Region:North America

Author(s):Shubham

Product Code:KRAA1741

Pages:96

Published On:August 2025

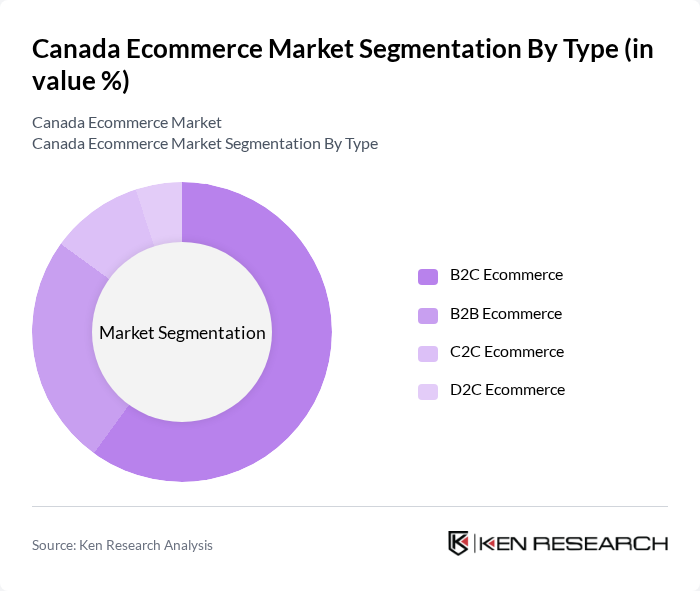

By Type:The ecommerce market can be segmented into various types, including B2C, B2B, C2C, and D2C. Each of these segments addresses distinct customer needs and go?to?market models. B2C remains the most prominent in Canada given widespread online retail adoption and its double?digit share of total retail sales, while B2B is also significant as enterprises digitize procurement and move to marketplace and self?service portals .

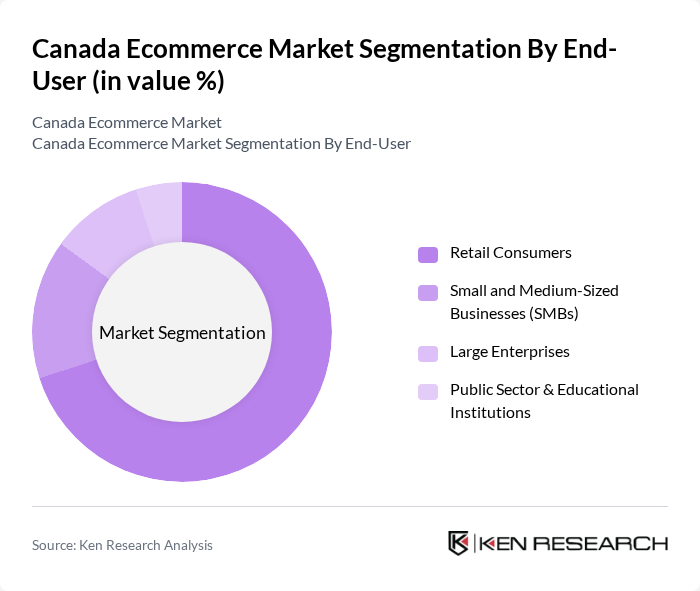

By End-User:The end-user segmentation includes retail consumers, small and medium-sized businesses (SMBs), large enterprises, and public sector & educational institutions. Retail consumers dominate due to the convenience of online shopping, broad category coverage (including grocery, electronics, apparel, and health/beauty), and improving delivery options. SMBs increasingly leverage marketplaces and storefront platforms to expand reach, while large enterprises invest in omnichannel and first?party ecommerce to optimize customer experience and margins .

The Canada Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.ca (Amazon Canada), Shopify Inc., Walmart Canada (Walmart.ca), Best Buy Canada (BestBuy.ca), eBay Canada (eBay.ca), Canadian Tire Corporation (including SportChek, Mark’s), The Bay (Hudson’s Bay Company), Indigo Books & Music (Indigo.ca), Loblaw Companies Limited (PC Express), Wayfair Canada, Etsy (Canada), Newegg Canada, AliExpress (Canada), Costco Wholesale Canada, Rakuten Kobo (Kobo.com) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Canadian ecommerce market appears promising, driven by technological advancements and changing consumer preferences. As more Canadians embrace online shopping, businesses are expected to enhance their digital presence and invest in innovative technologies. The integration of artificial intelligence and machine learning will likely personalize shopping experiences, while sustainability initiatives will resonate with environmentally conscious consumers. Additionally, the growth of cross-border ecommerce will open new avenues for Canadian retailers, allowing them to tap into international markets and expand their customer base.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Ecommerce B2B Ecommerce C2C Ecommerce D2C Ecommerce |

| By End-User | Retail Consumers Small and Medium-Sized Businesses (SMBs) Large Enterprises Public Sector & Educational Institutions |

| By Sales Channel | Online Marketplaces (e.g., Amazon, Walmart, eBay) Brand & Retailer Websites (including Shopify-powered stores) Social Commerce (e.g., Facebook Marketplace, Instagram Shops) Mobile Apps |

| By Product Category | Electronics & Media Fashion & Apparel Furniture, Home & DIY Health, Beauty & Personal Care Grocery & Essentials Sporting Goods & Outdoor |

| By Payment Method | Credit/Debit Cards Digital Wallets (e.g., Apple Pay, Google Pay, PayPal) Buy Now, Pay Later (BNPL) Bank Transfers & Interac e-Transfer |

| By Delivery Method | Standard Shipping Express & Next-Day Delivery Click and Collect (BOPIS) Same-Day Delivery |

| By Customer Demographics | Age Groups Income Levels Geographic Location (Urban, Suburban, Rural) Language Preference (English/French) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Consumer eCommerce Behavior | 150 | Online Shoppers, Frequent Buyers |

| Small Business eCommerce Adoption | 120 | Small Business Owners, Entrepreneurs |

| Logistics and Fulfillment Insights | 80 | Logistics Managers, Supply Chain Analysts |

| Digital Marketing Strategies | 70 | Marketing Directors, Digital Strategists |

| Consumer Electronics Online Sales | 90 | Retail Managers, Product Category Managers |

The Canada Ecommerce Market is valued at approximately USD 65 billion, driven by increased internet access, mobile-commerce adoption, and a growing preference for online retail, which accounts for about one-eighth of total retail spending in Canada.