Region:Asia

Author(s):Shubham

Product Code:KRAC0816

Pages:82

Published On:August 2025

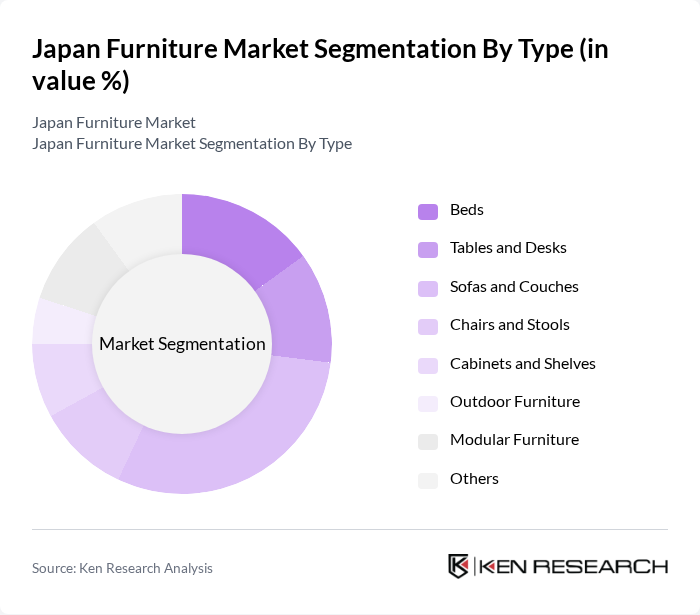

By Type:The furniture market in Japan is segmented into various types, including beds, tables and desks, sofas and couches, chairs and stools, cabinets and shelves, outdoor furniture, modular furniture, and others. Among these, sofas and couches hold a significant share of the market due to their essential role in living spaces and the increasing trend of home entertainment. Consumers are gravitating towards stylish, comfortable, and multifunctional options that enhance their living environments, with demand further supported by the popularity of open-plan and compact living arrangements .

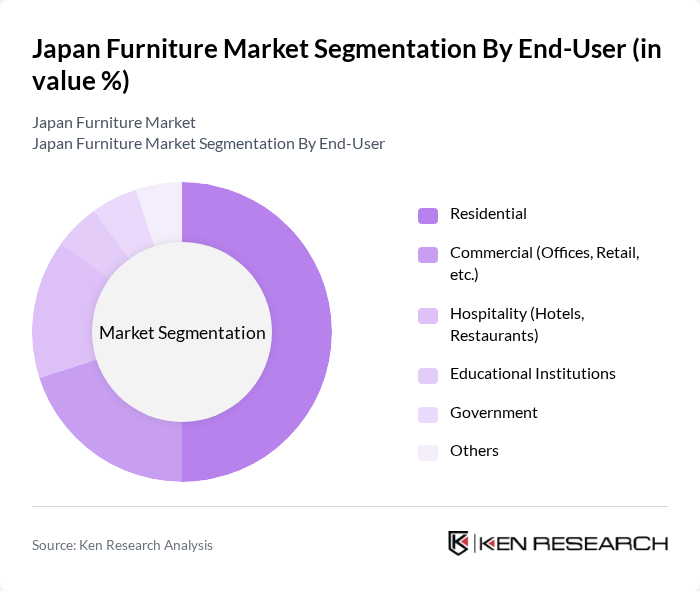

By End-User:The end-user segmentation of the furniture market includes residential, commercial (offices, retail, etc.), hospitality (hotels, restaurants), educational institutions, government, and others. The residential segment leads the market, driven by a growing trend of home renovations, the increasing number of households, and a strong preference for furniture that reflects personal style and enhances living spaces. The commercial and hospitality segments are also experiencing steady growth, supported by ongoing investments in office infrastructure and tourism-related facilities .

The Japan Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nitori Holdings Co., Ltd., Ryohin Keikaku Co., Ltd. (MUJI), IKEA Japan K.K., Karimoku Furniture Inc., Francfranc Corporation, Actus Co., Ltd., Hida Sangyo Co., Ltd., CondeHouse Co., Ltd., Cassina Ixc Ltd., Miyazaki Chair Factory Co., Ltd., Ariake (Legnatec Co., Ltd.), Seki Furniture Co., Ltd., Yamazaki Home Co., Ltd., Okamura Corporation, Itoki Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Japan furniture market is poised for transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture will rise. Additionally, the integration of smart technology into furniture design is expected to gain traction, appealing to tech-savvy consumers. Sustainability will also play a crucial role, with eco-friendly materials and practices becoming increasingly important. These trends will shape the market landscape, presenting both challenges and opportunities for industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Beds Tables and Desks Sofas and Couches Chairs and Stools Cabinets and Shelves Outdoor Furniture Modular Furniture Others |

| By End-User | Residential Commercial (Offices, Retail, etc.) Hospitality (Hotels, Restaurants) Educational Institutions Government Others |

| By Distribution Channel | Specialty Stores Supermarkets & Hypermarkets Online Retail Direct Sales Wholesale Others |

| By Price Range | Budget Mid-range Premium Luxury |

| By Material | Wood Metal Plastic Glass Fabric Others |

| By Style | Contemporary Traditional Minimalist Rustic Industrial Others |

| By Functionality | Multi-functional Space-saving Ergonomic Smart/Connected Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Decorators |

| Office Furniture Procurement | 80 | Office Managers, Facility Coordinators |

| Outdoor Furniture Trends | 50 | Landscape Architects, Retail Buyers |

| Consumer Preferences in Furniture Design | 90 | General Consumers, Design Enthusiasts |

| Sustainability in Furniture Manufacturing | 40 | Manufacturing Managers, Sustainability Officers |

The Japan Furniture Market is valued at approximately USD 22.5 billion, driven by factors such as urbanization, rising disposable income, and a growing interest in home improvement and interior design.