Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB2751

Pages:83

Published On:October 2025

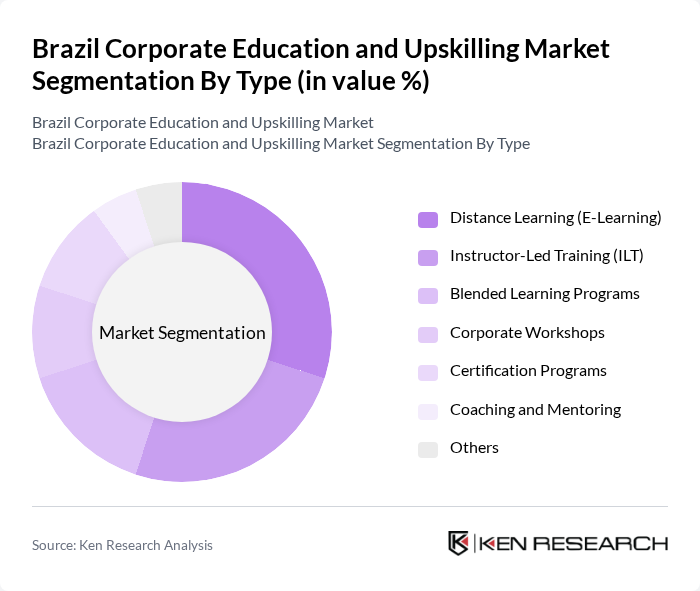

By Type:The market is segmented into various types of educational offerings, including Distance Learning (E-Learning), Instructor-Led Training (ILT), Blended Learning Programs, Corporate Workshops, Certification Programs, Coaching and Mentoring, and Others. Distance learning is the largest and fastest-growing segment, driven by technological adoption and demand for flexible, scalable training solutions. Instructor-led and blended formats remain relevant for skills requiring hands-on practice or interpersonal interaction. Corporate workshops, certification programs, and coaching cater to specific competency gaps and leadership development needs.

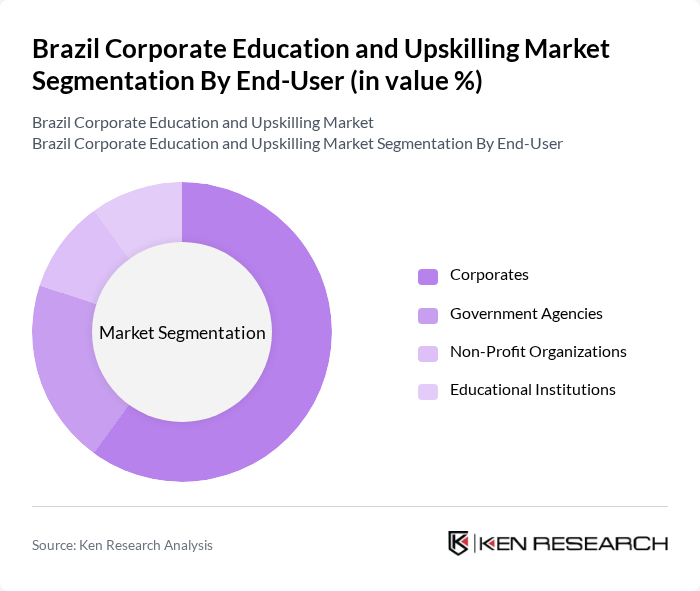

By End-User:The end-users of corporate education and upskilling services include Corporates, Government Agencies, Non-Profit Organizations, and Educational Institutions. Corporates represent the largest segment, driven by internal talent development strategies and compliance needs. Government agencies leverage upskilling programs to improve public sector capabilities, while non-profits and educational institutions focus on community upskilling and academic partnerships.

The Brazil Corporate Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Kroton, Estácio Participações S.A., Anhanguera Educacional, Senac (Serviço Nacional de Aprendizagem Comercial), Fundação Getulio Vargas (FGV), Alura, Udemy for Business, Skillshare, LinkedIn Learning, Sebrae (Serviço Brasileiro de Apoio às Micro e Pequenas Empresas), Instituto de Educação Superior de Brasília (IESB), Escola Superior de Propaganda e Marketing (ESPM), Instituto Brasileiro de Educação (IBRAN), Treinamento e Desenvolvimento (T&D) Consultoria, Conexão Educação contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's corporate education and upskilling market appears promising, driven by technological advancements and a growing emphasis on lifelong learning. As companies increasingly recognize the importance of employee development, investments in training programs are expected to rise. Additionally, the integration of artificial intelligence in learning platforms will enhance personalized learning experiences, making training more effective. The shift towards hybrid learning models will also facilitate greater accessibility, ensuring that a diverse workforce can benefit from upskilling opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Distance Learning (E-Learning) Instructor-Led Training (ILT) Blended Learning Programs Corporate Workshops Certification Programs Coaching and Mentoring Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions |

| By Industry | Technology Healthcare Finance Manufacturing Retail Others |

| By Training Format | Workshops Seminars E-Learning Modules Webinars |

| By Duration | Short-Term Courses Long-Term Programs Ongoing Training |

| By Certification Level | Entry-Level Certifications Professional Certifications Advanced Certifications |

| By Delivery Method | Instructor-Led Training Self-Paced Learning Hybrid Delivery |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs in Technology Sector | 120 | Training Managers, IT Directors |

| Upskilling Initiatives in Manufacturing | 85 | HR Managers, Operations Supervisors |

| Leadership Development in Financial Services | 75 | Executive Coaches, Learning & Development Heads |

| Soft Skills Training in Retail | 65 | Store Managers, Customer Experience Leaders |

| Compliance Training Across Various Industries | 80 | Compliance Officers, Risk Management Executives |

The Brazil Corporate Education and Upskilling Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the demand for skilled labor and the increasing adoption of digital learning solutions.