Region:Europe

Author(s):Rebecca

Product Code:KRAC0192

Pages:97

Published On:August 2025

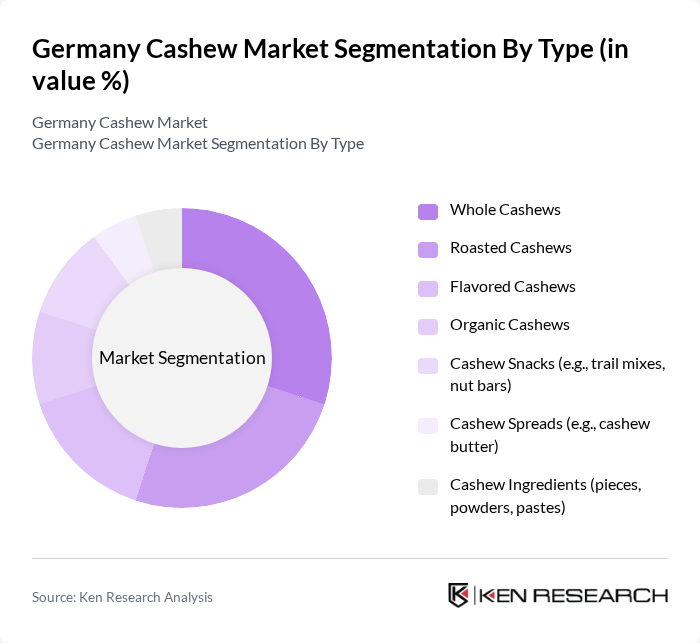

By Type:The cashew market can be segmented into various types, including whole cashews, roasted cashews, flavored cashews, organic cashews, cashew snacks, cashew spreads, and cashew ingredients. Among these, whole cashews and roasted cashews are the most popular due to their versatility and widespread use in both culinary applications and as standalone snacks. The demand for organic cashews is also on the rise, driven by increasing consumer preference for organic and sustainably sourced products. White cashews (whole and pieces) are especially dominant in the German market, favored for their use in both sweet and savory dishes .

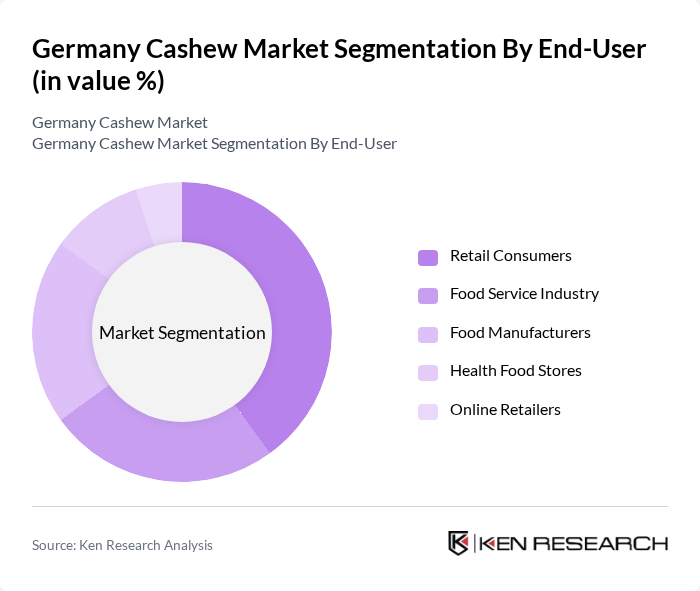

By End-User:The end-user segmentation includes retail consumers, the food service industry, food manufacturers, health food stores, and online retailers. Retail consumers represent the largest segment, driven by the increasing trend of healthy snacking and the availability of cashew products in supermarkets and health food stores. The food service industry is also a significant contributor, as restaurants and cafes incorporate cashews into their menus for both flavor and nutritional benefits. Food manufacturers are increasingly utilizing cashews in plant-based and dairy alternative products, reflecting broader market innovation .

The Germany Cashew Market is characterized by a dynamic mix of regional and international players. Leading participants such as Seeberger GmbH, RAPUNZEL NATURKOST GmbH, KoRo Handels GmbH, Märsch Importhandels-GmbH, Nutwork Handelsgesellschaft mbH, Naturata AG, Keimling Naturkost GmbH, The Lorenz Bahlsen Snack-World GmbH & Co KG, Kontorhaus Göricke UG (Kamelur), Alnatura Produktions- und Handels GmbH, Farmer's Snack GmbH, Kluth GmbH & Co. KG, MorgenLand (EgeSun GmbH), DMK Deutsches Milchkontor GmbH (for cashew-based dairy alternatives), Edeka Zentrale AG & Co. KG (private label cashew products) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany cashew market appears promising, driven by increasing health awareness and the growing trend of plant-based diets. As consumers continue to seek nutritious snack options, cashew products are likely to gain traction. Additionally, the expansion of e-commerce platforms will facilitate greater access to cashew products, enhancing market penetration. Companies that focus on product innovation and sustainable sourcing practices will be well-positioned to capitalize on these trends and meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Cashews Roasted Cashews Flavored Cashews Organic Cashews Cashew Snacks (e.g., trail mixes, nut bars) Cashew Spreads (e.g., cashew butter) Cashew Ingredients (pieces, powders, pastes) |

| By End-User | Retail Consumers Food Service Industry Food Manufacturers Health Food Stores Online Retailers |

| By Sales Channel | Supermarkets/Hypermarkets Specialty Food Stores E-commerce Platforms Convenience Stores |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging |

| By Price Range | Premium Mid-range Economy |

| By Region | Northern Germany Southern Germany Eastern Germany Western Germany |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Cashew Sales | 150 | Store Managers, Category Buyers |

| Wholesale Distribution Channels | 100 | Wholesale Distributors, Supply Chain Managers |

| Consumer Preferences and Trends | 150 | Health-Conscious Consumers, Snack Enthusiasts |

| Import and Export Dynamics | 80 | Import Managers, Trade Compliance Officers |

| Market Entry Strategies | 70 | Business Development Managers, Market Analysts |

The Germany cashew market is valued at approximately USD 740 million, reflecting a significant growth trend driven by increasing health consciousness and demand for nutritious snacks among consumers.