Region:North America

Author(s):Shubham

Product Code:KRAA1160

Pages:92

Published On:August 2025

Market.png)

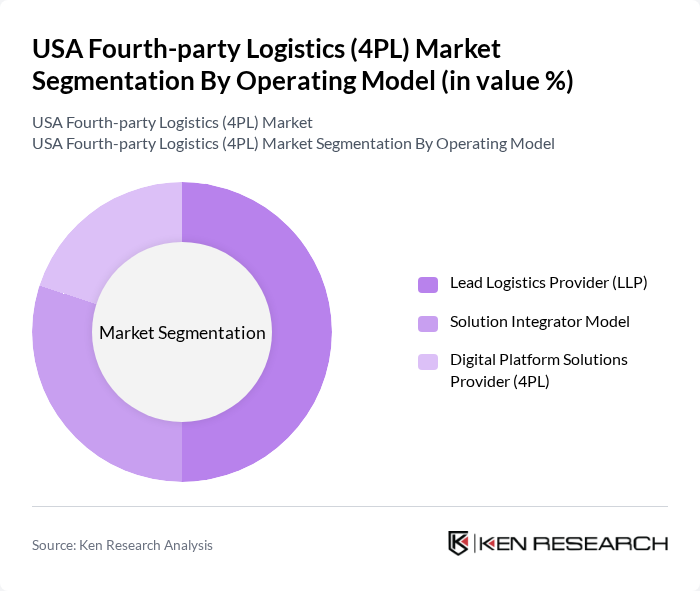

By Operating Model:The operating model segmentation includes Lead Logistics Provider (LLP), Solution Integrator Model, and Digital Platform Solutions Provider (4PL). The Lead Logistics Provider (LLP) segment leads the market due to its ability to offer comprehensive logistics solutions that integrate various supply chain functions. This model allows companies to streamline operations, reduce costs, and improve service levels, making it highly attractive for businesses looking to enhance their logistics capabilities. The adoption of digital technologies and advanced analytics is further strengthening the LLP model’s dominance, enabling real-time visibility and proactive management of supply chain disruptions .

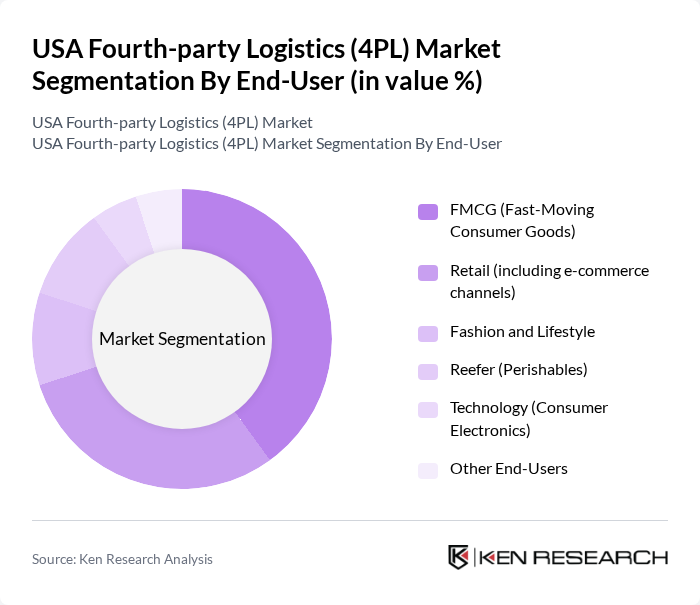

By End-User:This segmentation includes FMCG (Fast-Moving Consumer Goods), Retail (including e-commerce channels), Fashion and Lifestyle, Reefer (Perishables), Technology (Consumer Electronics), and Other End-Users. The FMCG segment is the dominant player in the market, driven by the constant demand for essential goods and the need for efficient distribution networks. The rise of e-commerce has further accelerated the growth of this segment, as consumers increasingly prefer online shopping, necessitating robust logistics solutions to meet delivery expectations. Additionally, the technology and retail sectors are experiencing rapid growth due to increased consumer electronics demand and omnichannel retail strategies .

The USA Fourth-party Logistics (4PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as XPO Logistics, C.H. Robinson, DHL Supply Chain, DB Schenker, Kuehne + Nagel, DSV, UPS Supply Chain Solutions, FedEx Logistics, J.B. Hunt Transport Services, Ryder Supply Chain Solutions, Geodis, Penske Logistics, Expeditors International, Coyote Logistics, NFI Industries, Schneider National contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA 4PL market appears promising, driven by ongoing digital transformation and a heightened focus on sustainability. As companies increasingly adopt integrated supply chain solutions, the demand for 4PL services is expected to rise. Additionally, the emphasis on data analytics will enable logistics providers to enhance operational efficiency and customer service. The market is likely to witness significant growth as businesses seek innovative solutions to navigate complex supply chain challenges and meet evolving consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Operating Model | Lead Logistics Provider (LLP) Solution Integrator Model Digital Platform Solutions Provider (4PL) |

| By End-User | FMCG (Fast-Moving Consumer Goods) Retail (including e-commerce channels) Fashion and Lifestyle Reefer (Perishables: fruits, vegetables, pharmaceuticals, meat, seafood) Technology (Consumer Electronics, Home Appliances) Other End-Users |

| By Service Model | Asset-Based 4PL Non-Asset-Based 4PL Hybrid 4PL |

| By Industry Vertical | Consumer Goods Electronics Food and Beverage Pharmaceuticals Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage |

| By Technology Integration | IoT-Enabled Logistics Blockchain in Supply Chain AI and Machine Learning Applications |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail 4PL Services | 100 | Supply Chain Managers, Logistics Directors |

| Manufacturing Logistics Solutions | 80 | Operations Managers, Procurement Specialists |

| Healthcare Supply Chain Management | 60 | Logistics Coordinators, Compliance Officers |

| Technology Integration in 4PL | 50 | IT Managers, Digital Transformation Leads |

| Environmental Sustainability in Logistics | 40 | Sustainability Managers, Corporate Social Responsibility Officers |

The USA Fourth-party Logistics (4PL) Market is valued at approximately USD 16 billion, reflecting a significant growth driven by the increasing complexity of supply chains and the rise of e-commerce, which demands integrated logistics solutions.