Region:North America

Author(s):Shubham

Product Code:KRAA1039

Pages:94

Published On:August 2025

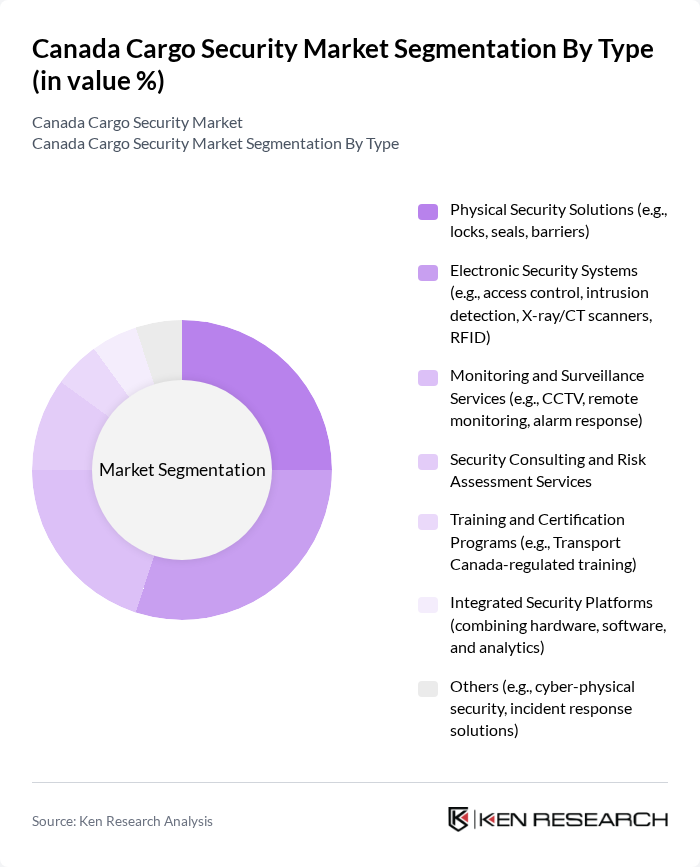

By Type:The segmentation by type includes various solutions and services that address the security needs of cargo transport. The subsegments are as follows:

The Electronic Security Systems segment is currently dominating the market due to the increasing adoption of advanced technologies such as RFID, biometric access, and intrusion detection systems. These solutions provide enhanced security and real-time monitoring capabilities, which are essential for protecting high-value cargo. The growing trend towards automation and digitalization in logistics further drives the demand for electronic security systems, making them a preferred choice among businesses seeking to mitigate risks associated with cargo theft and loss .

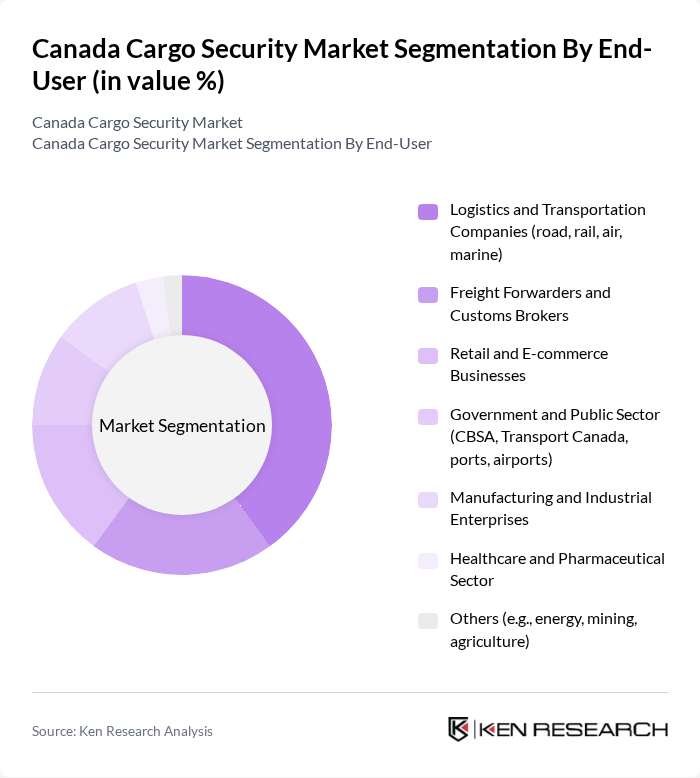

By End-User:The segmentation by end-user includes various sectors that utilize cargo security solutions. The subsegments are as follows:

