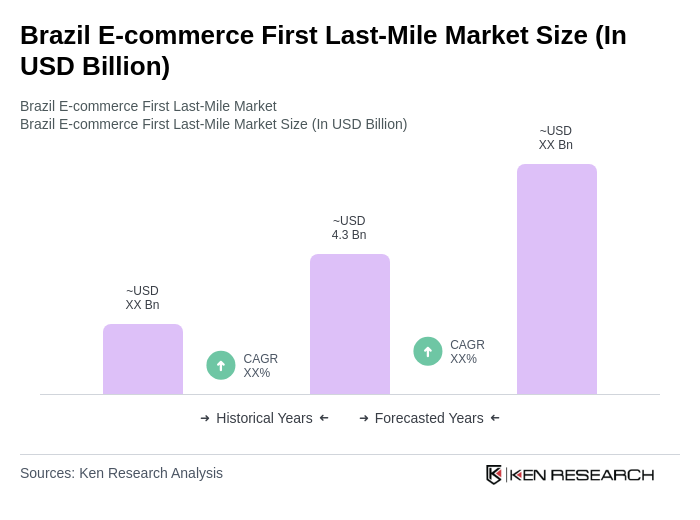

Brazil E-commerce First Last-Mile Market Overview

- The Brazil E-commerce First Last-Mile Market is valued at USD 4.3 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid increase in online shopping, fueled by the COVID-19 pandemic, which accelerated digital adoption among consumers and businesses alike. The rise in smartphone penetration, with over 97% of Brazilians having access to mobile devices, and improved internet connectivity have also significantly contributed to the market's expansion. Additionally, the adoption of digital payment solutions such as PIX and the proliferation of mobile commerce platforms have further accelerated e-commerce logistics demand .

- Key cities such as São Paulo, Rio de Janeiro, and Belo Horizonte dominate the market due to their large populations and robust infrastructure. São Paulo, being the financial hub, has a high concentration of e-commerce activities, while Rio de Janeiro benefits from its tourism and retail sectors. These cities have also seen significant investments in logistics and delivery services, including the expansion of micro-fulfillment centers and last-mile hubs, enhancing their market positions .

- In 2023, the Brazilian government implemented regulations to enhance the efficiency of last-mile delivery services. This includes the introduction of the “Plano Nacional de Logística Urbana” (National Urban Logistics Plan), issued by the Ministério do Desenvolvimento Regional in 2023. The framework mandates the use of sustainable delivery methods, such as electric vehicles and bicycles, and encourages the establishment of dedicated delivery zones in urban areas to reduce congestion and improve service efficiency. Operators must comply with new licensing requirements and report on sustainability metrics as part of their annual compliance .

