Region:Central and South America

Author(s):Rebecca

Product Code:KRAB4110

Pages:94

Published On:October 2025

By Type:The luggage and bags market is segmented into hard shell luggage, soft shell luggage, backpacks, handbags, travel accessories, duffel bags, tote bags, sports bags, and others. Suitcases, especially hard and soft shell variants, remain the largest segment due to their durability and suitability for frequent travelers. Backpacks are increasingly popular among younger consumers and students, driven by their versatility and ergonomic designs. Handbags and travel accessories are also gaining traction as consumers seek both functionality and style .

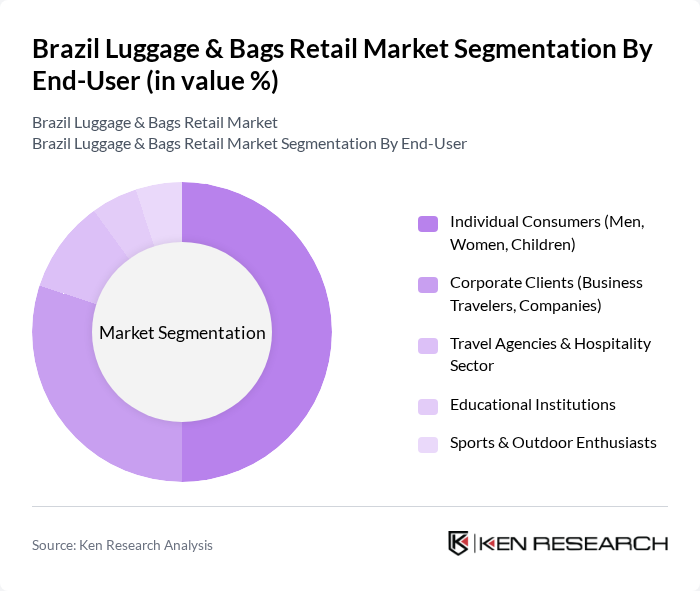

By End-User:The end-user segmentation covers individual consumers, corporate clients, travel agencies, educational institutions, and sports teams. Individual consumers—comprising men, women, and children—form the largest segment, reflecting diverse travel and daily use needs. Corporate clients are a significant segment as business travel rebounds, demanding durable and professional luggage. Travel agencies, educational institutions, and sports teams also contribute to market demand, each with distinct product requirements .

The Brazil Luggage & Bags Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite Brasil Ltda., Delsey do Brasil, Victorinox Brasil, Kipling Brasil (VF Corporation), American Tourister Brasil, Arpenaz (Decathlon Brasil), LeSportsac Brasil, Osprey Packs Brasil, Bagaggio, Mormaii, Roxy Brasil (Boardriders), Adidas Brasil Ltda., Nike do Brasil, Puma Brasil Ltda., Decathlon Brasil contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian luggage and bags retail market is poised for transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands focusing on eco-friendly materials and practices are likely to gain traction. Additionally, the integration of smart technology in luggage, such as GPS tracking and charging capabilities, will appeal to tech-savvy consumers. These trends, combined with the expansion of online retail, will create a dynamic market landscape, fostering innovation and growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Suitcases (Hard Shell, Soft Shell) Backpacks (Travel, Casual, Business) Handbags (Tote, Shoulder, Clutch, Satchel) Travel Accessories (Toiletry Bags, Organizers, Packing Cubes) Duffel Bags & Gym Bags Laptop & Business Bags School Bags & Kids’ Bags Others (Messenger Bags, Sling Bags, Waist Packs) |

| By End-User | Individual Consumers (Men, Women, Children) Corporate Clients (Business Travelers, Companies) Travel Agencies & Hospitality Sector Educational Institutions Sports & Outdoor Enthusiasts |

| By Sales Channel | Online Retail (E-commerce Platforms, Brand Websites) Brick-and-Mortar Stores (Specialty Luggage Stores, Multi-brand Outlets) Department Stores Hypermarkets & Supermarkets Duty-Free & Airport Retail |

| By Price Range | Budget (Entry-Level) Mid-Range Premium & Luxury |

| By Material | Fabric (Polyester, Nylon, Canvas) Leather (Genuine, Synthetic) Polycarbonate & ABS (Hard Shell) Eco-Friendly Materials (Recycled, Sustainable) |

| By Brand Positioning | Luxury Brands Mid-Tier Brands Value Brands |

| By Region | North Region Northeast Region Central-West Region Southeast Region South Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Luggage Sales | 150 | Store Managers, Retail Buyers |

| Consumer Preferences in Bags | 120 | Frequent Travelers, College Students |

| Online vs. Offline Purchasing Trends | 100 | E-commerce Managers, Marketing Directors |

| Brand Loyalty and Awareness | 80 | Brand Managers, Marketing Analysts |

| Product Feature Preferences | 40 | Product Development Managers, Consumer Insights Analysts |

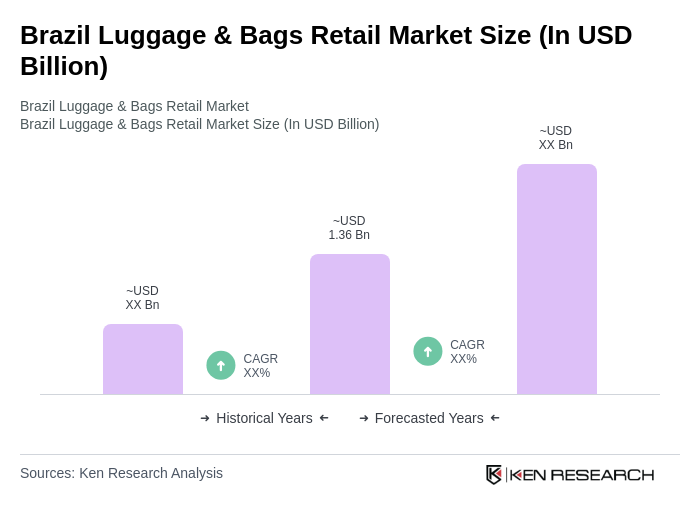

The Brazil Luggage & Bags Retail Market is valued at approximately USD 1.36 billion, reflecting a five-year historical analysis. This growth is attributed to rising disposable incomes, increased domestic travel, and a shift towards online shopping.