Brazil EV Battery Manufacturing Market Overview

- The Brazil EV Battery Manufacturing Market is valued at USD 2.0 billion, based on a five-year historical analysis. Growth is primarily driven by the increasing adoption of electric vehicles, robust government incentives for sustainable energy, and advancements in battery technology. The surge in demand for energy storage solutions, alongside the expansion of renewable energy sources, continues to accelerate market expansion. Recent investments from international players, such as BYD and Huawei, and the launch of advanced battery material facilities (notably niobium-based anodes by CBMM), are further strengthening Brazil's position as a regional leader in EV battery manufacturing and innovation .

- Key cities such as São Paulo, Rio de Janeiro, and Belo Horizonte remain dominant in the market due to their established industrial infrastructure, access to skilled labor, and proximity to major automotive manufacturers. These urban centers are pivotal in fostering innovation, attracting both domestic and international investments, and supporting the scale-up of electric vehicle technology and battery production .

- In December 2023, the Brazilian government issued Provisional Measure No. 1,205/2023, establishing new sustainability requirements and incentives for the automotive sector. The measure sets sustainability goals for fleet decarbonization and provides financial credits for companies investing in innovative technologies, including advanced battery systems. Companies meeting the program criteria can access substantial tax incentives, supporting the growth of the EV battery manufacturing sector and encouraging the adoption of higher-capacity battery systems in new electric vehicles .

