United States Furniture Market Overview

- The United States Furniture Market is valued at USD 190 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer spending on home improvement, a surge in residential construction and remodeling activities, and a growing trend towards online shopping for furniture. The market has seen a significant shift towards sustainable and eco-friendly furniture options, reflecting changing consumer preferences. The adoption of multi-purpose and space-saving designs, as well as the integration of smart technologies into furniture, are also notable trends shaping the industry .

- Key cities dominating the market includeNew York, Los Angeles, and Chicago, which are major urban centers with high disposable incomes and a strong demand for both residential and commercial furniture. The presence of numerous furniture retailers and manufacturers in these cities further enhances their market dominance, making them hubs for furniture design and innovation .

- Recent years have seen the U.S. government and industry bodies introduce and reinforce regulations and standards aimed at promoting sustainable furniture manufacturing practices. This includes the encouragement of eco-friendly materials, reduction of carbon emissions in production processes, and compliance with certifications such as GREENGUARD and FSC for responsible sourcing. These initiatives are designed to encourage manufacturers to adopt greener practices, thereby contributing to environmental sustainability in the furniture industry .

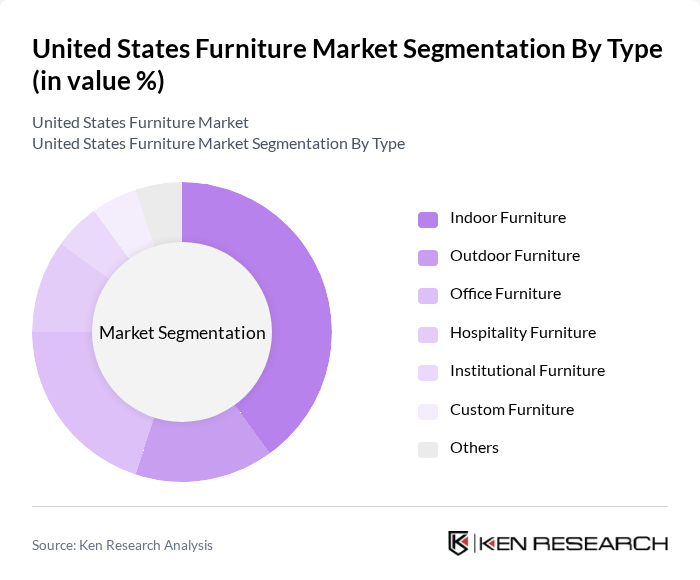

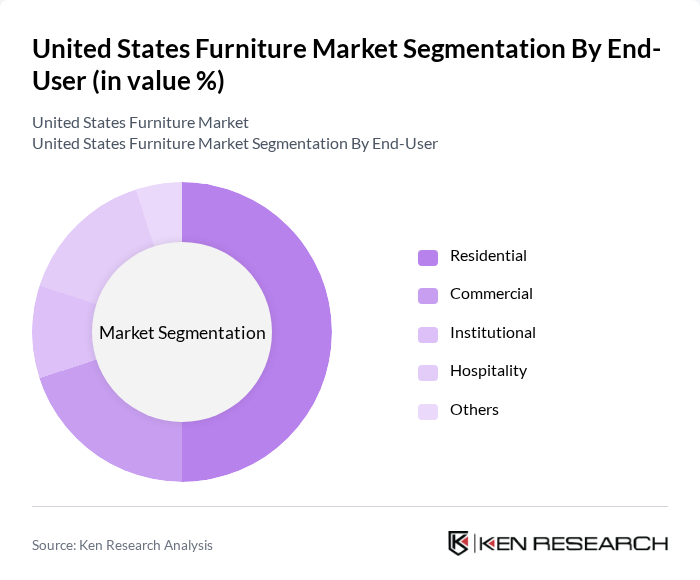

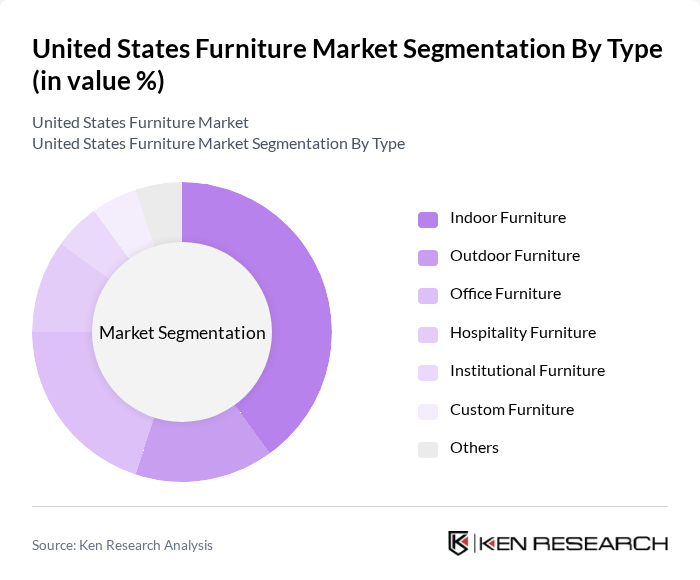

United States Furniture Market Segmentation

By Type:The furniture market can be segmented into various types, includingIndoor Furniture, Outdoor Furniture, Office Furniture, Hospitality Furniture, Institutional Furniture, Custom Furniture, and Others. Among these,Indoor Furnitureis the most dominant segment, driven by the increasing demand for home furnishings as consumers invest in their living spaces. The trend towards multifunctional, modular, and space-saving designs, as well as the growing popularity of sustainable and customizable furniture, has also contributed to the growth of this segment .

By End-User:The market can also be segmented based on end-users, which includeResidential, Commercial, Institutional, Hospitality, and Others. TheResidentialsegment is the largest, driven by the increasing trend of home renovations, urbanization, and the growing population. Consumers are increasingly looking for personalized, sustainable, and stylish furniture options that reflect their individual tastes and lifestyles. The commercial and hospitality segments are also experiencing growth due to increased investments in office spaces, hotels, and public infrastructure .

United States Furniture Market Competitive Landscape

The United States Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ashley Furniture Industries, Inc., La-Z-Boy Incorporated, Steelcase Inc., Herman Miller, Inc., IKEA USA, Wayfair Inc., Tempur Sealy International, Inc., Hooker Furnishings Corporation, Knoll, Inc., Flexsteel Industries, Inc., Bassett Furniture Industries, Inc., Kimball International, Inc., HNI Corporation, Sauder Woodworking Co., American Signature, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

United States Furniture Market Industry Analysis

Growth Drivers

