Region:Central and South America

Author(s):Rebecca

Product Code:KRAB1776

Pages:80

Published On:October 2025

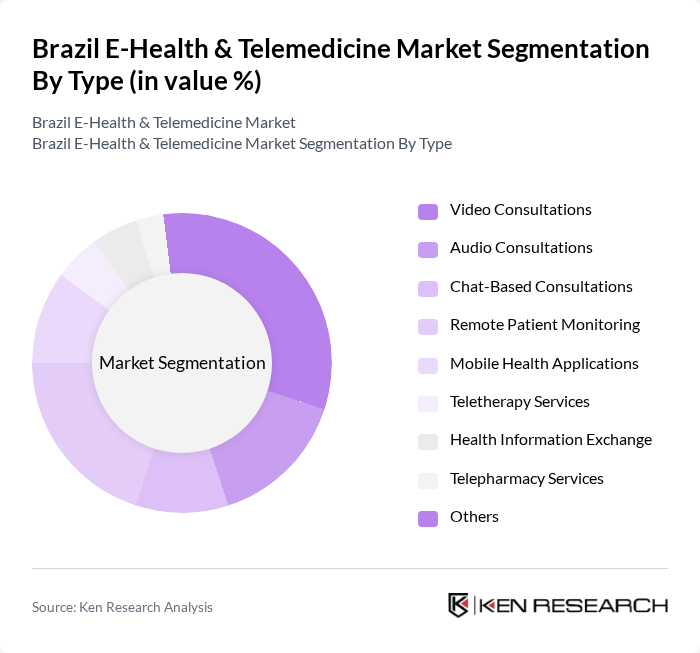

By Type:The market can be segmented into various types, including Video Consultations, Audio Consultations, Chat-Based Consultations, Remote Patient Monitoring, Mobile Health Applications, Teletherapy Services, Health Information Exchange, Telepharmacy Services, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics. Video consultations and remote patient monitoring are particularly prominent due to their ability to bridge care gaps in both urban and rural settings, while mobile health applications and teletherapy services are experiencing rapid adoption as digital literacy and smartphone penetration increase .

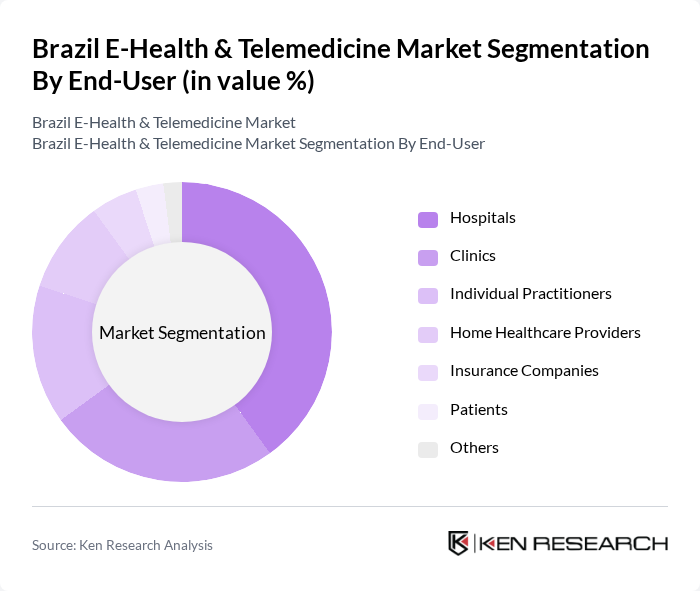

By End-User:The end-user segmentation includes Hospitals, Clinics, Individual Practitioners, Home Healthcare Providers, Insurance Companies, Patients, and Others. Each segment has unique needs and contributes differently to the market. Hospitals and clinics are the largest adopters, leveraging telemedicine to optimize resource allocation and patient flow, while home healthcare providers and individual practitioners are increasingly utilizing digital platforms to expand their reach and improve patient engagement .

The Brazil E-Health & Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Dasa S.A., Dr. Consulta, Conexa Saúde, Grupo Sabin, Hospital Israelita Albert Einstein, Amil, Unimed, iClinic, PEBMED, Acesso Saúde, Saúde iD, MedRoom, Telemedicina Brasil, Vitalk, iCliniq, Saúde Digital, Dr. App, Grupo São Francisco contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's e-health and telemedicine market appears promising, driven by technological advancements and a growing acceptance of digital health solutions. The integration of artificial intelligence and machine learning in telehealth platforms is expected to enhance diagnostic accuracy and patient engagement in future. Additionally, the collaboration between public and private sectors will likely foster innovation, leading to improved healthcare delivery models that prioritize patient-centric care and accessibility across diverse demographics.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Consultations Audio Consultations Chat-Based Consultations Remote Patient Monitoring Mobile Health Applications Teletherapy Services Health Information Exchange Telepharmacy Services Others |

| By End-User | Hospitals Clinics Individual Practitioners Home Healthcare Providers Insurance Companies Patients Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Services Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Others |

| By Technology | Video Conferencing Tools Mobile Applications Cloud-Based Solutions Wearable Devices Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Bundled Services Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 100 | CEOs, Operations Managers, Technology Officers |

| Healthcare Professionals | 150 | Doctors, Nurses, Telehealth Coordinators |

| Patients Using E-Health Services | 120 | Patients, Caregivers, Health Advocates |

| Health Insurance Companies | 80 | Policy Analysts, Product Managers, Underwriters |

| Regulatory Bodies and Health Authorities | 50 | Policy Makers, Health Economists, Compliance Officers |

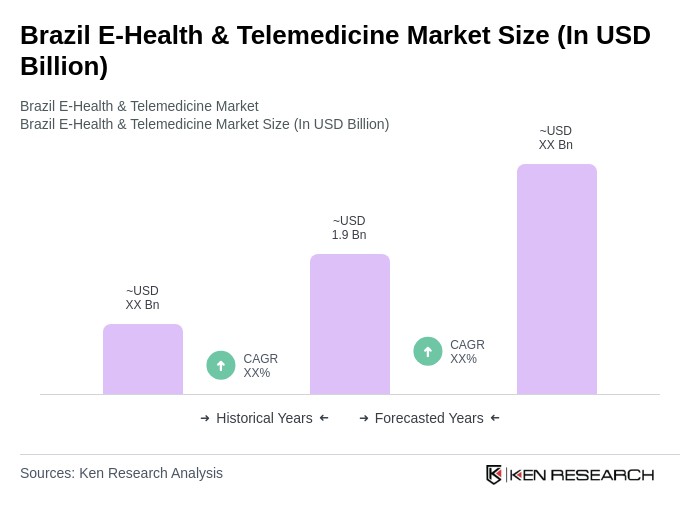

The Brazil E-Health & Telemedicine Market is valued at approximately USD 1.9 billion, reflecting significant growth driven by the adoption of digital health solutions and the increasing demand for remote healthcare services, particularly in rural areas.