Region:Central and South America

Author(s):Geetanshi

Product Code:KRAD0138

Pages:87

Published On:August 2025

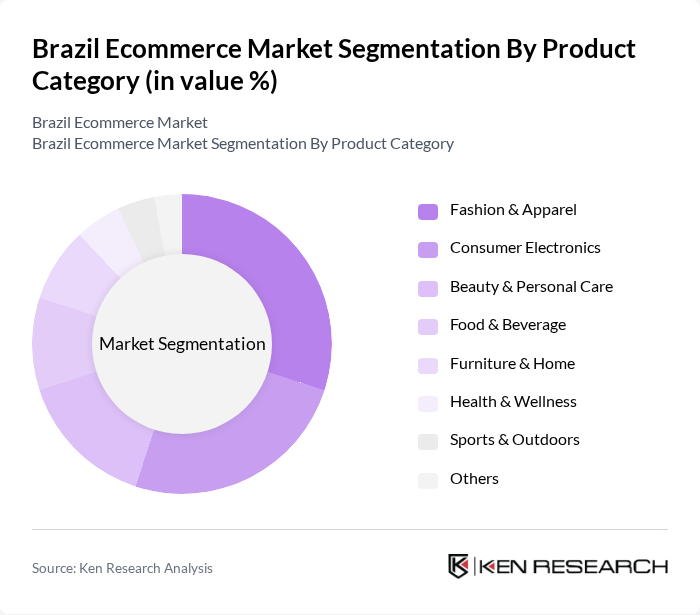

By Product Category:The ecommerce market in Brazil is segmented into Fashion & Apparel, Consumer Electronics, Beauty & Personal Care, Food & Beverage, Furniture & Home, Health & Wellness, Sports & Outdoors, and Others. Fashion & Apparel remains a leading segment, driven by evolving consumer preferences and the increasing trend of online shopping for clothing and accessories. The convenience of online shopping, extensive product variety, and frequent promotional campaigns make this category particularly attractive to consumers.

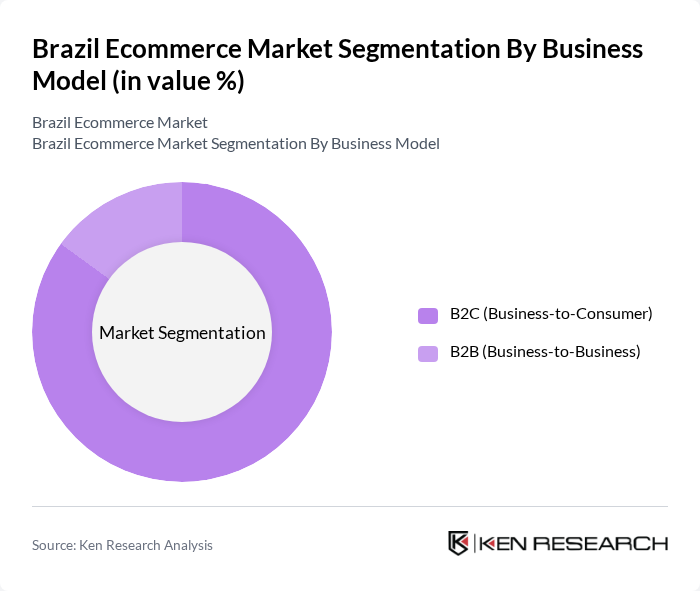

By Business Model:The ecommerce market is also segmented by business model into B2C (Business-to-Consumer) and B2B (Business-to-Business). The B2C model overwhelmingly dominates the market, serving a rapidly growing base of consumers who prefer the convenience of shopping from home and the broad selection of products available online.

The Brazil Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Livre, Americanas S.A., Magazine Luiza, Via (Casas Bahia, Ponto), Amazon Brasil, OLX Brasil, Carrefour Brasil, Submarino, Netshoes, Dafiti, Lojas Renner, Riachuelo, iFood, Rappi Brasil, Pão de Açúcar (GPA) contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian ecommerce market is poised for continued growth, driven by technological advancements and changing consumer behaviors. As digital payment solutions become more integrated and logistics improve, the market will likely see increased participation from both consumers and businesses. Additionally, the rise of social commerce and personalized shopping experiences will further enhance engagement. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capitalize on the expanding market opportunities in Brazil.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Fashion & Apparel Consumer Electronics Beauty & Personal Care Food & Beverage Furniture & Home Health & Wellness Sports & Outdoors Others |

| By Business Model | B2C (Business-to-Consumer) B2B (Business-to-Business) |

| By Device Type | Mobile Desktop |

| By Payment Method | Credit/Debit Cards Digital Wallets (e.g., PIX, Mercado Pago) Bank Transfers Cash on Delivery |

| By Delivery Method | Standard Shipping Express Delivery Click and Collect |

| By Customer Demographics | Age Groups Income Levels Urban vs Rural |

| By Product Lifecycle Stage | New Products Established Products Declining Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics E-commerce | 100 | Online Shoppers, Product Reviewers |

| Fashion and Apparel Online Sales | 90 | Fashion Retailers, Marketing Managers |

| Grocery Delivery Services | 80 | Logistics Coordinators, Supply Chain Analysts |

| SME E-commerce Adoption | 70 | Business Owners, E-commerce Managers |

| Payment Solutions in E-commerce | 60 | Fintech Executives, Payment Specialists |

The Brazil Ecommerce Market is valued at approximately USD 59 billion, driven by increased internet penetration, mobile device usage, and a shift in consumer behavior towards online shopping. This growth is supported by the adoption of digital payment solutions and improved logistics networks.