Region:Central and South America

Author(s):Dev

Product Code:KRAA2218

Pages:90

Published On:August 2025

By Type:The furniture market is segmented into Residential Furniture, Commercial Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Modular Furniture, Luxury Furniture, Contract Furniture, and Others. Residential furniture remains the largest segment, driven by ongoing urbanization and a growing middle class seeking modern, functional, and stylish home furnishings. Commercial and office furniture segments are supported by corporate expansions and the rise of co-working spaces, while outdoor and modular furniture gain traction due to increased interest in flexible living environments and sustainable materials. Luxury furniture is experiencing steady growth, reflecting rising affluence and demand for premium products.

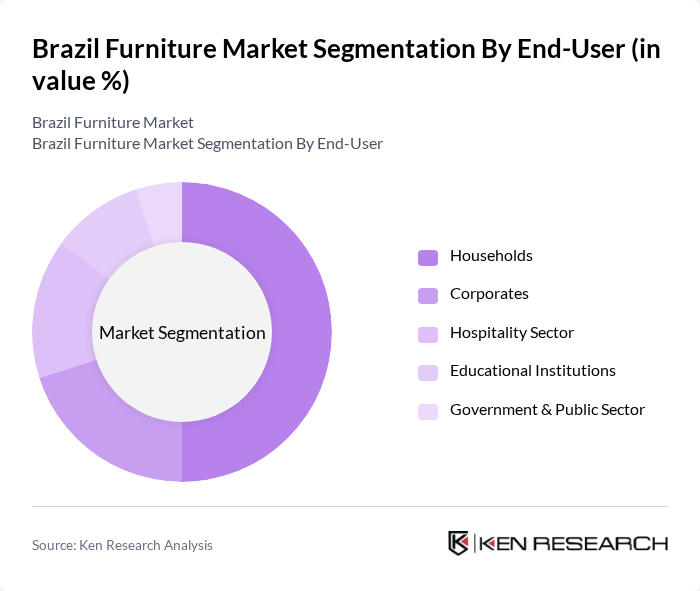

By End-User:The market is segmented by end-users, including Households, Corporates, Hospitality Sector, Educational Institutions, and Government & Public Sector. Households account for the majority share, reflecting strong demand for home improvement and renovation. Corporates and hospitality sectors are significant contributors, driven by investments in workspace modernization and tourism infrastructure. Educational institutions and government sectors continue to invest in durable, ergonomic, and sustainable furniture solutions for public spaces.

The Brazil Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tok&Stok, Etna, Mobly, Leroy Merlin Brasil, Casas Bahia, Magazine Luiza, Ponto (formerly Ponto Frio), Havan, Artefama Móveis, Sierra Móveis, Móveis Simonetto, Dalla Costa Móveis, Todeschini, Bertolini Móveis, Bartzen Móveis contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil furniture market is poised for transformation as urbanization and rising disposable incomes continue to shape consumer preferences. The increasing demand for sustainable and customizable furniture will drive innovation, while e-commerce growth will enhance accessibility. Companies that adapt to these trends by offering eco-friendly products and leveraging online platforms are likely to thrive. Additionally, the focus on ergonomic designs will cater to health-conscious consumers, further influencing market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Commercial Furniture Office Furniture Outdoor Furniture Custom Furniture Modular Furniture Luxury Furniture Contract Furniture Others |

| By End-User | Households Corporates Hospitality Sector Educational Institutions Government & Public Sector |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct-to-Consumer |

| By Material | Wood Metal Plastic Fabric Glass Others |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Contemporary Traditional Industrial Scandinavian Rustic |

| By Distribution Mode | Direct Sales Indirect Sales Franchise E-commerce Platforms |

| By Region | Southeast South Northeast North Central-West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Sales | 100 | Retail Managers, Sales Executives |

| Commercial Furniture Solutions | 80 | Office Managers, Procurement Specialists |

| Custom Furniture Manufacturing | 60 | Designers, Production Managers |

| Online Furniture Retail | 70 | E-commerce Managers, Digital Marketing Specialists |

| Furniture Export Market | 40 | Export Managers, Trade Compliance Officers |

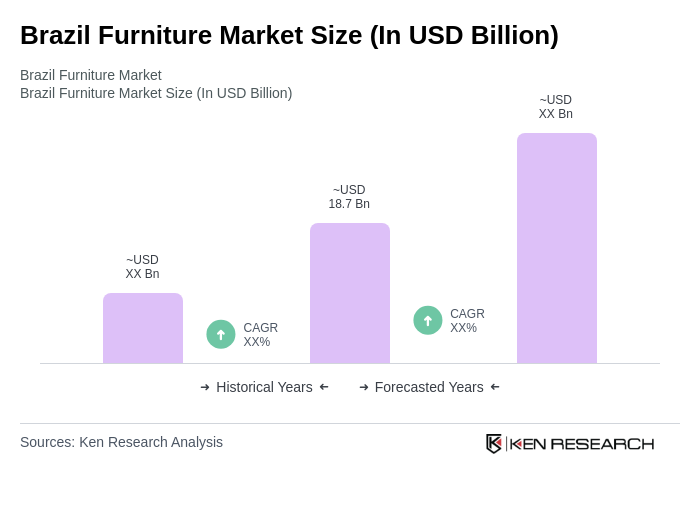

The Brazil Furniture Market is valued at approximately USD 18.7 billion, driven by urbanization, rising disposable incomes, and a growing interest in home improvement and interior design. This market reflects a shift towards quality and multifunctional furniture designs.