Region:Central and South America

Author(s):Shubham

Product Code:KRAA0700

Pages:83

Published On:August 2025

Market.png)

By Type:The market is segmented into a range of services designed to address diverse logistics needs. The subsegments include Integrated Logistics Services, Transportation Management Services, Warehousing and Distribution Services, Supply Chain Consulting Services, Freight Forwarding Services, Inventory Management Services, Reverse Logistics Services, Customs Brokerage and Compliance Services, and Others. Integrated Logistics Services is the leading subsegment, reflecting the trend of companies outsourcing logistics functions to specialized providers to enhance operational efficiency and focus on core business activities .

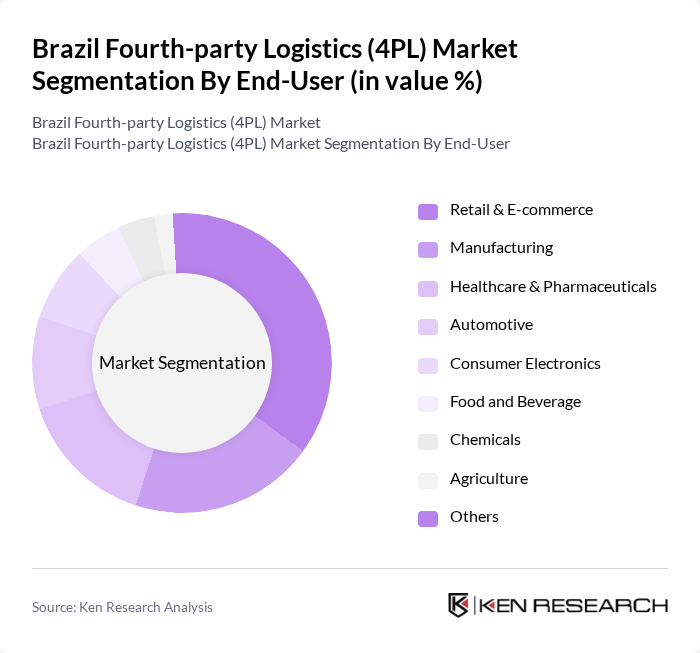

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Consumer Electronics, Food and Beverage, Chemicals, Agriculture, and Others. Retail & E-commerce remains the dominant end-user, propelled by the surge in online shopping and the need for advanced logistics solutions to meet consumer expectations for rapid delivery and high service quality. The manufacturing and automotive sectors also represent significant demand for 4PL services, leveraging integrated logistics to streamline supply chains and improve competitiveness .

The Brazil Fourth-party Logistics (4PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as CEVA Logistics, DHL Supply Chain Brazil, DB Schenker Brazil, Kuehne + Nagel Brazil, Penske Logistics Brazil, GEODIS Brazil, ID Logistics Brazil, UPS Supply Chain Solutions Brazil, Ryder Supply Chain Solutions Brazil, XPO Logistics, C.H. Robinson, DSV Brazil, Panalpina (now part of DSV), Loggi, and Tegma Gestão Logística contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil 4PL market appears promising, driven by the increasing integration of technology and the growing demand for efficient logistics solutions. As companies prioritize sustainability and digital transformation, 4PL providers will play a crucial role in optimizing supply chains. The focus on enhancing customer experience through innovative logistics solutions will further propel market growth. Additionally, the expansion of e-commerce and cross-border trade will create new avenues for 4PL services, ensuring a dynamic and evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Integrated Logistics Services Transportation Management Services Warehousing and Distribution Services Supply Chain Consulting Services Freight Forwarding Services Inventory Management Services Reverse Logistics Services Customs Brokerage and Compliance Services Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Consumer Electronics Food and Beverage Chemicals Agriculture Others |

| By Service Model | Asset-Based 4PL Non-Asset-Based 4PL Hybrid 4PL |

| By Industry Vertical | E-commerce Pharmaceuticals Electronics Construction Chemicals Automotive Consumer Goods Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage |

| By Customer Type | B2B B2C C2C |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 70 | Logistics Directors, Supply Chain Managers |

| Pharmaceutical Supply Chain | 50 | Operations Managers, Compliance Officers |

| Automotive Logistics Solutions | 40 | Procurement Managers, Warehouse Supervisors |

| E-commerce Fulfillment Strategies | 60 | eCommerce Operations Managers, Logistics Coordinators |

| Food and Beverage Distribution | 40 | Supply Chain Analysts, Distribution Managers |

The Brazil Fourth-party Logistics (4PL) Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by the demand for integrated supply chain solutions and the expansion of e-commerce in the region.