Region:Asia

Author(s):Dev

Product Code:KRAA4893

Pages:80

Published On:September 2025

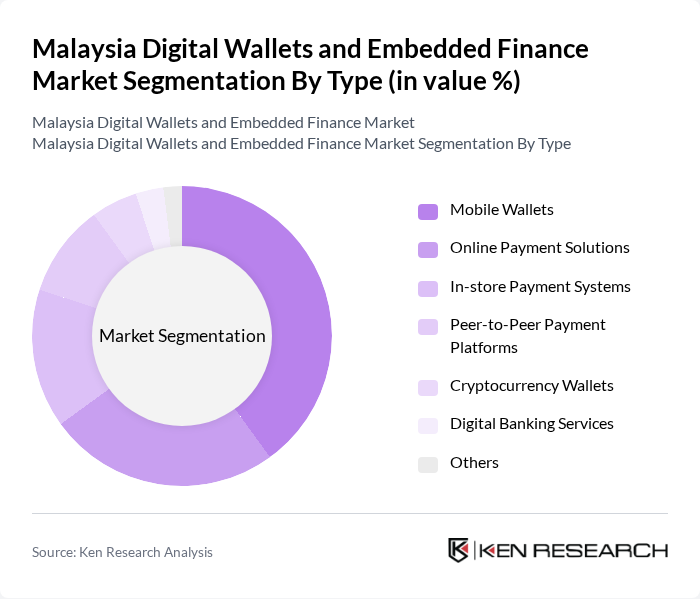

By Type:The market is segmented into various types, including Mobile Wallets, Online Payment Solutions, In-store Payment Systems, Peer-to-Peer Payment Platforms, Cryptocurrency Wallets, Digital Banking Services, and Others. Among these, Mobile Wallets have emerged as the leading sub-segment, driven by their convenience and user-friendly interfaces. Consumers increasingly prefer mobile wallets for everyday transactions, leading to a significant increase in their adoption across various demographics.

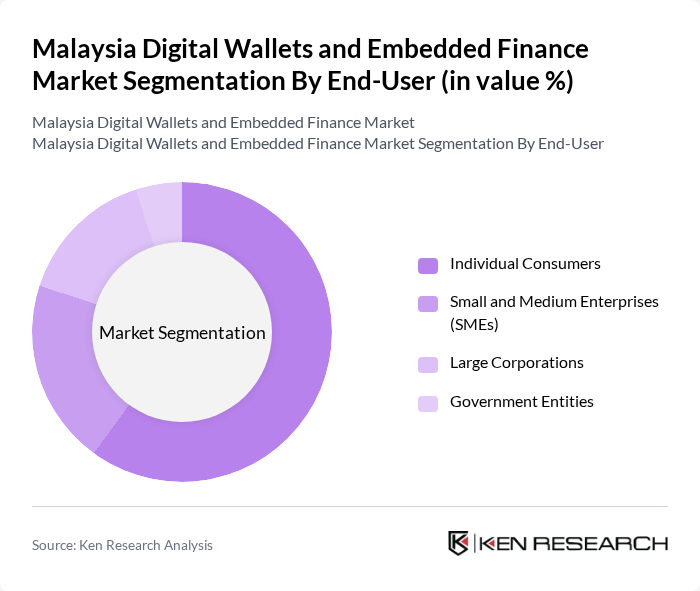

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers represent the largest segment, as the growing trend of cashless transactions among the general public drives the demand for digital wallets. The convenience and accessibility of these solutions have made them a preferred choice for personal finance management.

The Malaysia Digital Wallets and Embedded Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Touch 'n Go eWallet, GrabPay, Boost, Maybank2u, CIMB Pay, Razer Pay, BigPay, DuitNow, FPX (Financial Process Exchange), PayNet, Samsung Pay, Alipay, WeChat Pay, Visa Checkout, Mastercard Pay contribute to innovation, geographic expansion, and service delivery in this space.

The future of Malaysia's digital wallets and embedded finance market appears promising, driven by technological advancements and changing consumer behaviors. As smartphone penetration continues to rise, the integration of digital wallets into everyday transactions will likely become more prevalent. Additionally, the increasing focus on user experience and security will shape the development of innovative financial products, ensuring that digital wallets remain a preferred payment method among consumers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Payment Solutions In-store Payment Systems Peer-to-Peer Payment Platforms Cryptocurrency Wallets Digital Banking Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Retail Payments Bill Payments Remittances E-commerce Transactions |

| By Sales Channel | Direct Sales Online Platforms Retail Partnerships |

| By Distribution Mode | Digital Distribution Physical Distribution |

| By Pricing Strategy | Subscription-Based Transaction Fee-Based Freemium Model |

| By Customer Segment | Tech-Savvy Users Traditional Users Business Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 150 | Regular Users, Occasional Users |

| Embedded Finance Adoption in SMEs | 100 | Small Business Owners, Financial Managers |

| Merchant Acceptance of Digital Payments | 80 | Retail Managers, Payment Processors |

| Consumer Attitudes Towards Embedded Finance | 120 | Millennials, Gen Z Consumers |

| Regulatory Impact on Digital Wallets | 60 | Policy Makers, Financial Regulators |

The Malaysia Digital Wallets and Embedded Finance Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions, e-commerce, and mobile banking.