Region:Central and South America

Author(s):Shubham

Product Code:KRAB3232

Pages:100

Published On:October 2025

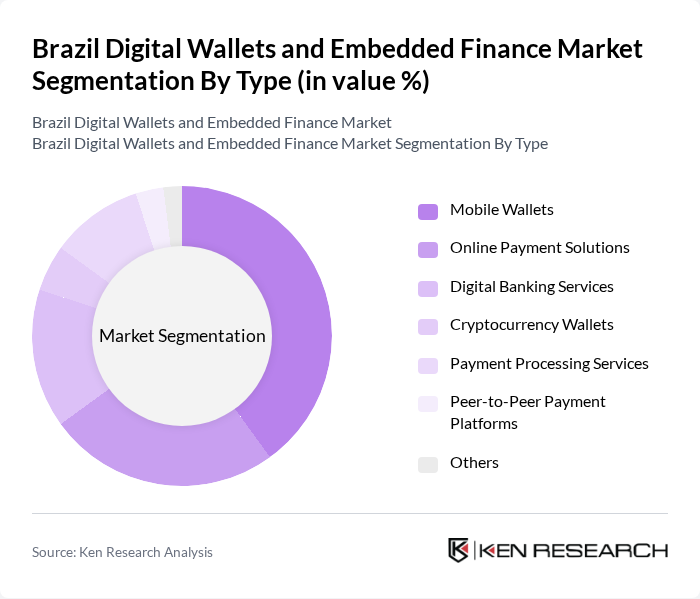

By Type:The market is segmented into various types, including Mobile Wallets, Online Payment Solutions, Digital Banking Services, Cryptocurrency Wallets, Payment Processing Services, Peer-to-Peer Payment Platforms, and Others. Among these, Mobile Wallets have emerged as the leading sub-segment due to their user-friendly interfaces and widespread acceptance across retail and e-commerce platforms. The convenience of storing multiple payment methods in a single app has driven consumer preference towards mobile wallets, making them a dominant force in the market.

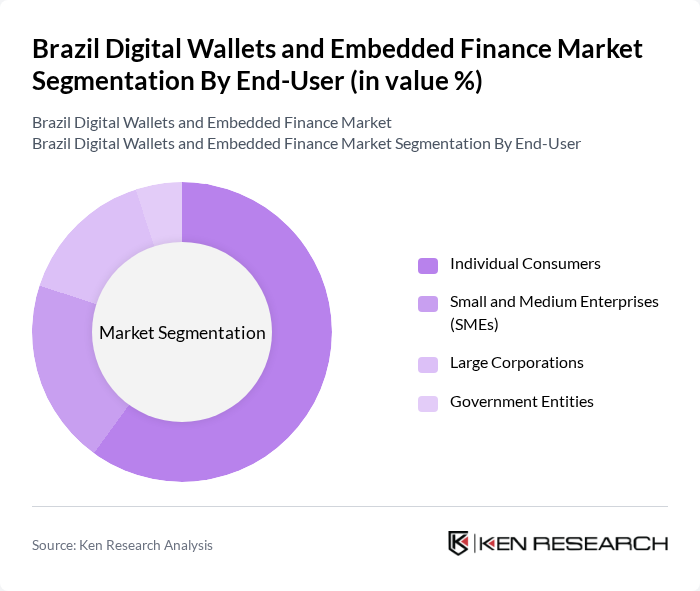

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers represent the largest segment, driven by the increasing trend of online shopping and the need for convenient payment solutions. The growing number of smartphone users and the shift towards digital transactions have made individual consumers the primary drivers of market growth.

The Brazil Digital Wallets and Embedded Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Pago, PicPay, Nubank, PagSeguro, Banco Inter, StoneCo, PayU, Cielo, Getnet, Zeta, Sicoob, B2W Digital, Oi Paggo, Banrisul, Banco do Brasil contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's digital wallets and embedded finance market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance user experience and security, while the growth of Buy Now Pay Later (BNPL) services will cater to diverse consumer needs. Additionally, the shift towards decentralized finance (DeFi) may open new avenues for innovation, allowing for more flexible financial solutions that align with the demands of a tech-savvy population.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Payment Solutions Digital Banking Services Cryptocurrency Wallets Payment Processing Services Peer-to-Peer Payment Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Retail Payments Bill Payments Money Transfers E-commerce Transactions Remittances Others |

| By Distribution Channel | Online Platforms Mobile Applications Retail Outlets Direct Sales |

| By Payment Method | Credit/Debit Cards Bank Transfers QR Code Payments NFC Payments |

| By User Demographics | Age Groups Income Levels Geographic Distribution |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 150 | Regular Users, Occasional Users, Non-Users |

| SME Adoption of Embedded Finance | 100 | Business Owners, Financial Managers |

| Regulatory Impact on Digital Payments | 80 | Regulatory Officials, Compliance Officers |

| Consumer Preferences in Payment Methods | 120 | Millennials, Gen Z, Older Adults |

| Fintech Innovation Insights | 90 | Product Managers, Technology Officers |

The Brazil Digital Wallets and Embedded Finance Market is valued at approximately USD 15 billion, driven by increased smartphone adoption, e-commerce growth, and a shift towards cashless transactions among consumers and businesses.