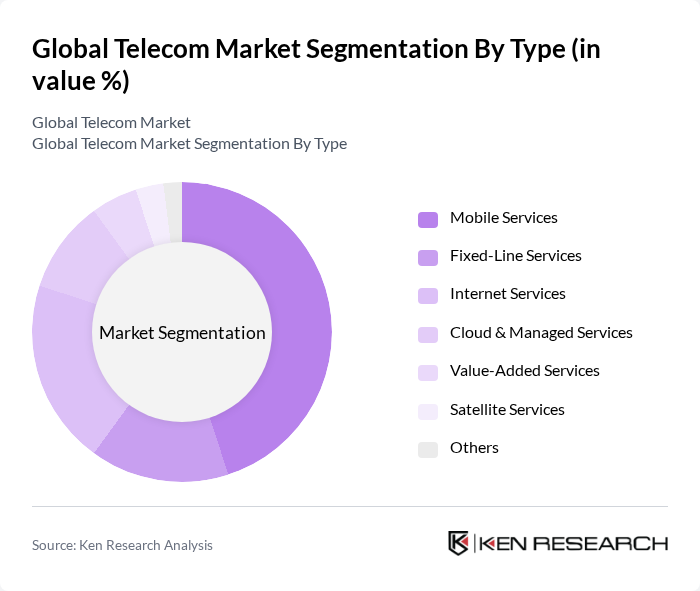

By Type:The telecom market can be segmented into various types, including Mobile Services, Fixed-Line Services, Internet Services, Cloud & Managed Services, Value-Added Services, Satellite Services, and Others. Among these, Mobile Services dominate the market due to the widespread adoption of smartphones, rapid 5G deployment, and the increasing demand for mobile data. The shift towards mobile-first strategies by consumers and businesses, alongside the expansion of mobile broadband coverage, has significantly contributed to the growth of this segment .

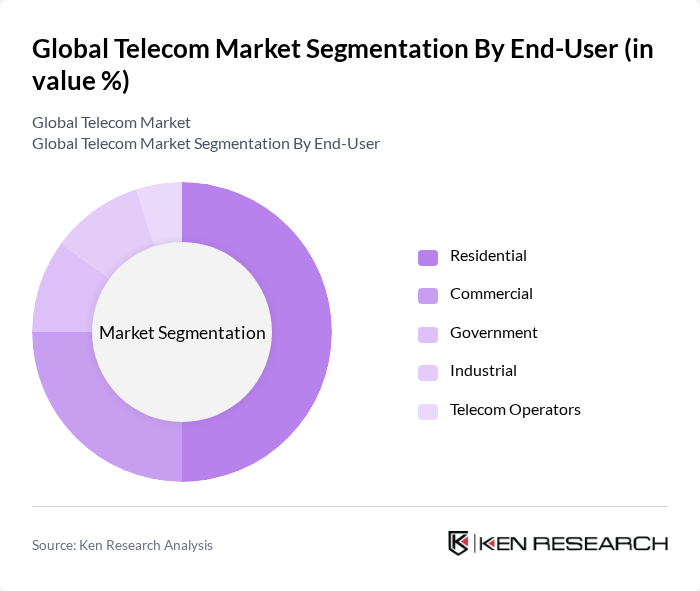

By End-User:The telecom market is also segmented by end-user categories, including Residential, Commercial, Government, Industrial, and Telecom Operators. The Residential segment is the largest, driven by the increasing number of households requiring internet and mobile services. The growing trend of remote work, online education, and digital entertainment has further accelerated the demand for reliable telecom services in residential areas .

The Global Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as AT&T Inc., Verizon Communications Inc., Deutsche Telekom AG, Vodafone Group Plc, China Mobile Ltd., Orange S.A., Telefónica S.A., BT Group plc, T-Mobile US, Inc., Nippon Telegraph and Telephone Corporation (NTT Group), Comcast Corporation, Lumen Technologies, Inc., SoftBank Group Corp., Telstra Corporation Limited, Koninklijke KPN N.V., SK Telecom Co., Ltd., Reliance Jio Infocomm Ltd., China Telecom Corporation Limited, MTN Group Limited, América Móvil, S.A.B. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The telecom industry is poised for transformative growth driven by technological advancements and evolving consumer demands. The integration of AI and automation is expected to enhance operational efficiencies, while the shift towards digital transformation will redefine service delivery. Additionally, sustainability initiatives will gain traction, as companies aim to reduce their carbon footprint. As these trends unfold, telecom operators will need to adapt swiftly to maintain competitive advantages and meet the changing needs of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services Fixed-Line Services Internet Services Cloud & Managed Services Value-Added Services Satellite Services Others |

| By End-User | Residential Commercial Government Industrial Telecom Operators |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | G Technology G Technology Fiber Optic Technology Satellite Technology Cloud-Native & Edge Computing |

| By Application | Voice Communication Data Communication Video Communication IoT Applications Managed Security Services |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment |

| By Policy Support | Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Providers | 100 | CEOs, CTOs, and Marketing Directors |

| Broadband Infrastructure Companies | 60 | Operations Managers, Network Engineers |

| Enterprise Telecom Solutions | 50 | IT Managers, Procurement Officers |

| Telecom Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Managers |

| Telecom Equipment Manufacturers | 50 | Product Development Managers, Sales Directors |

The Global Telecom Market is valued at approximately USD 2 trillion, reflecting significant growth driven by the increasing demand for mobile and internet services, advancements in technology like 5G, and the proliferation of smart devices and IoT technologies.