Region:Europe

Author(s):Dev

Product Code:KRAB0522

Pages:88

Published On:August 2025

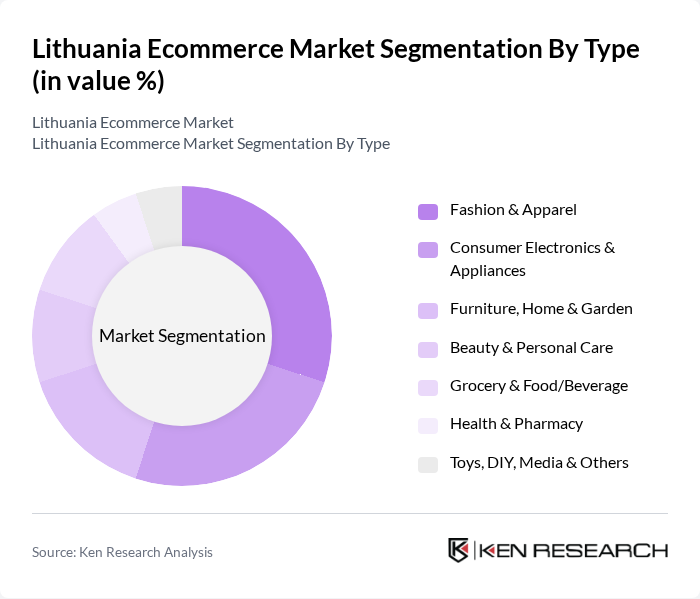

By Type:The ecommerce market in Lithuania can be segmented into various types, including Fashion & Apparel, Consumer Electronics & Appliances, Furniture, Home & Garden, Beauty & Personal Care, Grocery & Food/Beverage, Health & Pharmacy, and Toys, DIY, Media & Others. Each of these segments caters to different consumer needs and preferences, contributing to the overall market growth .

The Fashion & Apparel segment is currently the leading sub-segment in the ecommerce market, driven by online-first discovery, targeted social marketing, and frequent promotions; categories such as consumer electronics and beauty also represent significant baskets in Lithuania’s online mix .

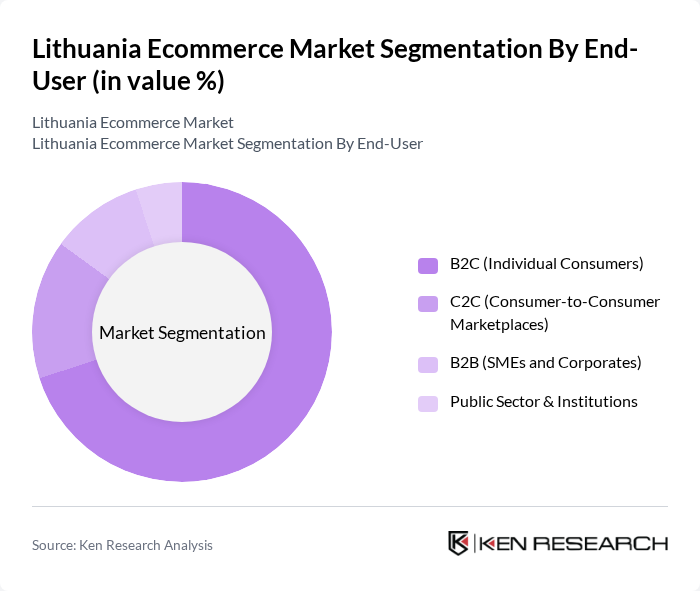

By End-User:The ecommerce market can also be segmented by end-user categories, including B2C (Individual Consumers), C2C (Consumer-to-Consumer Marketplaces), B2B (SMEs and Corporates), and Public Sector & Institutions. Each of these segments plays a crucial role in shaping the overall market dynamics, with B2C remaining the dominant channel and C2C gaining traction for recommerce and secondhand goods .

The B2C segment dominates the ecommerce market, accounting for the majority of sales as consumers increasingly transact via mobile and digital wallets; C2C platforms have accelerated due to strong interest in secondhand fashion and home goods, led by recommerce marketplaces .

The Lithuania Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pigu.lt, Barbora (Maxima Grup?), Vinted, Senukai (Kesko Senukai), Rimi e-parduotuv? (Rimi Lietuva), Varle.lt, 1a.lt, Avitela, Elektromarkt, Omniva Lietuva, DPD Lietuva, LP EXPRESS (Lietuvos paštas), Wolt Market Lithuania, Bolt Market Lithuania, Zalgiris Shop (example of branded D2C) contribute to innovation, geographic expansion, and service delivery in this space .

Additional validated insights to enhance growth drivers:

The future of the Lithuanian e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As digital payment solutions become more integrated and logistics improve, the market is expected to expand further. Additionally, the rise of social commerce and personalized shopping experiences will likely enhance customer engagement. Retailers who adapt to these trends and invest in technology will be well-positioned to capture a larger share of the growing e-commerce landscape in Lithuania.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion & Apparel Consumer Electronics & Appliances Furniture, Home & Garden Beauty & Personal Care Grocery & Food/Beverage Health & Pharmacy Toys, DIY, Media & Others |

| By End-User | B2C (Individual Consumers) C2C (Consumer-to-Consumer Marketplaces) B2B (SMEs and Corporates) Public Sector & Institutions |

| By Sales Channel | Direct-to-Consumer Webstores Online Marketplaces Social Commerce Mobile Apps |

| By Payment Method | Cards (Credit/Debit) E-wallets (e.g., Paysera, Google Pay, Apple Pay) Bank Transfers (including SEPA) Cash on Delivery |

| By Delivery Method | Standard Home Delivery Express/Same- or Next-Day Delivery Click & Collect / Parcel Lockers |

| By Customer Demographics | Age Groups Income Levels Urban vs Rural |

| By Product Lifecycle Stage | New Products Established Products Declining Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retailers | 120 | E-commerce Managers, Business Owners |

| Logistics Providers | 90 | Operations Managers, Logistics Coordinators |

| Consumer Insights | 140 | Online Shoppers, Market Researchers |

| Payment Solutions | 80 | Product Managers, Financial Analysts |

| Digital Marketing Agencies | 70 | Marketing Directors, SEO Specialists |

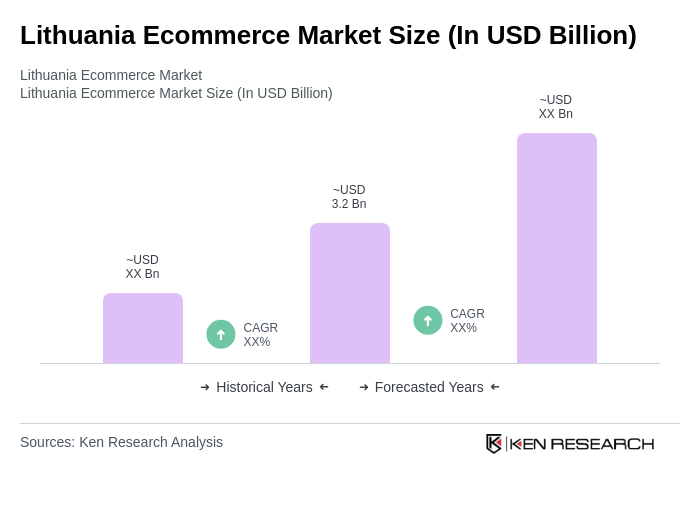

The Lithuania Ecommerce Market is valued at approximately USD 3.2 billion, reflecting strong online retail penetration and consumer adoption of digital channels. This valuation is based on a five-year historical analysis and aligns with recent industry estimates.