Region:Central and South America

Author(s):Rebecca

Product Code:KRAA4870

Pages:89

Published On:September 2025

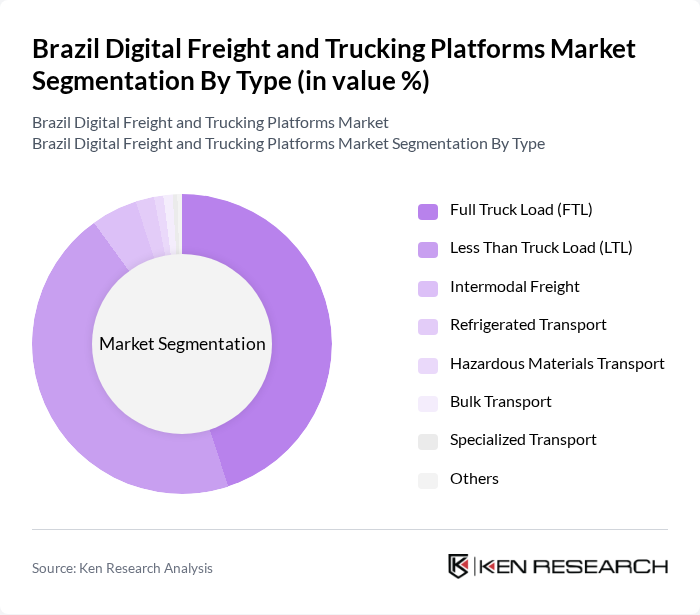

By Type:The market is segmented into various types of freight and trucking services, including Full Truck Load (FTL), Less Than Truck Load (LTL), Intermodal Freight, Refrigerated Transport, Hazardous Materials Transport, Bulk Transport, Specialized Transport, and Others. Each of these segments caters to specific logistics needs. The FTL segment is the most prominent, accounting for the majority of shipments due to its efficiency in transporting large volumes over long distances, especially for agricultural and industrial goods. LTL is rapidly growing, driven by the e-commerce boom and the increasing need for flexible, smaller-scale deliveries .

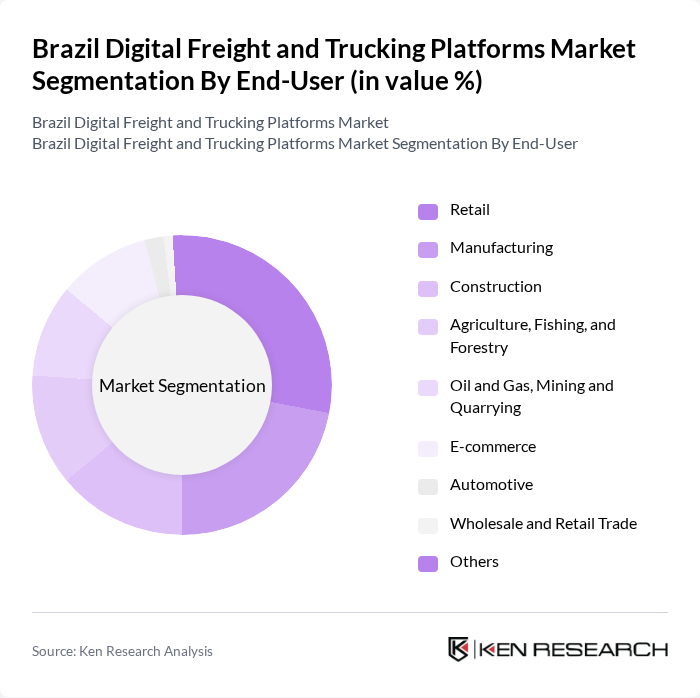

By End-User:The end-user segmentation includes Retail, Manufacturing, Construction, Agriculture, Fishing, and Forestry, Oil and Gas, Mining and Quarrying, E-commerce, Automotive, Wholesale and Retail Trade, and Others. The retail and e-commerce sectors are particularly significant, driving demand for agile and technology-enabled logistics solutions to meet consumer expectations for fast and reliable delivery. Manufacturing and agriculture also represent substantial shares due to Brazil’s industrial and agribusiness strength .

The Brazil Digital Freight and Trucking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as CargoX, Frete.com, TruckPad, Loggi, BBM Logística, JSL S.A., Sequoia Logística, RTE Rodonaves, DHL Supply Chain Brazil, A.P. Moller-Maersk (Brazil), B2Log, Rapiddo, Intelipost, Tmov, and 99Frete contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's digital freight and trucking platforms is poised for significant evolution, driven by ongoing technological advancements and increasing consumer expectations. As e-commerce continues to expand, platforms will likely enhance their service offerings, focusing on real-time tracking and automated logistics solutions. Additionally, sustainability will become a key focus, with companies exploring eco-friendly practices to meet regulatory demands and consumer preferences, ultimately shaping a more efficient and responsible logistics landscape in Brazil.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Freight Refrigerated Transport Hazardous Materials Transport Bulk Transport Specialized Transport Others |

| By End-User | Retail Manufacturing Construction Agriculture, Fishing, and Forestry Oil and Gas, Mining and Quarrying E-commerce Automotive Wholesale and Retail Trade Others |

| By Service Type | Freight Brokerage Freight Forwarding Fleet Management Last-Mile Delivery Supply Chain Management Others |

| By Payment Model | Subscription-Based Pay-Per-Use Commission-Based Others |

| By Technology | Mobile Applications Web Platforms IoT Integration Blockchain Technology Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Logistics Providers Others |

| By Fleet Type | Owned Fleet Leased Fleet Outsourced Fleet Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Platform Users | 100 | Logistics Managers, Fleet Operators |

| Technology Providers in Logistics | 60 | Product Managers, Software Developers |

| Regulatory Bodies and Policy Makers | 40 | Government Officials, Industry Regulators |

| End-users of Freight Services | 80 | Supply Chain Directors, Procurement Managers |

| Industry Experts and Consultants | 50 | Logistics Consultants, Market Analysts |

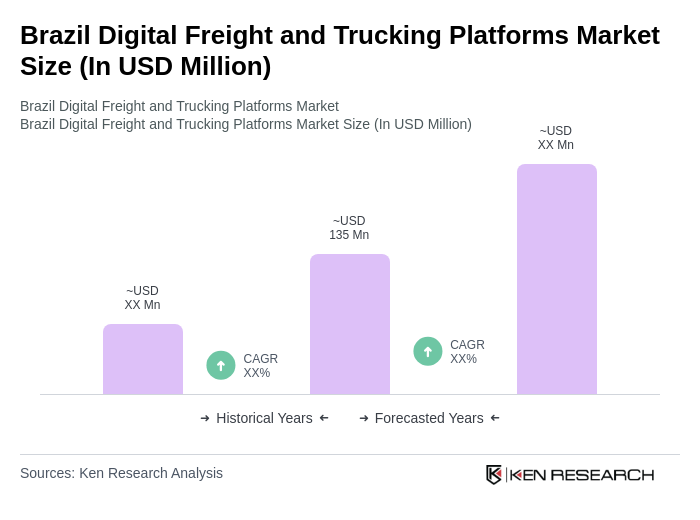

The Brazil Digital Freight and Trucking Platforms Market is valued at approximately USD 135 million, reflecting a historical analysis of the digital freight brokerage segment and highlighting the growth driven by e-commerce and logistics efficiency demands.