Region:Asia

Author(s):Shubham

Product Code:KRAB3791

Pages:80

Published On:October 2025

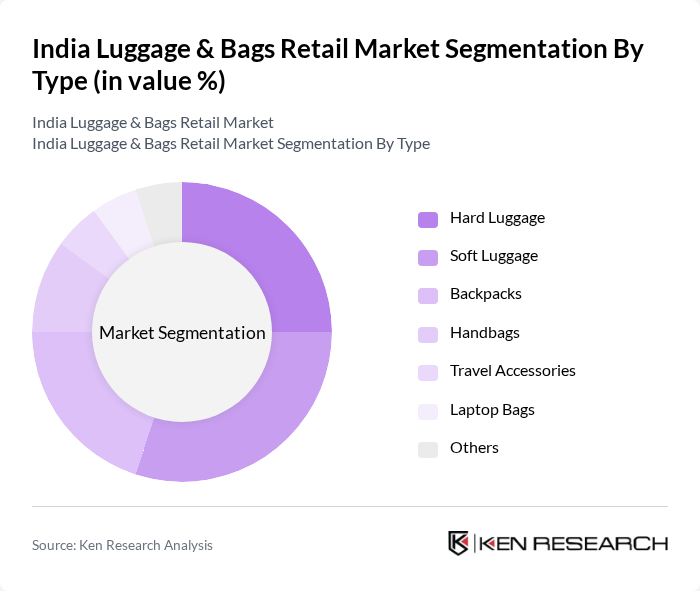

By Type:The luggage and bags market can be segmented into various types, including hard luggage, soft luggage, backpacks, handbags, travel accessories, laptop bags, and others. Each of these sub-segments caters to different consumer needs and preferences, with specific trends influencing their popularity. For instance, hard luggage is favored for its durability and security, while soft luggage is preferred for its lightweight and flexible nature. Backpacks and handbags are increasingly popular among younger consumers due to their versatility and style.

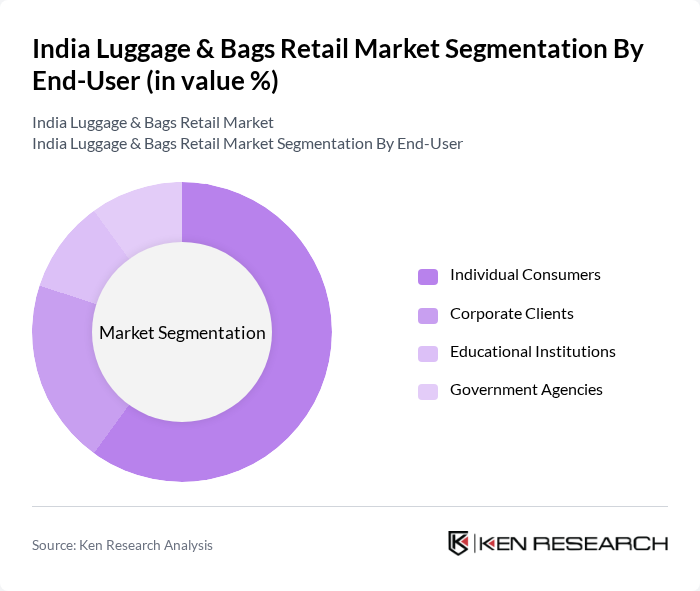

By End-User:The end-user segmentation includes individual consumers, corporate clients, educational institutions, and government agencies. Individual consumers represent the largest segment, driven by the increasing trend of travel and lifestyle purchases. Corporate clients often require luggage for business travel, while educational institutions and government agencies have specific needs for backpacks and other functional bags. The growing emphasis on branding and quality among these segments is shaping purchasing decisions.

The India Luggage & Bags Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite India Pvt. Ltd., VIP Industries Ltd., American Tourister, Wildcraft India Ltd., Puma SE, Adidas AG, Decathlon S.A., Skybags, Fastrack, Targus Inc., Delsey S.A., House of Anita Dongre, Baggit, Lavie, Caprese contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India luggage and bags retail market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability is likely to shape product offerings, with brands prioritizing eco-friendly materials. Additionally, the integration of smart technology in luggage, such as GPS tracking and built-in charging ports, is expected to attract tech-savvy consumers, enhancing market growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Luggage Soft Luggage Backpacks Handbags Travel Accessories Laptop Bags Others |

| By End-User | Individual Consumers Corporate Clients Educational Institutions Government Agencies |

| By Sales Channel | Online Retail Offline Retail Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Material | Polyester Nylon Leather Canvas |

| By Occasion | Business Travel Leisure Travel Daily Commute |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Focused Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Travel Bag Retailers | 150 | Store Managers, Regional Sales Directors |

| Consumer Preferences in Luggage | 200 | Frequent Travelers, Online Shoppers |

| Brand Perception Studies | 100 | Brand Managers, Marketing Executives |

| Market Trends Analysis | 80 | Industry Analysts, Retail Consultants |

| Product Feature Preferences | 120 | Product Development Managers, Consumer Insights Analysts |

The India Luggage & Bags Retail Market is valued at approximately INR 45 billion, driven by factors such as increasing disposable incomes, a rise in travel, and a growing trend towards fashion and lifestyle products.