Region:Middle East

Author(s):Dev

Product Code:KRAA0399

Pages:99

Published On:August 2025

Market.png)

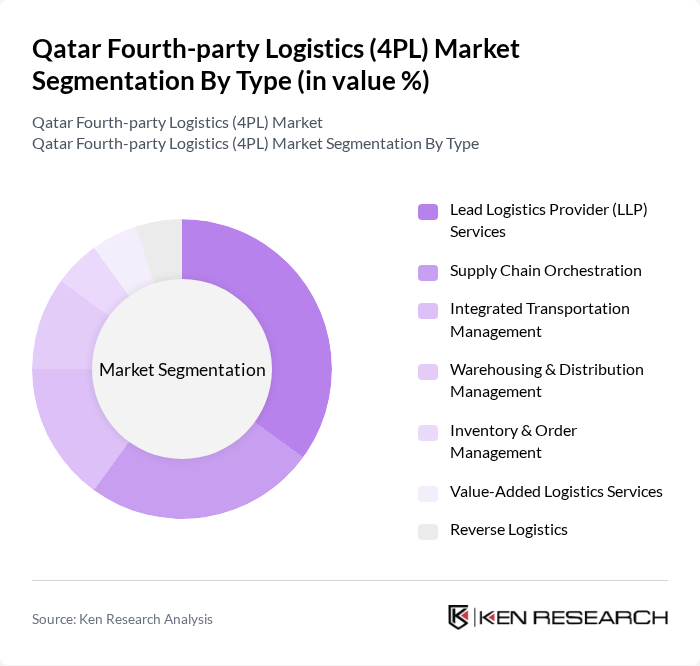

By Type:The market is segmented into various types of services that cater to different logistics needs. The dominant sub-segment is Lead Logistics Provider (LLP) Services, which is favored for its ability to manage complex supply chains efficiently. Supply Chain Orchestration and Integrated Transportation Management also play significant roles, driven by the need for seamless coordination and real-time visibility in logistics operations. Warehousing & Distribution Management and Value-Added Logistics Services are increasingly important as businesses seek to enhance service offerings and customer satisfaction .

By End-User:The end-user segmentation reveals that Retail & E-commerce is the leading sector, driven by the rapid growth of online shopping and consumer demand for fast delivery services. Manufacturing and Healthcare & Pharmaceuticals also represent significant portions of the market, as these industries require reliable logistics solutions to manage their supply chains effectively. The Oil & Gas sector is notable for its specialized logistics needs, while Construction & Infrastructure is growing due to ongoing projects in Qatar .

The Qatar Fourth-party Logistics (4PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as GWC (Gulf Warehousing Company), DHL Supply Chain, Agility Logistics, DB Schenker, Kuehne + Nagel, CEVA Logistics, XPO Logistics, UPS Supply Chain Solutions, FedEx Logistics, Bolloré Logistics, Yusen Logistics, Expeditors International, DSV Solutions, Maersk Logistics, GEODIS contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's 4PL market appears promising, driven by ongoing investments in logistics infrastructure and technology. As the government continues to enhance trade facilitation measures, the sector is expected to attract more foreign direct investment, fostering innovation. Additionally, the integration of digital technologies and automation will likely streamline operations, improve efficiency, and enhance customer satisfaction, positioning Qatar as a competitive player in the global logistics landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Lead Logistics Provider (LLP) Services Supply Chain Orchestration Integrated Transportation Management Warehousing & Distribution Management Inventory & Order Management Value-Added Logistics Services Reverse Logistics |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Oil & Gas Food & Beverage Construction & Infrastructure Others |

| By Service Model | Asset-Based 4PL Non-Asset-Based 4PL Hybrid 4PL Industry Innovator Model |

| By Industry Vertical | Oil and Gas Construction Telecommunications Aerospace Pharmaceuticals Retail Others |

| By Geographic Coverage | Domestic Logistics International Logistics Regional Logistics (GCC/MENA) Others |

| By Technology Utilization | IoT & Telematics Integration Blockchain-enabled Logistics Cloud-based Supply Chain Platforms Advanced Data Analytics & AI Automation & Robotics Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Logistics Management | 60 | Logistics Directors, Supply Chain Managers |

| Retail Supply Chain Operations | 50 | Operations Managers, Procurement Specialists |

| Healthcare Distribution Networks | 40 | Pharmaceutical Logistics Coordinators, Warehouse Managers |

| Construction Material Logistics | 40 | Project Managers, Logistics Supervisors |

| E-commerce Fulfillment Strategies | 50 | eCommerce Operations Managers, Customer Experience Leads |

The Qatar Fourth-party Logistics (4PL) Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for integrated supply chain solutions and the rise of e-commerce in the region.