Region:Middle East

Author(s):Dev

Product Code:KRAB6120

Pages:98

Published On:October 2025

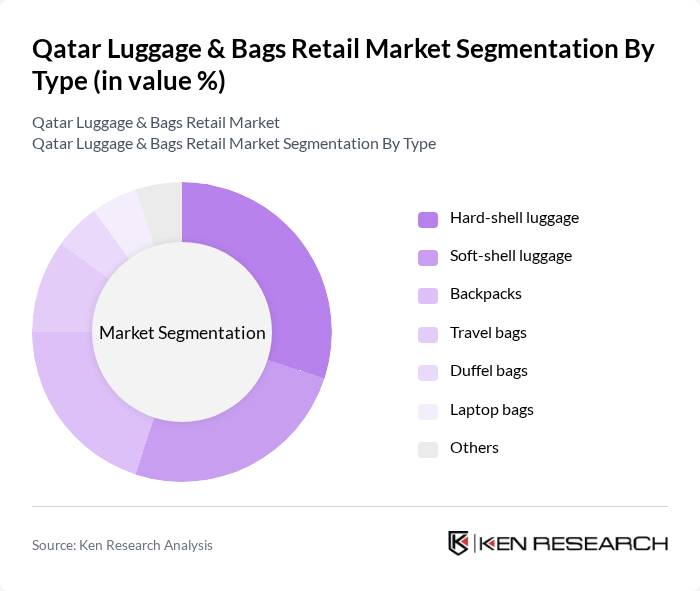

By Type:The luggage and bags retail market is segmented into various types, including hard-shell luggage, soft-shell luggage, backpacks, travel bags, duffel bags, laptop bags, and others. Among these, hard-shell luggage is gaining popularity due to its durability and security features, appealing to frequent travelers. Soft-shell luggage, on the other hand, offers flexibility and lightweight options, making it a preferred choice for casual travelers. Backpacks and travel bags are also in high demand, especially among younger consumers and those seeking convenience.

By End-User:The end-user segmentation includes individual consumers, corporate clients, travel agencies, and educational institutions. Individual consumers dominate the market, driven by the increasing trend of travel and leisure activities. Corporate clients also contribute significantly, as businesses invest in quality luggage for their employees. Travel agencies and educational institutions are emerging segments, with growing needs for group travel and student excursions, respectively.

The Qatar Luggage & Bags Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Carrefour Qatar, Lulu Hypermarket, Jarir Bookstore, Landmark Group, Al Meera Consumer Goods Company, Qatar Duty Free, Doha Festival City, M.H. Alshaya Co., Al-Attiya Motors and Trading Company, Qatar Shopping Center, The Mall Doha, Qatari Retail Group, Al-Shaab Group, Qatar Luggage Company contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar luggage and bags retail market is poised for significant growth, driven by increasing tourism, rising disposable incomes, and the expansion of retail channels. As consumer preferences shift towards sustainability and technology, retailers must adapt by offering eco-friendly products and smart luggage solutions. The integration of online shopping platforms will further enhance market accessibility, allowing brands to reach a broader audience. Overall, the market is expected to evolve, presenting new opportunities for innovation and customer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard-shell luggage Soft-shell luggage Backpacks Travel bags Duffel bags Laptop bags Others |

| By End-User | Individual consumers Corporate clients Travel agencies Educational institutions |

| By Sales Channel | Online retail Brick-and-mortar stores Department stores Specialty luggage shops |

| By Price Range | Budget Mid-range Premium |

| By Brand | Local brands International brands Private labels |

| By Material | Polyester Nylon Leather Canvas |

| By Usage Occasion | Business travel Leisure travel Sports and outdoor activities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Luggage | 150 | Frequent Travelers, Tourists, Business Professionals |

| Retail Outlet Insights | 100 | Store Managers, Sales Associates, Brand Representatives |

| E-commerce Shopping Behavior | 120 | Online Shoppers, E-commerce Managers, Digital Marketing Experts |

| Market Trends and Innovations | 80 | Product Designers, Industry Analysts, Retail Strategists |

| Brand Loyalty and Awareness | 90 | Brand Loyalists, Casual Shoppers, Travel Enthusiasts |

The Qatar Luggage & Bags Retail Market is valued at approximately USD 1.2 billion, reflecting a robust growth trend driven by increasing travel activities and rising disposable incomes among consumers.