Region:Europe

Author(s):Shubham

Product Code:KRAB0679

Pages:100

Published On:August 2025

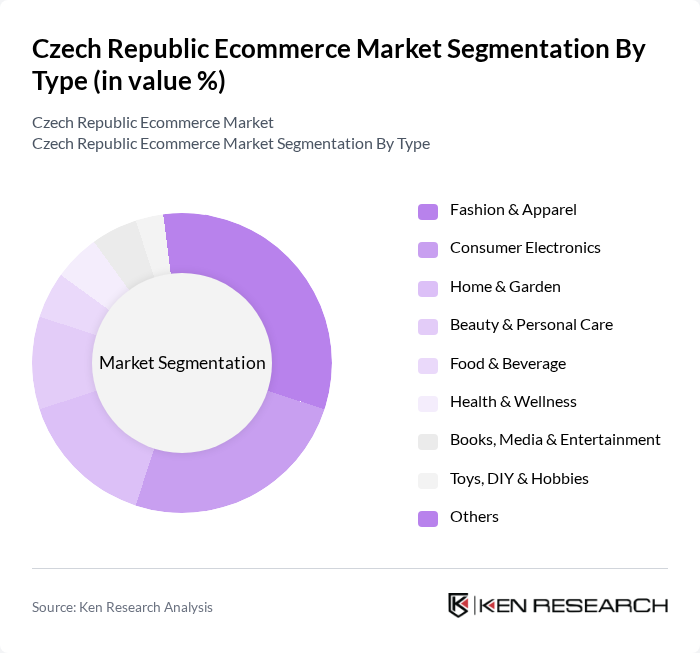

By Type:The ecommerce market is segmented into Fashion & Apparel, Consumer Electronics, Home & Garden, Beauty & Personal Care, Food & Beverage, Health & Wellness, Books, Media & Entertainment, Toys, DIY & Hobbies, and Others. Apparel and Home & Garden are the leading categories by store count, while Food & Beverage and Beauty & Personal Care are experiencing above-average growth due to increased demand for convenience and wellness products.

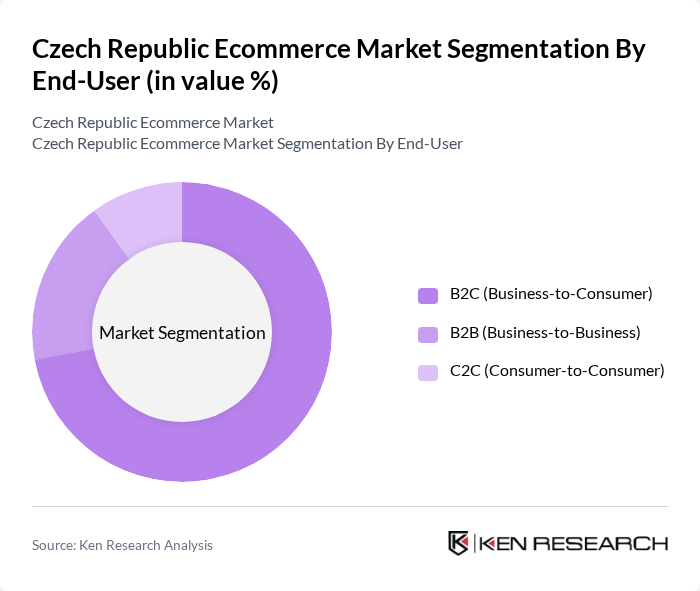

By End-User:The ecommerce market is also segmented by end-user categories, which include B2C (Business-to-Consumer), B2B (Business-to-Business), and C2C (Consumer-to-Consumer). B2C platforms account for the largest share of transactions, driven by broad product assortments and fast fulfilment, while B2B and C2C segments continue to grow through specialized offerings and peer-to-peer platforms.

The Czech Republic Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alza.cz, Heureka.cz, Mall.cz, CZC.cz, Notino, Zoot, Slevomat, Rohlík.cz, Datart, Kasa.cz, Sportisimo, Aukro.cz, Biano, Euronics, FAnn.cz contribute to innovation, geographic expansion, and service delivery in this space.

The Czech Republic's e-commerce market is poised for continued growth, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance personalization in shopping experiences, while the rise of omnichannel retailing will blur the lines between online and offline shopping. Additionally, as sustainability becomes a priority, businesses that adopt eco-friendly practices will likely attract a growing segment of environmentally conscious consumers, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion & Apparel Consumer Electronics Home & Garden Beauty & Personal Care Food & Beverage Health & Wellness Books, Media & Entertainment Toys, DIY & Hobbies Others |

| By End-User | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) |

| By Sales Channel | Online Marketplaces (e.g., Alza.cz, Mall.cz, Heureka.cz) Brand & Retailer Websites Social Commerce Platforms Mobile Apps |

| By Payment Method | Credit/Debit Cards Digital Wallets (e.g., Google Pay, Apple Pay) Bank Transfers Cash on Delivery Buy Now, Pay Later (BNPL) |

| By Delivery Method | Home Delivery Click & Collect Locker Pickup (e.g., Zásilkovna, AlzaBox) |

| By Customer Demographics | Age Group Income Level Urban vs Rural Gender |

| By Product Category | Electronics Fashion Home & Garden Health & Beauty Sports & Outdoors Toys & Hobbies Food & Beverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General E-commerce Trends | 120 | Online Shoppers, E-commerce Managers |

| Consumer Electronics Purchases | 90 | Tech-savvy Consumers, Retail Buyers |

| Fashion and Apparel Online Sales | 60 | Fashion Retailers, Marketing Executives |

| Grocery Delivery Services | 50 | Logistics Coordinators, Grocery Retail Managers |

| SME E-commerce Adoption | 40 | Small Business Owners, E-commerce Consultants |

The Czech Republic Ecommerce Market is valued at approximately USD 8 billion, driven by increased internet penetration, mobile commerce growth, and changing consumer preferences towards online shopping. This market is expected to continue expanding in the coming years.