Germany Furniture Market Overview

- The Germany Furniture Market is valued at approximatelyUSD 52 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer spending on home improvement, a rise in urbanization, and a growing trend towards sustainable and eco-friendly furniture options. The market has seen a significant shift towards online retail, which has further fueled its expansion. Key trends include the adoption of modern, minimalist designs, a focus on functionality, and a rising demand for customized furniture, reflecting evolving consumer lifestyles and preferences .

- Key cities such asBerlin, Munich, and Hamburgdominate the market due to their large populations, high disposable incomes, and vibrant real estate sectors. These urban centers are also hubs for design and innovation, attracting both local and international furniture brands, which enhances competition and variety in the market. Southern Germany, anchored by affluent hubs like Munich and Stuttgart, commands a significant share, with robust purchasing power and tourism adding to market traffic .

- In 2023, the German government implemented regulations aimed at promoting sustainable furniture production. This includes mandatory eco-labeling for furniture products, which requires manufacturers to disclose the environmental impact of their products, thereby encouraging the use of sustainable materials and practices in the industry. TheGerman Eco-label Regulation (Umweltzeichenverordnung), 2023, issued by the Federal Ministry for the Environment, Nature Conservation, Nuclear Safety and Consumer Protection, mandates disclosure of lifecycle environmental impacts and compliance with minimum thresholds for recycled or renewable materials in furniture products .

Germany Furniture Market Segmentation

By Type:The furniture market can be segmented into various types, including Living Room Furniture, Bedroom Furniture, Office Furniture, Outdoor Furniture, Storage Solutions, Kitchen Furniture, Healthcare Furniture, Custom Furniture, and Others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth. Modern and minimalist designs, sustainability, and customization are particularly driving growth in Living Room, Bedroom, and Office Furniture segments, while Outdoor and Kitchen Furniture benefit from increased home improvement activity and real estate development .

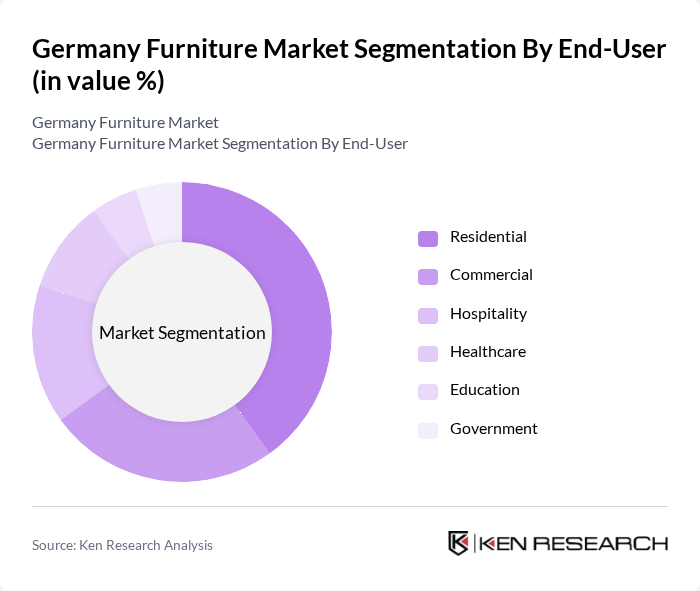

By End-User:The market can also be segmented based on end-users, which include Residential, Commercial, Hospitality, Healthcare, Education, and Government. Each segment has unique requirements and purchasing behaviors that influence the types of furniture being produced and sold. The Residential segment is driven by home improvement trends and demand for personalized, sustainable furniture, while Commercial and Hospitality segments benefit from expanding real estate and tourism sectors. Healthcare and Education segments are influenced by ergonomic and specialized furniture needs .

Germany Furniture Market Competitive Landscape

The Germany Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Höffner, XXXLutz KG, Roller, Home24, Otto Group, Möbel Martin, Nobilia, Hülsta-Werke Hüls GmbH, Rauch Möbelwerke GmbH, Musterring, Rolf Benz, Vitra, Thonet, USM Haller contribute to innovation, geographic expansion, and service delivery in this space. Strategic moves include investments in carbon-neutral production, digital mass customization, and circularity claims, with regulatory scrutiny ensuring fair competition and compliance .

Germany Furniture Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization in Germany is projected to reach 78% by future, with cities like Berlin and Munich experiencing significant population growth. This trend drives demand for furniture as urban dwellers seek to optimize smaller living spaces. The urban population is expected to increase by approximately 1.5 million people, leading to a heightened need for stylish, space-efficient furniture solutions that cater to modern lifestyles and preferences.

- Rising Disposable Income:Germany's disposable income per capita is forecasted to rise to €27,000 in future, reflecting a 3% increase from previous periods. This growth in disposable income enables consumers to invest more in home furnishings, particularly in quality and design. As households have more financial flexibility, they are likely to prioritize furniture purchases, contributing to a robust market for both traditional and contemporary styles.

- Growing E-commerce Adoption:E-commerce sales in the German furniture sector are expected to reach €9 billion by future, driven by a 15% annual growth rate. The convenience of online shopping, coupled with the rise of digital marketing strategies, has made it easier for consumers to access a wide range of furniture options. This shift towards online retail is reshaping consumer purchasing behavior, making it a significant growth driver in the furniture market.

Market Challenges

- Intense Competition:The German furniture market is characterized by intense competition, with over 1,000 companies vying for market share. Major players like IKEA and local brands dominate, making it challenging for new entrants to establish themselves. This competitive landscape pressures companies to innovate continuously and offer unique value propositions, which can strain resources and impact profitability.

- Supply Chain Disruptions:The furniture industry in Germany faces significant supply chain disruptions, exacerbated by global events such as the COVID-19 pandemic. In future, delays in raw material shipments are expected to increase by 20%, affecting production timelines. These disruptions can lead to inventory shortages and increased costs, ultimately impacting the ability of companies to meet consumer demand effectively.

Germany Furniture Market Future Outlook

The future of the German furniture market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative, space-saving furniture will likely rise. Additionally, the integration of smart technology into furniture design is expected to gain traction, appealing to tech-savvy consumers. Companies that adapt to these trends and focus on sustainability will be well-positioned to capture market share and drive growth in future.

Market Opportunities

- Expansion of Online Retail:The shift towards online retail presents a significant opportunity for furniture brands. With e-commerce projected to account for 20% of total furniture sales by future, companies can leverage digital platforms to reach a broader audience. Investing in user-friendly websites and targeted online marketing strategies can enhance customer engagement and drive sales growth.

- Customization Trends:The demand for customized furniture solutions is on the rise, with 40% of consumers expressing interest in personalized designs. This trend offers manufacturers the chance to differentiate their products and cater to individual preferences. By providing customization options, companies can enhance customer satisfaction and loyalty, ultimately boosting their market presence.