Thailand Luggage & Bags Retail Market Overview

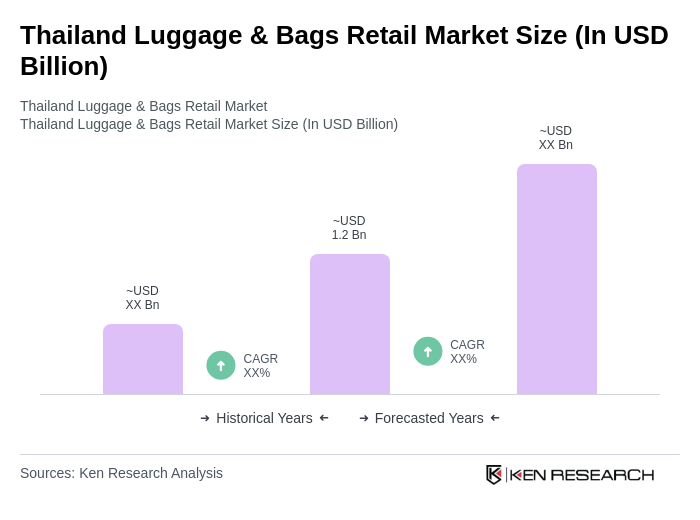

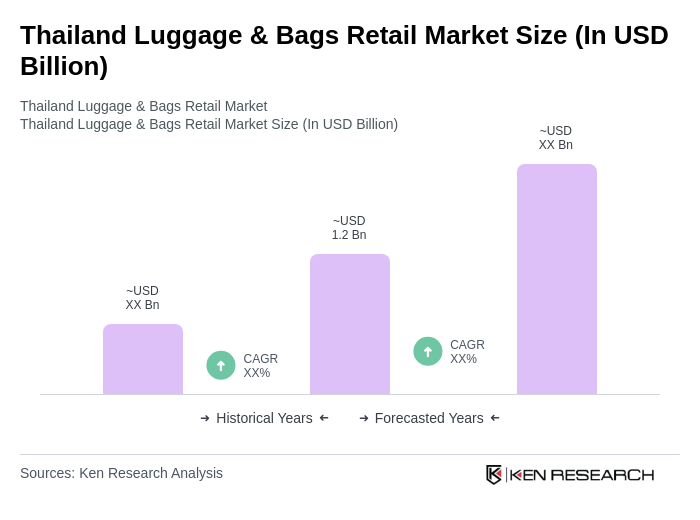

- The Thailand Luggage & Bags Retail Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing travel and tourism sector, coupled with rising disposable incomes among consumers. The demand for various types of luggage and bags has surged, reflecting changing consumer preferences towards stylish and functional travel accessories.

- Bangkok, as the capital city, dominates the market due to its status as a major travel hub in Southeast Asia, attracting millions of tourists annually. Other key cities like Chiang Mai and Phuket also contribute significantly to the market, driven by their popularity as tourist destinations and the presence of numerous retail outlets catering to both local and international consumers.

- In 2023, the Thai government implemented regulations aimed at promoting sustainable practices in the luggage and bags industry. This includes guidelines for manufacturers to reduce plastic usage in packaging and encourage the use of eco-friendly materials, aligning with global sustainability trends and consumer demand for environmentally responsible products.

Thailand Luggage & Bags Retail Market Segmentation

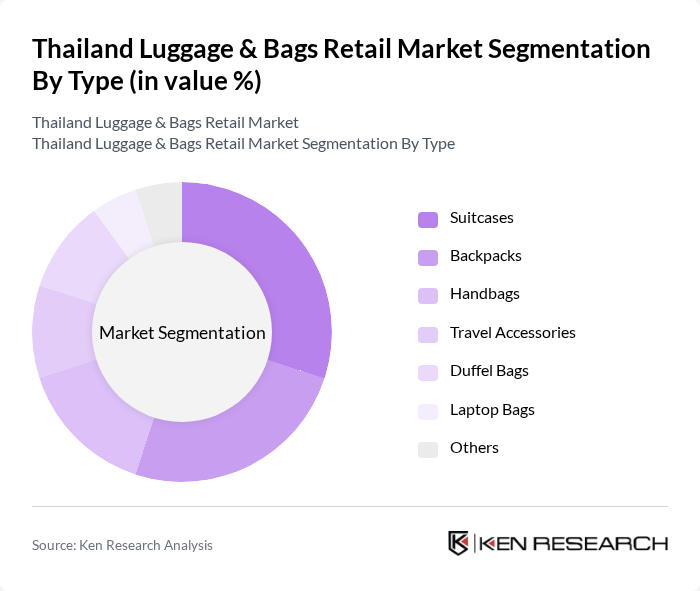

By Type:The luggage and bags market can be segmented into various types, including suitcases, backpacks, handbags, travel accessories, duffel bags, laptop bags, and others. Among these, suitcases and backpacks are particularly popular due to their practicality and versatility for both travel and daily use. The increasing trend of adventure tourism has also boosted the demand for specialized backpacks.