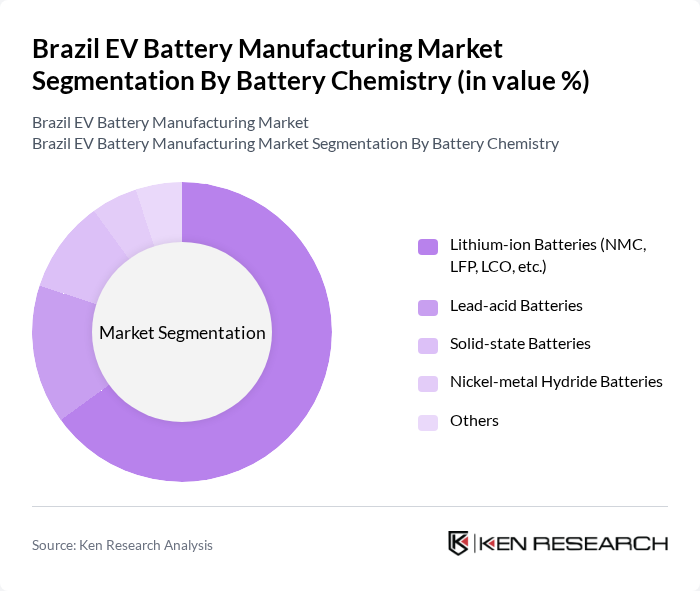

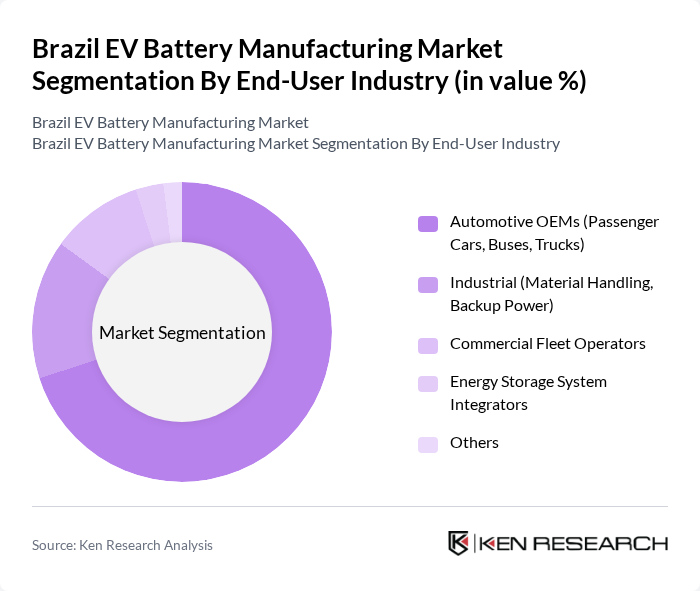

Brazil EV Battery Manufacturing Market Segmentation

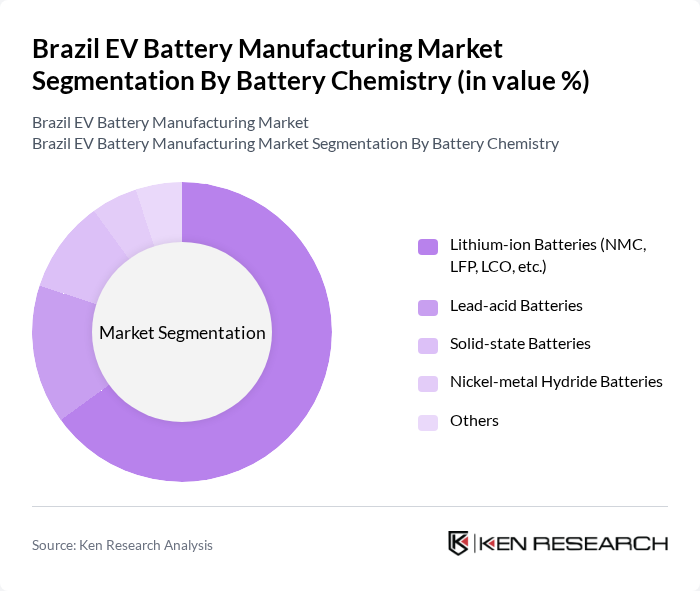

By Battery Chemistry:The battery chemistry segment includes various types of batteries used in electric vehicles and energy storage systems. The subsegments are Lithium-ion Batteries (NMC, LFP, LCO, etc.), Lead-acid Batteries, Solid-state Batteries, Nickel-metal Hydride Batteries, and Others. Among these, lithium-ion batteries hold the largest share due to their high energy density, efficiency, and ongoing cost reductions. The introduction of advanced materials, such as niobium-based anodes, is further enhancing the performance and lifespan of lithium-ion batteries, reinforcing their dominance in the Brazilian market .

By End-User Industry:This segment encompasses various industries utilizing EV batteries, including Automotive OEMs, Industrial applications, Commercial Fleet Operators, Energy Storage System Integrators, and Others. Automotive OEMs represent the largest segment, driven by the rapid expansion of electric vehicle production and the increasing demand for sustainable transportation. The growth of industrial and commercial fleet applications is also notable, supported by government incentives and the scaling of local battery manufacturing .

Brazil EV Battery Manufacturing Market Competitive Landscape

The Brazil EV Battery Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as BYD Company Limited, LG Energy Solution Ltd., Samsung SDI Co., Ltd., WEG S.A., CBMM (Companhia Brasileira de Metalurgia e Mineração), Sigma Lithium Corporation, Baterias Moura S.A., Electrocell, Sunred Energy Brasil, UCB Power, CATL (Contemporary Amperex Technology Co., Limited), BorgWarner Inc., Intelbras S.A., Heliar, and Baterias Cral contribute to innovation, geographic expansion, and service delivery in this space.

Brazil EV Battery Manufacturing Market Industry Analysis

Growth Drivers

- Increasing Demand for Electric Vehicles:The Brazilian electric vehicle (EV) market is projected to reach approximately 1.5 million units in the future, driven by a growing consumer preference for sustainable transportation. The country's automotive sector is experiencing a shift, with EV sales increasing by 30% annually. This surge is supported by rising fuel prices, which averaged R$5.50 per liter in the future, prompting consumers to seek more cost-effective alternatives, thereby boosting demand for EVs and their associated battery technologies.

- Government Incentives for EV Adoption:The Brazilian government has implemented various incentives to promote EV adoption, including tax exemptions and subsidies. In the future, the government allocated R$1 billion to support EV infrastructure development, including charging stations. Additionally, the reduction of the IPI (Industrialized Product Tax) for electric vehicles has made them more affordable, with an average price reduction of R$10,000 per vehicle, significantly enhancing market accessibility and stimulating battery manufacturing growth.

- Advancements in Battery Technology:Technological innovations in battery manufacturing are propelling the Brazilian EV battery market forward. In the future, the introduction of solid-state batteries is expected to enhance energy density by 50%, improving vehicle range and performance. Furthermore, local research institutions are collaborating with manufacturers, resulting in a 20% reduction in production costs. This technological progress not only boosts the competitiveness of Brazilian manufacturers but also aligns with global trends towards more efficient and sustainable battery solutions.

Market Challenges

- High Initial Investment Costs:The capital required for establishing EV battery manufacturing facilities in Brazil is substantial, with estimates ranging from R$200 million to R$500 million per plant. This financial barrier limits entry for new players and constrains existing manufacturers from scaling operations. Additionally, the high costs associated with advanced technology adoption and skilled labor further exacerbate the challenge, making it difficult for companies to achieve profitability in the short term.

- Supply Chain Disruptions:The Brazilian EV battery manufacturing sector faces significant supply chain challenges, particularly in sourcing raw materials like lithium and cobalt. In the future, global lithium prices surged to R$300,000 per ton, impacting production costs. Furthermore, geopolitical tensions and trade restrictions have led to delays in material imports, causing production bottlenecks. These disruptions hinder manufacturers' ability to meet growing demand and maintain competitive pricing in the market.

Brazil EV Battery Manufacturing Market Future Outlook

The future of Brazil's EV battery manufacturing market appears promising, driven by increasing investments in sustainable technologies and infrastructure. In the future, the expansion of charging networks is expected to facilitate greater EV adoption, while partnerships between battery manufacturers and automotive companies will enhance innovation. Additionally, the focus on recycling technologies will address environmental concerns, creating a circular economy for battery materials. These trends indicate a robust growth trajectory for the industry, positioning Brazil as a key player in the regional EV market.

Market Opportunities

- Expansion of Charging Infrastructure:The Brazilian government plans to invest R$500 million in expanding the EV charging network in the future. This initiative aims to increase the number of charging stations from 1,000 to 5,000, significantly enhancing the convenience of EV ownership. Improved infrastructure will likely drive consumer confidence and accelerate EV adoption, creating a favorable environment for battery manufacturers to thrive.

- Development of Recycling Technologies:The growing emphasis on sustainability presents opportunities for battery recycling technologies. In the future, the Brazilian market for battery recycling is projected to reach R$200 million, driven by regulatory pressures and consumer demand for eco-friendly solutions. Companies investing in recycling processes can reduce raw material costs and contribute to a circular economy, positioning themselves as leaders in sustainable battery manufacturing.