Region:Central and South America

Author(s):Shubham

Product Code:KRAA1026

Pages:83

Published On:August 2025

Market.png)

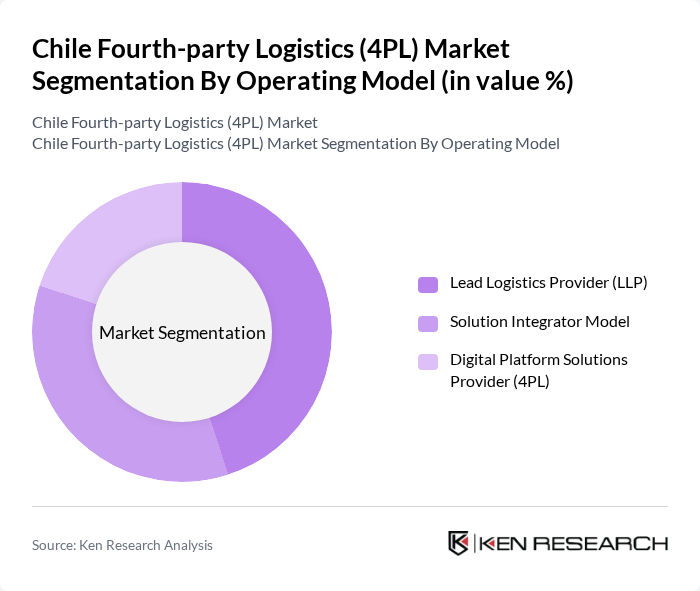

By Operating Model:The operating model segmentation includes Lead Logistics Provider (LLP), Solution Integrator Model, and Digital Platform Solutions Provider (4PL). Each model serves distinct needs within the logistics ecosystem, with LLPs focusing on managing entire supply chains, solution integrators providing tailored logistics solutions, and digital platforms leveraging technology for enhanced service delivery. The LLP model currently dominates the market, but digital platform solutions are rapidly gaining traction as companies seek greater supply chain visibility and automation .

By End-User:The end-user segmentation encompasses FMCG (Fast-moving Consumer Goods), Retail (Hypermarkets, Supermarkets, Convenience Stores, E-commerce Channels), Fashion and Lifestyle (Apparel, Footwear), Reefer (Fruits, Vegetables, Pharmaceuticals, Meat, Fish, Seafood), Technology (Consumer Electronics, Home Appliances), and Other End-Users. Each segment has unique logistics requirements, with FMCG and Retail being the largest due to their high volume and frequency of shipments. The reefer segment is expanding due to Chile's strong agricultural exports and pharmaceutical logistics needs .

The Chile Fourth-party Logistics (4PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, CEVA Logistics, Agility Logistics, UPS Supply Chain Solutions, FedEx Logistics, C.H. Robinson, DSV, Geodis, Expeditors International, Ryder Supply Chain Solutions, Panalpina (now part of DSV), Toll Group, Ransa Comercial S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Chilean 4PL market is poised for significant transformation as businesses increasingly adopt integrated logistics solutions to enhance operational efficiency. The focus on last-mile delivery will intensify, driven by the growing e-commerce sector and consumer demand for rapid fulfillment. Additionally, advancements in technology, such as automation and data analytics, will play a crucial role in optimizing logistics processes, enabling companies to make informed decisions and improve service delivery in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Operating Model | Lead Logistics Provider (LLP) Solution Integrator Model Digital Platform Solutions Provider (4PL) |

| By End-User | FMCG (Fast-moving Consumer Goods) Retail (Hypermarkets, Supermarkets, Convenience Stores, E-commerce Channels) Fashion and Lifestyle (Apparel, Footwear) Reefer (Fruits, Vegetables, Pharmaceuticals, Meat, Fish, Seafood) Technology (Consumer Electronics, Home Appliances) Other End-Users |

| By Service Model | Asset-Based 4PL Non-Asset-Based 4PL Hybrid 4PL |

| By Industry Vertical | E-commerce Pharmaceuticals Construction Chemicals Aerospace Others |

| By Delivery Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Others |

| By Customer Type | B2B B2C C2C |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 60 | Logistics Directors, Supply Chain Managers |

| Manufacturing Supply Chain Optimization | 50 | Operations Managers, Procurement Specialists |

| Healthcare Logistics Solutions | 40 | Supply Chain Coordinators, Compliance Officers |

| Food and Beverage Distribution | 45 | Warehouse Managers, Distribution Supervisors |

| E-commerce Fulfillment Strategies | 55 | eCommerce Operations Managers, Logistics Analysts |

The Chile Fourth-party Logistics (4PL) market is valued at approximately USD 480 million, reflecting a significant growth driven by the demand for integrated supply chain solutions and advancements in logistics technology.