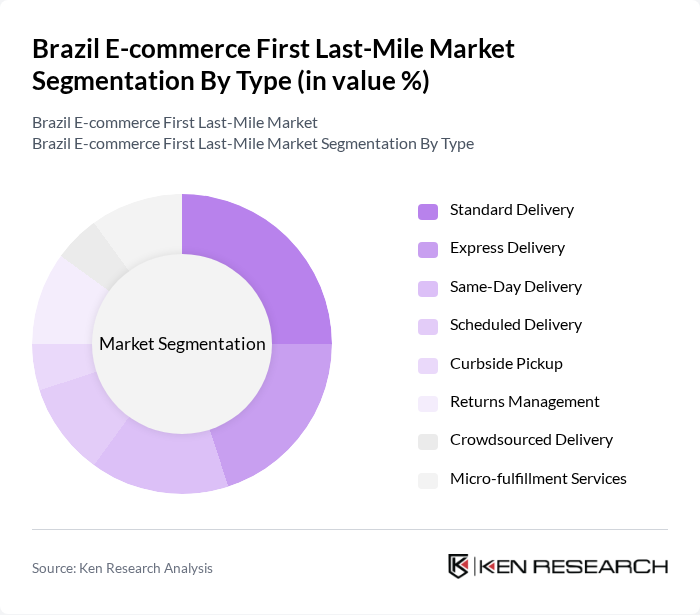

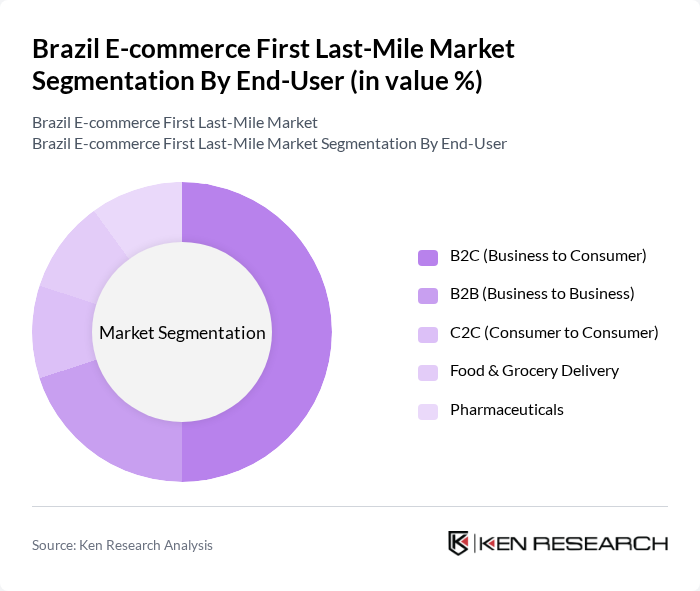

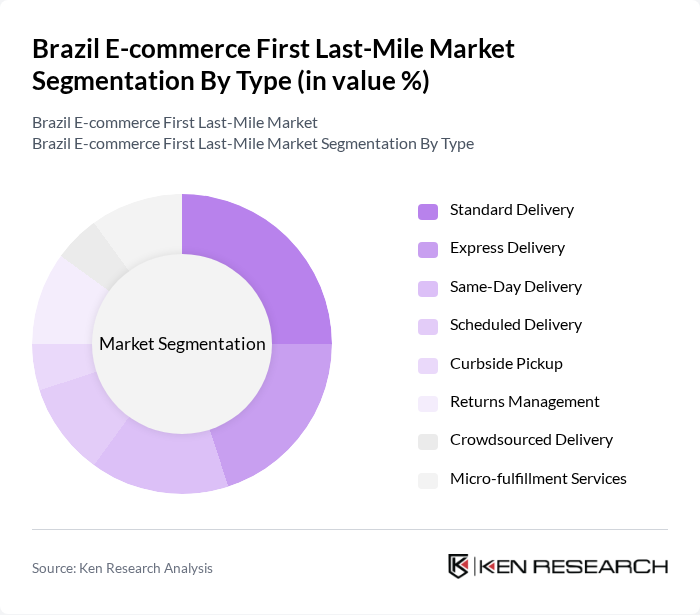

Brazil E-commerce First Last-Mile Market Segmentation

By Type:The market can be segmented into various types of delivery services, including Standard Delivery, Express Delivery, Same-Day Delivery, Scheduled Delivery, Curbside Pickup, Returns Management, Crowdsourced Delivery, and Micro-fulfillment Services. Each of these sub-segments caters to different consumer needs and preferences, with varying levels of urgency and convenience. Standard Delivery remains the most widely used, while Express and Same-Day Delivery are rapidly gaining traction in urban areas due to rising consumer expectations for speed. Micro-fulfillment services are expanding, especially in densely populated cities, to enable faster and more efficient order processing .

By End-User:The end-user segmentation includes B2C (Business to Consumer), B2B (Business to Business), C2C (Consumer to Consumer), Food & Grocery Delivery, and Pharmaceuticals. Each segment has unique requirements and growth drivers, with B2C being the largest due to the increasing number of online shoppers and the dominance of consumer-focused platforms. B2B is expanding rapidly as digital procurement and wholesale e-commerce accelerate, while Food & Grocery Delivery and Pharmaceuticals have seen strong growth from changing consumer habits and health sector digitization .