The Logistics and Transportation Companies segment leads the market, driven by the increasing volume of goods transported across various modes of transport. These companies are investing heavily in cargo security solutions to protect their assets and ensure compliance with regulatory requirements. The rise of e-commerce has also contributed to the growth of this segment, as businesses seek to secure their supply chains and enhance customer trust through reliable delivery services .

The Canada Cargo Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as G4S Canada, Securitas Canada, GardaWorld, Brinks Canada, Paladin Security, Convergint Technologies, Honeywell Security, Axis Communications, Genetec, Bosch Security Systems, Hikvision Canada, Allied Universal, Securitas Transport Aviation Security Ltd. (STAS Canada), Smiths Detection, Rapiscan Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada cargo security market is poised for significant transformation, driven by technological advancements and evolving regulatory frameworks. As the logistics sector increasingly embraces digital solutions, the integration of IoT and AI technologies will enhance real-time monitoring and threat detection capabilities. Furthermore, the growing emphasis on sustainable practices will likely lead to the development of eco-friendly security solutions, aligning with global trends towards sustainability and efficiency in cargo transportation.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Security Solutions (e.g., locks, seals, barriers) Electronic Security Systems (e.g., access control, intrusion detection, X-ray/CT scanners, RFID) Monitoring and Surveillance Services (e.g., CCTV, remote monitoring, alarm response) Security Consulting and Risk Assessment Services Training and Certification Programs (e.g., Transport Canada-regulated training) Integrated Security Platforms (combining hardware, software, and analytics) Others (e.g., cyber-physical security, incident response solutions) |

| By End-User | Logistics and Transportation Companies (road, rail, air, marine) Freight Forwarders and Customs Brokers Retail and E-commerce Businesses Government and Public Sector (CBSA, Transport Canada, ports, airports) Manufacturing and Industrial Enterprises Healthcare and Pharmaceutical Sector Others (e.g., energy, mining, agriculture) |

| By Application | Freight and Cargo Transport (road, rail, air, marine) Warehousing and Storage Security Customs and Border Protection Supply Chain Visibility and Management High-Value and Sensitive Goods Protection Others |

| By Distribution Mode | Direct Sales (manufacturer to end-user) Online Sales and E-commerce Platforms Distributors, Integrators, and Value-Added Resellers Others |

| By Security Level | Basic Security Measures (e.g., standard locks, basic surveillance) Advanced Security Solutions (e.g., biometric access, AI analytics, tamper-evident tech) Comprehensive Security Systems (integrated multi-layered solutions) Others |

| By Industry Compliance | ISO 28000 and Related Standards Compliance Transport Canada and CBSA Regulations Compliance C-TPAT, PIP, and Other International Program Compliance Others |

| By Price Range | Budget Solutions Mid-Range Solutions Premium Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Cargo Security Measures | 100 | Security Managers, Operations Directors |

| Maritime Cargo Security Protocols | 80 | Port Authorities, Compliance Officers |

| Land Transport Security Practices | 90 | Logistics Coordinators, Fleet Managers |

| Technology Adoption in Cargo Security | 60 | IT Security Specialists, Technology Officers |

| Regulatory Compliance in Cargo Handling | 50 | Customs Officials, Regulatory Affairs Managers |

The Canada Cargo Security Market is valued at approximately USD 900 million, reflecting a significant growth driven by increasing concerns over cargo theft, regulatory compliance, and the demand for secure logistics solutions.