Region:North America

Author(s):Geetanshi

Product Code:KRAD0152

Pages:91

Published On:August 2025

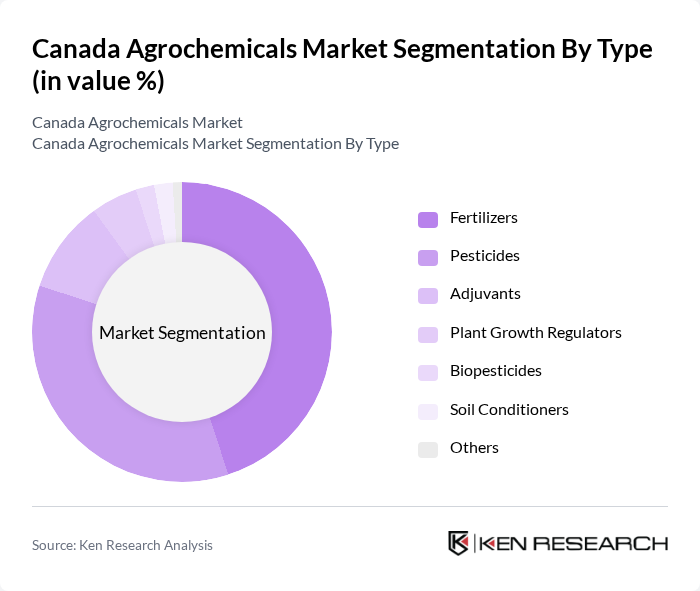

By Type:The agrochemicals market can be segmented into various types, including fertilizers, pesticides, adjuvants, plant growth regulators, biopesticides, soil conditioners, and others. Among these, fertilizers and pesticides are the most significant contributors to market growth, driven by the increasing need for crop yield enhancement and pest control.

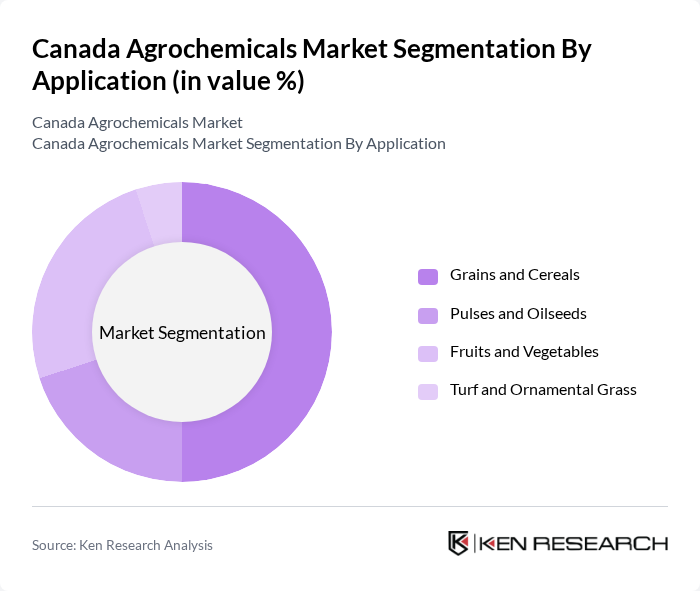

By Application:The agrochemicals market is also segmented by application, which includes grains and cereals, pulses and oilseeds, fruits and vegetables, and turf and ornamental grass. The grains and cereals segment is the largest, driven by the high demand for staple food crops and the need for effective pest and nutrient management.

The Canada Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience Inc., Syngenta Crop Protection AG, BASF Canada Inc., Corteva Agriscience Canada Company, FMC Corporation, Nutrien Ltd., Agrium Inc., Dow AgroSciences Canada Inc., Helena Agri-Enterprises, LLC, Sumitomo Chemical Co., Ltd., UPL Limited, ADAMA Agricultural Solutions Ltd., Nufarm Limited, K+S Potash Canada GP, Isagro S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada agrochemicals market appears promising, driven by technological advancements and a growing emphasis on sustainability. As farmers increasingly adopt precision agriculture and integrated pest management practices, the demand for innovative agrochemical solutions will likely rise. Furthermore, government initiatives aimed at promoting sustainable farming will encourage the development of eco-friendly products, positioning the market for significant growth in the coming years while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Fertilizers Pesticides Adjuvants Plant Growth Regulators Biopesticides Soil Conditioners Others |

| By Application | Grains and Cereals Pulses and Oilseeds Fruits and Vegetables Turf and Ornamental Grass |

| By End-User | Agriculture Horticulture Forestry Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores |

| By Formulation Type | Liquid Granular Powder |

| By Packaging Type | Bulk Packaging Retail Packaging |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Agrochemicals | 120 | Agronomists, Crop Advisors |

| Fruit and Vegetable Agrochemicals | 90 | Farmers, Horticulturists |

| Herbicide Usage in Canada | 60 | Retail Managers, Product Specialists |

| Pesticide Application Trends | 50 | Field Technicians, Agricultural Scientists |

| Fertilizer Market Insights | 70 | Supply Chain Managers, Agribusiness Executives |

The Canada Agrochemicals Market is valued at approximately USD 7.1 billion, driven by increasing food production demands, advancements in precision agriculture, and a focus on sustainable farming practices.