Region:Central and South America

Author(s):Dev

Product Code:KRAA2210

Pages:83

Published On:August 2025

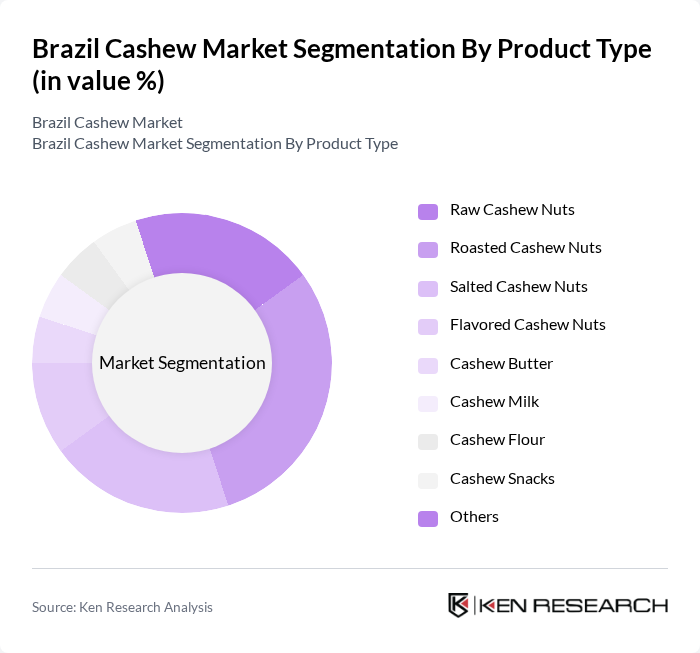

By Product Type:The product type segmentation of the Brazil Cashew Market includes various forms of cashew nuts and related products. The subsegments are Raw Cashew Nuts, Roasted Cashew Nuts, Salted Cashew Nuts, Flavored Cashew Nuts, Cashew Butter, Cashew Milk, Cashew Flour, Cashew Snacks, and Others. Among these, Roasted Cashew Nuts are particularly popular due to their enhanced flavor and convenience as a snack option. The growing trend of healthy snacking and the introduction of new flavors have led to increased consumption of roasted and flavored varieties, making them the leading subsegment in the market .

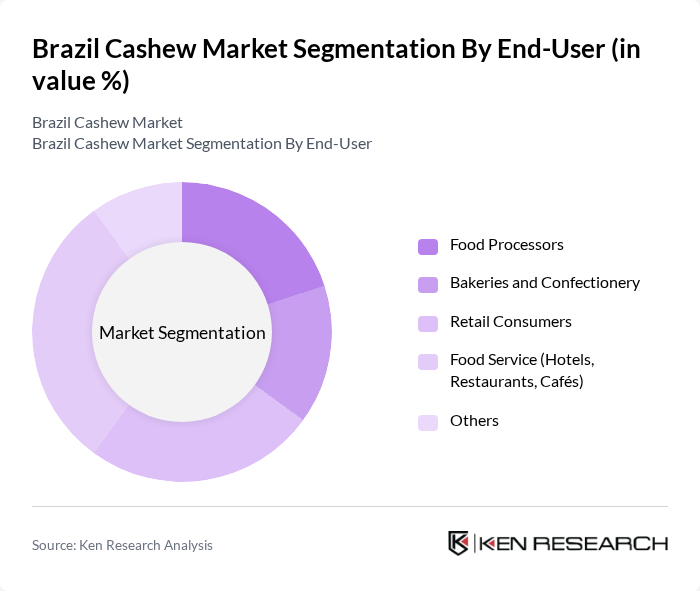

By End-User:The end-user segmentation of the Brazil Cashew Market includes Food Processors, Bakeries and Confectionery, Retail Consumers, Food Service (Hotels, Restaurants, Cafés), and Others. The Food Service sector is currently the dominant end-user, driven by the increasing incorporation of cashew nuts in various culinary applications, including desserts and gourmet dishes. The trend towards healthier menu options in restaurants and cafes, as well as the adoption of cashew-based dairy alternatives, has further propelled the demand for cashew products .

The Brazil Cashew Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caju Brasil Indústria e Comércio Ltda., Vitória Cashew Exportadora Ltda., Agrobras Agroindústria de Castanha Ltda., Brazil Nuts S/A, Noble Cashew do Brasil Ltda., Usibras – Usina de Beneficiamento de Castanha de Caju S/A, Cajuesp – Cooperativa dos Cajucultores do Estado de São Paulo, Cione – Companhia Industrial de Óleos do Nordeste, Grupo Amêndoas do Brasil, Cacique de Café Solúvel S.A. (Cashew Division), Olam International (Brazil Operations), Bunge Alimentos S.A., Intersnack Group (Brazil), Golden Star Caju Ltda., Agropecuária Santa Rita Ltda. contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil cashew market is poised for significant transformation, driven by evolving consumer preferences and increasing health awareness. Innovations in product offerings, such as cashew milk and value-added snacks, are expected to capture a larger market share. Additionally, the integration of sustainable farming practices will likely enhance production efficiency. As e-commerce continues to expand, direct-to-consumer sales channels will provide new opportunities for growth, allowing producers to reach health-conscious consumers more effectively.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Raw Cashew Nuts Roasted Cashew Nuts Salted Cashew Nuts Flavored Cashew Nuts Cashew Butter Cashew Milk Cashew Flour Cashew Snacks Others |

| By End-User | Food Processors Bakeries and Confectionery Retail Consumers Food Service (Hotels, Restaurants, Cafés) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Direct Sales |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Price Range | Premium Mid-Range Economy |

| By Region | Ceará Piauí Rio Grande do Norte São Paulo Paraná Others |

| By Product Form | Whole Nuts Chopped Nuts Powdered Nuts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cashew Farmers | 100 | Smallholder Farmers, Cooperative Leaders |

| Exporters and Importers | 60 | Trade Managers, Logistics Coordinators |

| Processing Facilities | 50 | Operations Managers, Quality Control Supervisors |

| Retail Market Insights | 40 | Retail Buyers, Category Managers |

| Industry Experts | 40 | Agricultural Economists, Market Analysts |

The Brazil Cashew Market is valued at approximately USD 2 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand for healthy snacks and innovations in farming and processing practices.