Region:Asia

Author(s):Dev

Product Code:KRAA1531

Pages:96

Published On:August 2025

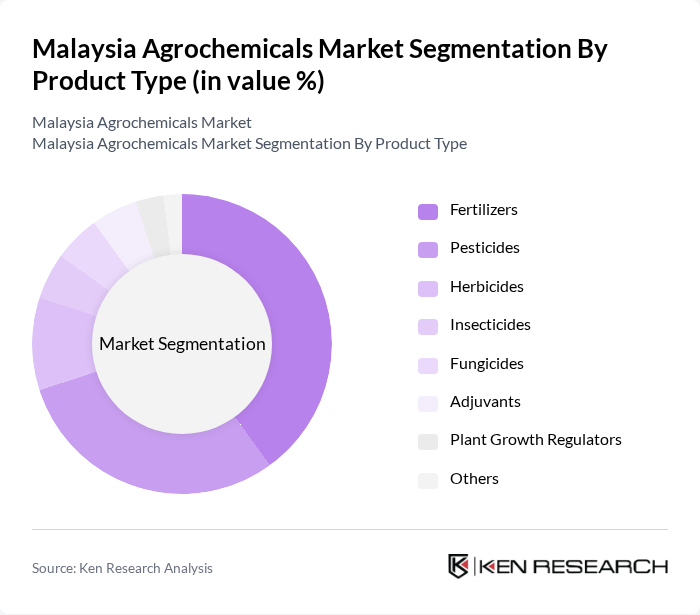

By Product Type:The product type segmentation includes fertilizers, pesticides, herbicides, insecticides, fungicides, adjuvants, plant growth regulators, and others. Among these, fertilizers and pesticides are the most significant contributors to the market, driven by the increasing need for enhanced crop productivity and pest management solutions. Fertilizers, particularly nitrogenous and phosphatic types, dominate due to their essential role in crop growth, while pesticides are crucial for protecting crops from pests and diseases .

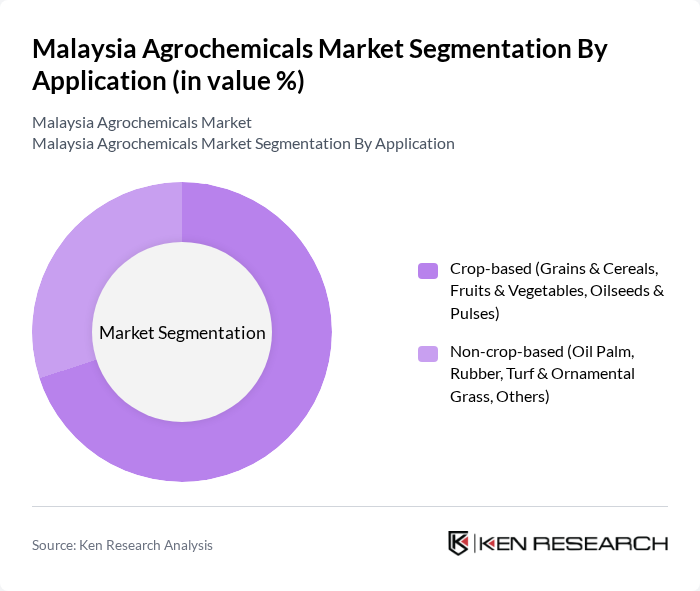

By Application:The application segmentation is divided into crop-based and non-crop-based categories. Crop-based applications, which include grains & cereals, fruits & vegetables, and oilseeds & pulses, dominate the market due to the high demand for food production. Non-crop-based applications, such as oil palm and rubber, are also significant but are secondary to crop-based applications. The increasing focus on food security and sustainable agricultural practices drives the growth of crop-based applications .

The Malaysia Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hextar Group, Advansia Sdn Bhd, Agricultural Chemicals (M) Sdn. Bhd. (ACM), Crop Protection (M) Sdn. Bhd., Sin Seng Huat, PK Fertilizers Sdn Bhd, Central Minerals & Chemicals Sdn Bhd, Nufarm Limited, Syngenta AG, Bayer CropScience AG, BASF (Malaysia) Sdn Bhd, UPL Limited, Corteva Agriscience, FMC Corporation, Mitsui Chemicals, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Malaysia agrochemicals market appears promising, driven by a strong emphasis on sustainable agricultural practices and technological advancements. As the government continues to invest in agricultural innovation, the integration of digital technologies and precision farming is expected to enhance productivity. Additionally, the growing consumer awareness regarding the impacts of agrochemicals will likely push for more eco-friendly solutions, creating a favorable environment for the development of organic and biopesticide products in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fertilizers Pesticides Herbicides Insecticides Fungicides Adjuvants Plant Growth Regulators Others |

| By Application | Crop-based (Grains & Cereals, Fruits & Vegetables, Oilseeds & Pulses) Non-crop-based (Oil Palm, Rubber, Turf & Ornamental Grass, Others) |

| By End-User | Large-scale Plantations Commercial Farms Smallholder Farmers Others |

| By Distribution Channel | Direct Sales Distributors Retail Stores Online Sales Others |

| By Region | Peninsular Malaysia Sabah Sarawak Others |

| By Price Range | Low Medium High |

| By Product Formulation | Liquid Granular Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agrochemical Manufacturers | 60 | Product Managers, R&D Directors |

| Farmers and Agricultural Producers | 120 | Crop Farmers, Cooperative Leaders |

| Distributors and Retailers | 50 | Supply Chain Managers, Retail Owners |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Research Institutions | 40 | Agricultural Researchers, Academics |

The Malaysia Agrochemicals Market is valued at approximately USD 680 million, reflecting a significant growth driven by food security concerns, government initiatives, and advancements in agricultural technology.