Region:North America

Author(s):Shubham

Product Code:KRAC0881

Pages:83

Published On:August 2025

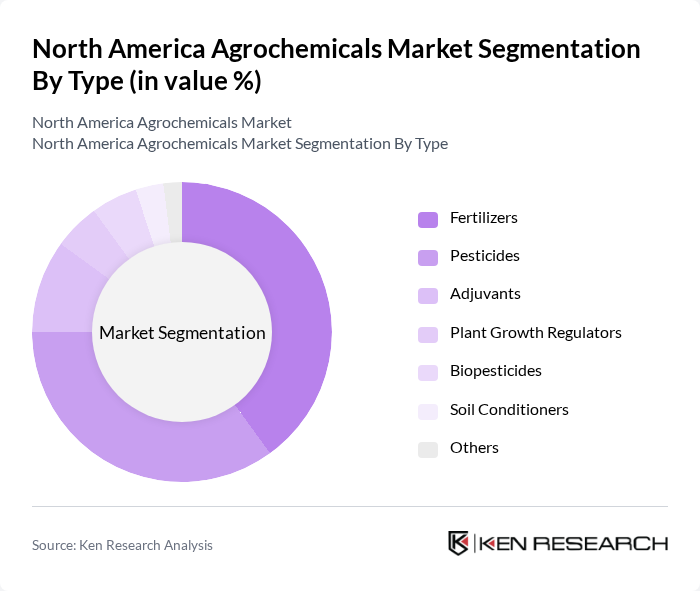

By Type:The agrochemicals market is segmented into fertilizers, pesticides, adjuvants, plant growth regulators, biopesticides, soil conditioners, and others. Fertilizers and pesticides remain the most significant contributors to market growth, with fertilizers essential for enhancing crop yields and pesticides crucial for protecting crops from pests and diseases. The market is witnessing increased demand for biopesticides and adjuvants, driven by the shift toward sustainable and integrated pest management practices, as well as regulatory support for bio-based inputs .

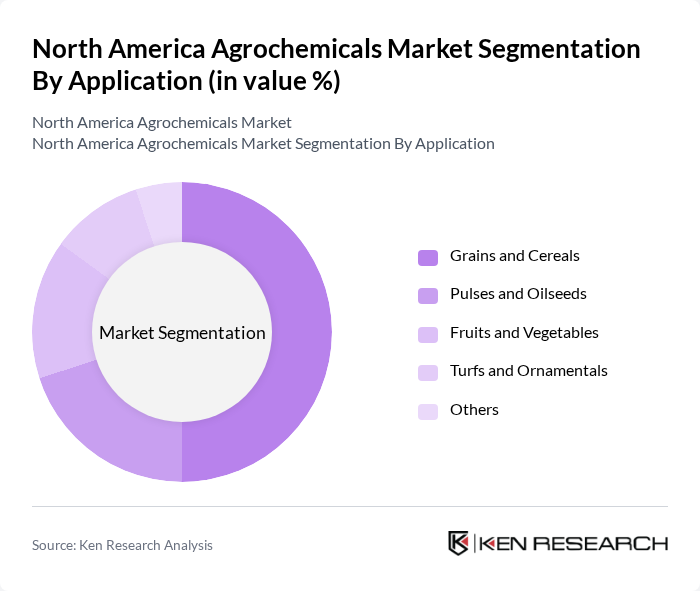

By Application:The agrochemicals market is further segmented by application into grains and cereals, pulses and oilseeds, fruits and vegetables, turfs and ornamentals, and others. Grains and cereals account for the largest share of agrochemical use, reflecting their central role in regional food production. The growing consumption of fruits and vegetables, driven by health and wellness trends, is also expanding agrochemical demand in these segments. Turf and ornamental applications are supported by the landscaping and horticulture sectors, particularly in the United States and Canada .

The North America Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience AG, Syngenta AG, Corteva Agriscience, BASF SE, FMC Corporation, Nutrien Ltd., ADAMA Agricultural Solutions Ltd., UPL Limited, Marrone Bio Innovations, Inc., Helena Agri-Enterprises, LLC, Gowan Company, LLC, AMVAC Chemical Corporation, Nufarm Limited, Sumitomo Chemical Company, Limited, The Mosaic Company, Yara International ASA, CF Industries Holdings, Inc., Potash Corporation of Saskatchewan Inc., Dow AgroSciences LLC, Agrium Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North America agrochemicals market is poised for transformation as it adapts to evolving consumer preferences and regulatory landscapes. The increasing integration of technology in agriculture, particularly through precision farming, will drive innovation in agrochemical formulations. Additionally, the focus on sustainability will encourage the development of eco-friendly products. Companies that invest in research and development to create biopesticides and biofertilizers will likely gain a competitive edge, positioning themselves favorably in a market increasingly driven by environmental considerations.

| Segment | Sub-Segments |

|---|---|

| By Type | Fertilizers Pesticides Adjuvants Plant Growth Regulators Biopesticides Soil Conditioners Others |

| By Application | Grains and Cereals Pulses and Oilseeds Fruits and Vegetables Turfs and Ornamentals Others |

| By End-User | Agriculture Horticulture Forestry Turf and Ornamental Others |

| By Distribution Channel | Direct Sales Retail E-commerce Distributors Others |

| By Region | United States Canada Mexico Rest of North America |

| By Product Formulation | Liquid Granular Powder Others |

| By Pricing Strategy | Premium Mid-range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbicide Usage in Corn Production | 120 | Agronomists, Crop Managers |

| Insecticide Application in Soybean Fields | 90 | Farm Owners, Pest Control Specialists |

| Fungicide Trends in Wheat Cultivation | 70 | Field Researchers, Agricultural Extension Officers |

| Organic Agrochemical Adoption Rates | 60 | Organic Farmers, Sustainability Consultants |

| Market Insights from Agrochemical Distributors | 80 | Sales Managers, Supply Chain Coordinators |

The North America Agrochemicals Market is valued at approximately USD 38 billion, driven by the increasing demand for food production, advancements in precision agriculture technologies, and the adoption of sustainable farming practices.