Region:Europe

Author(s):Dev

Product Code:KRAC0427

Pages:87

Published On:August 2025

By Type:The furniture market can be segmented into various types, including living room furniture, bedroom furniture, kitchen & dining furniture, office furniture, outdoor & garden furniture, storage & shelving solutions, bathroom & entryway furniture, and custom/bespoke furniture. Each of these segments caters to different consumer needs and preferences, with living room and bedroom furniture being the most popular due to their essential roles in home decor.

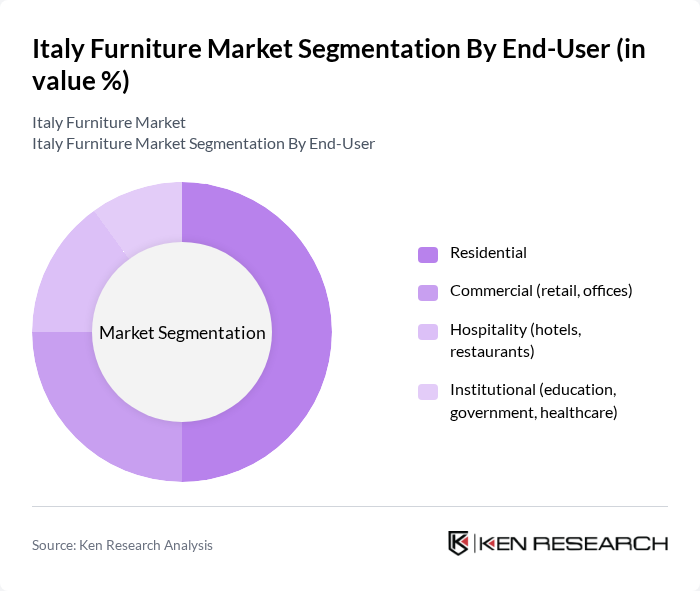

By End-User:The market is segmented based on end-users, including residential, commercial, hospitality, and institutional sectors. The residential segment dominates the market, driven by ongoing home renovation activity, replacement cycles, and design-led purchases, while the commercial segment is supported by office refurbishments, retail fit-outs, and contract projects in urban centers.

The Italy Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Italia, Poltrona Frau, B&B Italia, Natuzzi, Cassina, Molteni & C S.p.A. (Molteni&C | Dada), Flexform, Lema, Fendi Casa, Minotti, Riva 1920, Giorgetti, Cattelan Italia, Arper, Calligaris, Kartell, Scavolini, Snaidero, Poliform, Zanotta, MDF Italia, Lago, Bonaldo, Gufram, Driade contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian furniture market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative and space-saving furniture solutions will likely rise. Additionally, the integration of smart technology into furniture design is expected to gain traction, appealing to tech-savvy consumers. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share and drive growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture (sofas, armchairs, coffee tables) Bedroom Furniture (beds, wardrobes, nightstands) Kitchen & Dining Furniture (kitchen systems, tables, chairs) Office Furniture (desks, task chairs, storage) Outdoor & Garden Furniture Storage & Shelving Solutions Bathroom & Entryway Furniture Custom/Bespoke Furniture |

| By End-User | Residential Commercial (retail, offices) Hospitality (hotels, restaurants) Institutional (education, government, healthcare) |

| By Sales Channel | Online Platforms (brand e-shops, marketplaces) Specialty & Standalone Stores Department Stores & Home Centers Direct-to-Project/Contract Sales Distributors & Dealer Networks |

| By Material | Wood Metal Plastic & Polymer Upholstered (fabric, leather) Glass & Stone |

| By Price Range | Budget Mid-range Premium Luxury |

| By Design Style | Modern/Contemporary Traditional/Classical Minimalist/Scandinavian Rustic/Industrial Artisanal/Heritage |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise & License Partnerships Contract/Project-Based Distribution |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 100 | Office Managers, Facility Coordinators |

| Custom Furniture Orders | 80 | Architects, Custom Furniture Designers |

| Online Furniture Shopping Trends | 120 | eCommerce Managers, Digital Marketing Specialists |

| Sustainability in Furniture Manufacturing | 70 | Sustainability Officers, Product Development Managers |

The Italy Furniture Market is valued at approximately EUR 25 billion, reflecting a robust growth driven by consumer demand for high-quality furniture and a strong real estate market that encourages home renovations and new constructions.