- Increasing Consumer Spending on Home Furnishings:In future, consumer spending on home furnishings in the United States is projected to reach approximately $150 billion, driven by a robust economy and rising disposable incomes. The U.S. Bureau of Economic Analysis reported a 3.5% increase in personal consumption expenditures in the last quarter of 2023, indicating a strong consumer confidence that fuels spending on furniture. This trend is expected to continue as households prioritize home aesthetics and comfort.

- Rise in Home Renovation and Remodeling Activities:The home renovation market in the U.S. is anticipated to exceed $420 billion, reflecting a significant increase in remodeling projects. According to the Joint Center for Housing Studies of Harvard University, approximately 60% of homeowners plan to undertake renovations, which often include new furniture purchases. This surge in renovation activities is largely attributed to the aging housing stock and the desire for modernized living spaces, driving demand for updated furniture.

- Growth of E-commerce in Furniture Sales:E-commerce sales in the U.S. furniture market are expected to surpass $70 billion, representing a substantial shift towards online shopping. The U.S. Census Bureau reported a 15% year-over-year increase in online retail sales, with furniture being one of the fastest-growing categories. This growth is fueled by the convenience of online shopping, enhanced digital marketing strategies, and the proliferation of mobile devices, making furniture more accessible to consumers.

Market Challenges

- Supply Chain Disruptions:The furniture industry continues to face significant supply chain disruptions, with delays affecting over 40% of manufacturers. According to the National Association of Manufacturers, these disruptions have led to increased lead times and inventory shortages, impacting sales and customer satisfaction. The ongoing global logistics challenges, including port congestion and labor shortages, are expected to persist into future, complicating supply chain management for furniture companies.

- Fluctuating Raw Material Prices:The volatility in raw material prices poses a considerable challenge for the furniture industry, with costs for wood and metals rising by approximately 20%. The U.S. Bureau of Labor Statistics reported that the Producer Price Index for furniture manufacturing increased significantly, impacting profit margins. As manufacturers grapple with these rising costs, they may be forced to pass on price increases to consumers, potentially dampening demand in a competitive market.

United States Furniture Market Future Outlook

The future of the U.S. furniture market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are likely to innovate with eco-friendly materials and practices. Additionally, the integration of smart technology into furniture design is expected to enhance functionality and appeal. With the continued growth of e-commerce, companies will need to adapt their strategies to meet the demands of a digitally-savvy consumer base, ensuring a competitive edge in the market.

Market Opportunities

- Expansion into Emerging Markets:Companies have a significant opportunity to expand into emerging markets, where urbanization and rising incomes are driving furniture demand. The World Bank projects that emerging economies will see a robust growth rate in future, creating a favorable environment for U.S. furniture brands to establish a presence and tap into new customer bases.

- Customization and Personalization Trends:The demand for customized furniture solutions is on the rise, with consumers increasingly seeking unique designs that reflect their personal style. Industry reports indicate that 30% of consumers are willing to pay a premium for personalized products, presenting a lucrative opportunity for manufacturers to offer tailored solutions and enhance customer engagement.