Brazil E-commerce First Last-Mile Market Competitive Landscape

The Brazil E-commerce First Last-Mile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Livre, B2W Digital (Americanas S.A.), Magazine Luiza, Via Varejo (Via S.A.), Amazon Brasil, Loggi, Rappi, iFood, Correios (Empresa Brasileira de Correios e Telégrafos), Jamef, Total Express, Sequoia Logística, Movile, Azul Cargo, GOLLOG (GOL Linhas Aéreas Logística), Jadlog, Motoboy.com, Uello, Zé Delivery, Flash Courier, Appétit Delivery, Vuxx, Mottu, Courri, Tembici, Yellow contribute to innovation, geographic expansion, and service delivery in this space .

Brazil E-commerce First Last-Mile Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:Brazil's internet penetration rate is approximately 84%, with around 160 million users accessing online services. This growth is driven by affordable mobile data plans and increased smartphone adoption, which is estimated at 87% of the population. Enhanced connectivity facilitates e-commerce transactions, enabling consumers to shop online conveniently. The Brazilian government’s initiatives to expand broadband access in rural areas further support this trend, making e-commerce more accessible across diverse demographics.

- Rise in Mobile Commerce:Mobile commerce in Brazil accounted for approximately 54% of total e-commerce sales, translating to about BRL 110 billion. The increasing use of mobile wallets and payment apps, such as PicPay and Mercado Pago, has streamlined the purchasing process. With over 80 million Brazilians using mobile devices for shopping, this trend is expected to continue growing, driven by improved mobile network infrastructure and consumer preference for on-the-go shopping experiences, particularly among younger demographics.

- Expansion of Logistics Infrastructure:Brazil's logistics sector is estimated to grow by 5%, supported by significant investments in transportation networks. The government allocated approximately BRL 9 billion for infrastructure improvements, including roads and ports, enhancing last-mile delivery capabilities. This investment is crucial for e-commerce growth, as efficient logistics reduce delivery times and costs, making online shopping more appealing. Improved infrastructure also facilitates access to remote areas, expanding the market reach for e-commerce businesses.

Market Challenges

- High Delivery Costs:Delivery costs in Brazil can account for up to 28% of the total e-commerce transaction value, significantly impacting profitability. Factors contributing to these high costs include fuel prices, labor expenses, and the complexity of navigating urban traffic. As e-commerce continues to grow, companies must find innovative solutions to optimize delivery routes and reduce costs, which is essential for maintaining competitive pricing and customer satisfaction in the market.

- Regulatory Hurdles:The Brazilian e-commerce sector faces numerous regulatory challenges, including complex tax structures and compliance requirements. The average tax burden for e-commerce businesses is estimated at 34%, which can deter new entrants and stifle innovation. Additionally, varying regulations across states complicate logistics and delivery operations. Addressing these regulatory hurdles is crucial for fostering a more conducive environment for e-commerce growth and attracting foreign investment.

Brazil E-commerce First Last-Mile Market Future Outlook

The future of Brazil's e-commerce last-mile market appears promising, driven by technological advancements and evolving consumer preferences. As logistics companies increasingly adopt automation and data analytics, efficiency in delivery operations is expected to improve significantly. Furthermore, the growing emphasis on sustainability will likely lead to the adoption of eco-friendly practices in logistics. With the Brazilian government focusing on enhancing infrastructure, the market is poised for robust growth, catering to a diverse consumer base across urban and rural areas.

Market Opportunities

- Growth of Same-Day Delivery Services:The demand for same-day delivery services is surging, with an estimated market value of BRL 18 billion. This trend is driven by consumer expectations for faster service and convenience. Companies that can effectively implement same-day delivery solutions will gain a competitive edge, attracting more customers and increasing market share in the rapidly evolving e-commerce landscape.

- Integration of Technology in Logistics:The integration of advanced technologies, such as AI and IoT, in logistics operations presents significant opportunities. Investments in logistics technology are estimated to exceed BRL 4.5 billion. These technologies can enhance route optimization, inventory management, and customer service, leading to improved operational efficiency and reduced costs, ultimately benefiting both businesses and consumers in the e-commerce sector.