Region:Africa

Author(s):Geetanshi

Product Code:KRAA2078

Pages:99

Published On:August 2025

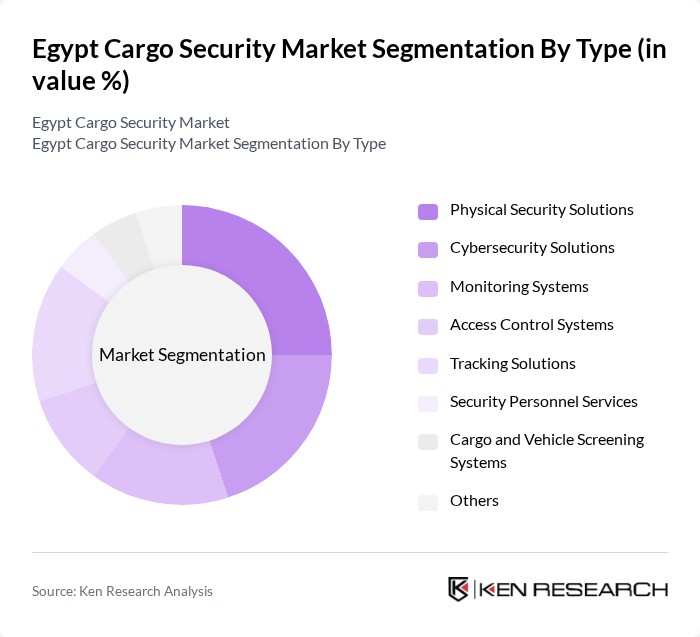

By Type:The market is segmented into a comprehensive range of security solutions addressing the evolving needs of cargo protection. Subsegments include Physical Security Solutions (such as fencing, locks, and barriers), Cybersecurity Solutions (protecting digital logistics platforms and cargo data), Monitoring Systems (CCTV, sensors), Access Control Systems (biometric and electronic entry), Tracking Solutions (GPS and RFID-based systems), Security Personnel Services (guarding and patrols), Cargo and Vehicle Screening Systems (X-ray, explosive detection), and Others. Each subsegment is integral to safeguarding cargo from theft, tampering, and unauthorized access at every stage of the logistics process .

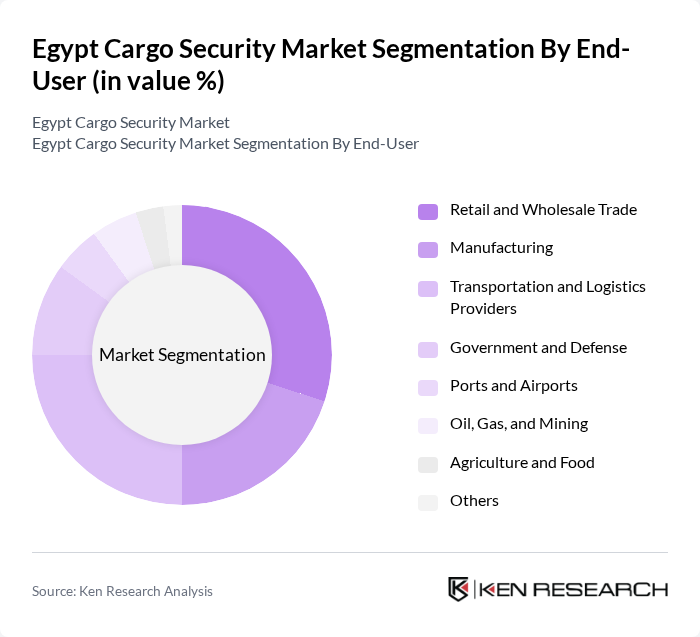

By End-User:The end-user segmentation reflects the diverse sectors utilizing cargo security solutions. These include Retail and Wholesale Trade (requiring secure supply chains for high-value goods), Manufacturing (protection of raw materials and finished products), Transportation and Logistics Providers (ensuring safe transit and delivery), Government and Defense (compliance with national security mandates), Ports and Airports (screening and monitoring for international shipments), Oil, Gas, and Mining (securing hazardous and high-value materials), Agriculture and Food (preventing contamination and theft), and Others. Each sector’s unique operational risks and regulatory requirements drive the adoption of specialized security solutions .

The Egypt Cargo Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as G4S Secure Solutions Egypt, Securitas Egypt, Secure Logistics Egypt, EgyptAir Cargo, DHL Global Forwarding Egypt, Maersk Egypt, FedEx Express Egypt, Agility Logistics Egypt, Al-Futtaim Logistics Egypt, A.P. Moller-Maersk Egypt, DB Schenker Egypt, Kuehne + Nagel Egypt, CEVA Logistics Egypt, Aramex Egypt, Smiths Detection Middle East (Egypt), Rapiscan Systems Egypt, SISCO Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt cargo security market appears promising, driven by technological advancements and increasing regulatory pressures. As businesses recognize the importance of securing their supply chains, investments in IoT and AI technologies are expected to rise significantly. Additionally, the government's commitment to enhancing infrastructure will likely create a more conducive environment for security solution providers, fostering innovation and collaboration within the industry. Overall, the market is poised for substantial growth as stakeholders prioritize security in their operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Security Solutions Cybersecurity Solutions Monitoring Systems Access Control Systems Tracking Solutions Security Personnel Services Cargo and Vehicle Screening Systems Others |

| By End-User | Retail and Wholesale Trade Manufacturing Transportation and Logistics Providers Government and Defense Ports and Airports Oil, Gas, and Mining Agriculture and Food Others |

| By Application | Freight Transport (Road, Rail, Air, Sea) Warehousing and Distribution Port and Border Operations Air Cargo Security Customs and Regulatory Compliance Others |

| By Distribution Channel | Direct Sales Online Sales Distributors System Integrators Retail Outlets Others |

| By Region | Cairo Alexandria Giza Port Said Suez Others |

| By Price Range | Low Price Mid Price High Price Premium |

| By Technology | RFID Technology GPS Tracking Biometric Systems Surveillance Cameras & Video Analytics X-ray and Scanning Systems IoT-based Security Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Cargo Security | 100 | Airport Security Managers, Cargo Operations Supervisors |

| Maritime Cargo Security | 80 | Port Security Officers, Shipping Line Managers |

| Land Freight Security | 90 | Logistics Coordinators, Fleet Managers |

| Customs and Border Security | 70 | Customs Inspectors, Border Control Agents |

| Technology in Cargo Security | 40 | IT Security Managers, Technology Providers |

The Egypt Cargo Security Market is valued at approximately USD 1.1 billion, based on a five-year historical analysis. This valuation reflects the market's share within the broader Egypt freight and logistics sector, which is estimated at just under USD 10 billion.