Region:Africa

Author(s):Geetanshi

Product Code:KRAA2071

Pages:100

Published On:August 2025

Market.png)

By Type:The market is segmented into Integrated Logistics Services, Transportation Management, Warehousing & Distribution Services, Freight Forwarding Services, Supply Chain Planning & Consulting, Reverse Logistics, and Others. Integrated Logistics Services remain the dominant segment, as businesses increasingly seek comprehensive solutions to streamline operations, improve visibility, and reduce costs. Transportation Management follows, driven by the rising need for efficient goods movement and real-time tracking across Nigeria’s diverse geography. Warehousing & Distribution Services are gaining traction due to the expansion of e-commerce and the need for last-mile delivery optimization .

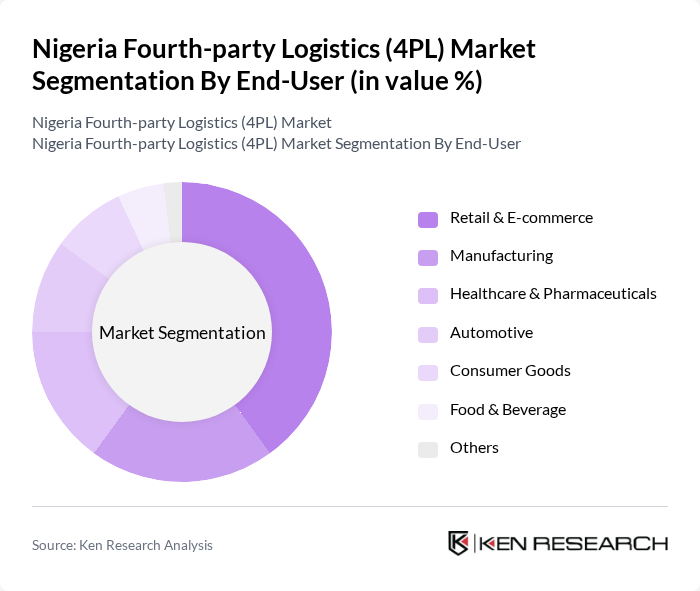

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Consumer Goods, Food & Beverage, and Others. Retail & E-commerce is the leading segment, propelled by surging online shopping and the demand for rapid, reliable delivery services. Manufacturing remains significant, as companies focus on optimizing supply chains to enhance competitiveness and resilience. Healthcare & Pharmaceuticals are expanding due to increased regulatory requirements and the need for temperature-controlled logistics .

The Nigeria Fourth-party Logistics (4PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Nigeria, Kuehne + Nagel Nigeria, Maersk Nigeria, Agility Logistics Nigeria, CEVA Logistics Nigeria, GIG Logistics, Red Star Express, Transcorp Logistics, Jumia Logistics, TSL Logistics, APM Terminals Nigeria, Nigerian Ports Authority, SIFAX Group, BUA Group, Nigerian Railway Corporation, Bolloré Transport & Logistics Nigeria, FedEx Nigeria, UPS Nigeria, MSC Mediterranean Shipping Company Nigeria, Creseada International Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's 4PL market appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly adopt digital solutions, the integration of AI and automation in logistics operations is expected to enhance efficiency and reduce costs. Additionally, the rising consumer demand for sustainable practices will likely push logistics providers to innovate, creating a more resilient and environmentally friendly supply chain landscape in Nigeria.

| Segment | Sub-Segments |

|---|---|

| By Type | Integrated Logistics Services Transportation Management Warehousing & Distribution Services Freight Forwarding Services Supply Chain Planning & Consulting Reverse Logistics Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Consumer Goods Food & Beverage Others |

| By Service Type | Contract Logistics Lead Logistics Provider Services Value-Added Services Customs & Compliance Management Others |

| By Distribution Channel | Direct Sales Online Platforms Third-party Distributors Others |

| By Industry Vertical | Consumer Goods Electronics Pharmaceuticals Food and Beverage Automotive Others |

| By Geographic Coverage | Urban Areas Rural Areas Cross-Border Logistics Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 100 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain Solutions | 60 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Strategies | 90 | eCommerce Operations Managers, Logistics Analysts |

| Pharmaceutical Distribution Networks | 50 | Supply Chain Executives, Compliance Officers |

| Automotive Logistics Services | 70 | Warehouse Managers, Logistics Engineers |

The Nigeria Fourth-party Logistics (4PL) Market is valued at approximately USD 120 million, reflecting a growing demand for integrated supply chain solutions, particularly driven by the rise of e-commerce and advancements in digital technologies.