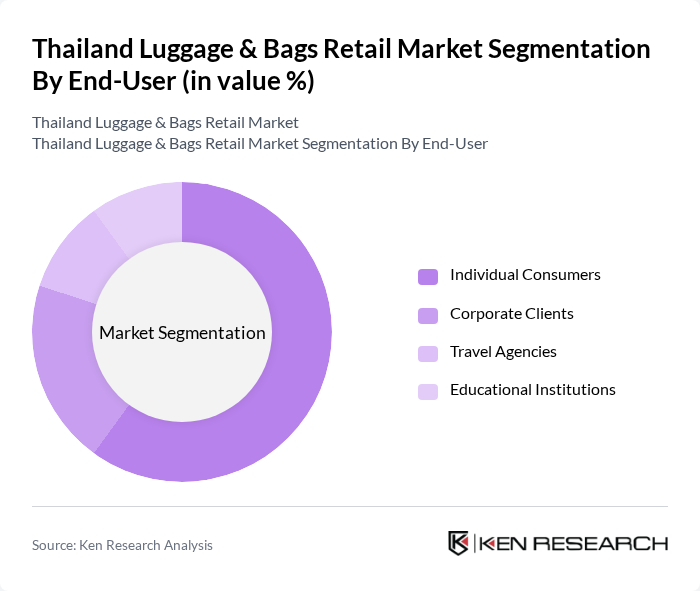

By End-User:The end-user segmentation includes individual consumers, corporate clients, travel agencies, and educational institutions. Individual consumers dominate the market, driven by the growing trend of personal travel and the need for stylish and functional bags. Corporate clients also contribute significantly, as businesses often require branded luggage for their employees and events.

Thailand Luggage & Bags Retail Market Competitive Landscape

The Thailand Luggage & Bags Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., TUMI Holdings, Inc., American Tourister, Delsey S.A., Rimowa GmbH, Antler Ltd., Travelpro Products, Inc., Osprey Packs, Inc., Eastpak, Herschel Supply Co., Kipling, Fjällräven, Thule Group AB, Briggs & Riley, Victorinox AG contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Luggage & Bags Retail Market Industry Analysis

Growth Drivers

- Increasing Travel and Tourism:In future, Thailand is projected to welcome approximately 40 million international tourists, contributing significantly to the luggage and bags retail market. The tourism sector is expected to generate around THB 2.5 trillion in revenue, reflecting a robust recovery post-pandemic. This influx of travelers drives demand for various luggage types, from suitcases to backpacks, as consumers seek reliable and stylish options for their journeys.

- Rising Disposable Income:Thailand's GDP per capita is anticipated to reach THB 200,000 in future, indicating a steady increase in disposable income. As consumers have more financial flexibility, they are likely to invest in higher-quality luggage and bags. This trend is particularly evident among the middle class, which is projected to grow by 10% annually, further fueling demand for premium and branded products in the luggage sector.

- E-commerce Growth:The e-commerce sector in Thailand is expected to surpass THB 1 trillion in sales by future, with online retailing becoming a crucial channel for luggage sales. The convenience of online shopping, coupled with the rise of mobile payment systems, has led to a 30% increase in online luggage purchases. This shift allows brands to reach a broader audience and cater to changing consumer preferences for digital shopping experiences.

Market Challenges

- Intense Competition:The Thai luggage market is characterized by fierce competition, with over 200 brands vying for market share. Major players like Samsonite and local brands are constantly innovating to attract consumers. This saturation leads to price wars, which can erode profit margins. In future, the market is expected to see a 15% increase in promotional activities, further intensifying competition among retailers.

- Fluctuating Raw Material Prices:The luggage manufacturing sector faces challenges due to volatile raw material prices, particularly for plastics and metals. In future, the cost of raw materials is projected to rise by 8%, impacting production costs. Manufacturers may struggle to maintain profit margins while balancing quality and affordability, leading to potential price increases for consumers and reduced competitiveness in the market.

Thailand Luggage & Bags Retail Market Future Outlook

The Thailand luggage and bags retail market is poised for significant growth, driven by increasing travel, rising disposable incomes, and the expansion of e-commerce. As consumers prioritize quality and sustainability, brands that innovate with eco-friendly materials and smart luggage features are likely to thrive. Additionally, the integration of omnichannel retail strategies will enhance customer experiences, allowing brands to cater to diverse consumer preferences and shopping habits effectively.

Market Opportunities

- Expansion of Online Retail:With e-commerce sales projected to exceed THB 1 trillion, brands have a significant opportunity to enhance their online presence. Investing in digital marketing and user-friendly platforms can attract tech-savvy consumers, leading to increased sales and brand loyalty in the luggage sector.

- Customization and Personalization Trends:As consumers seek unique products, offering customization options can differentiate brands in a crowded market. Personalized luggage solutions, such as monogramming or tailored designs, can enhance customer satisfaction and drive sales, tapping into the growing demand for individualized shopping experiences.