Region:Middle East

Author(s):Shubham

Product Code:KRAA1005

Pages:87

Published On:August 2025

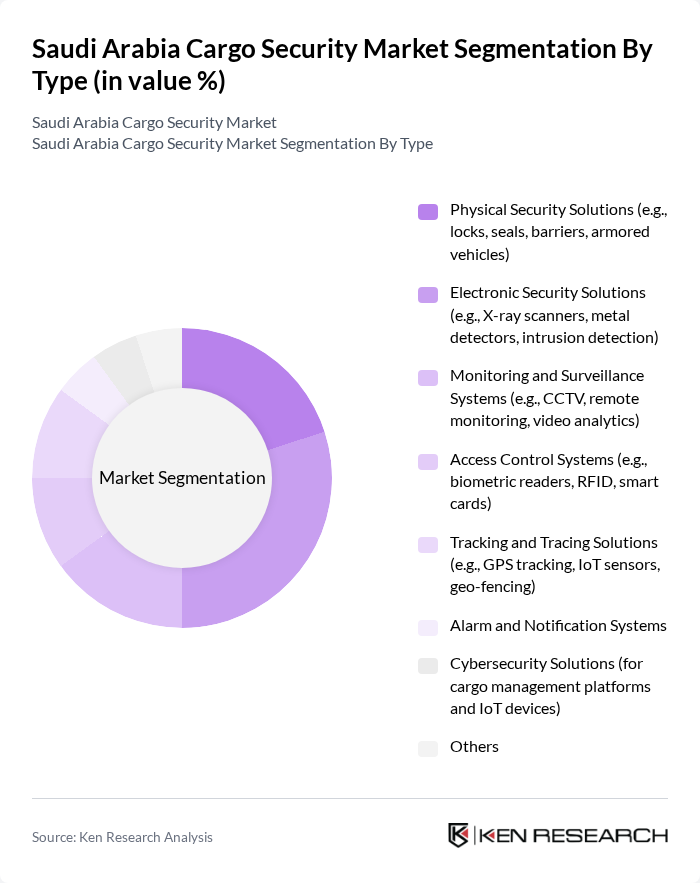

By Type:The market is segmented into various types of security solutions, including physical security solutions, electronic security solutions, monitoring and surveillance systems, access control systems, tracking and tracing solutions, alarm and notification systems, cybersecurity solutions, and others. Among these, electronic security solutions are gaining traction due to the increasing adoption of advanced technologies such as AI-powered surveillance, IoT-enabled sensors, and integrated monitoring platforms in cargo management .

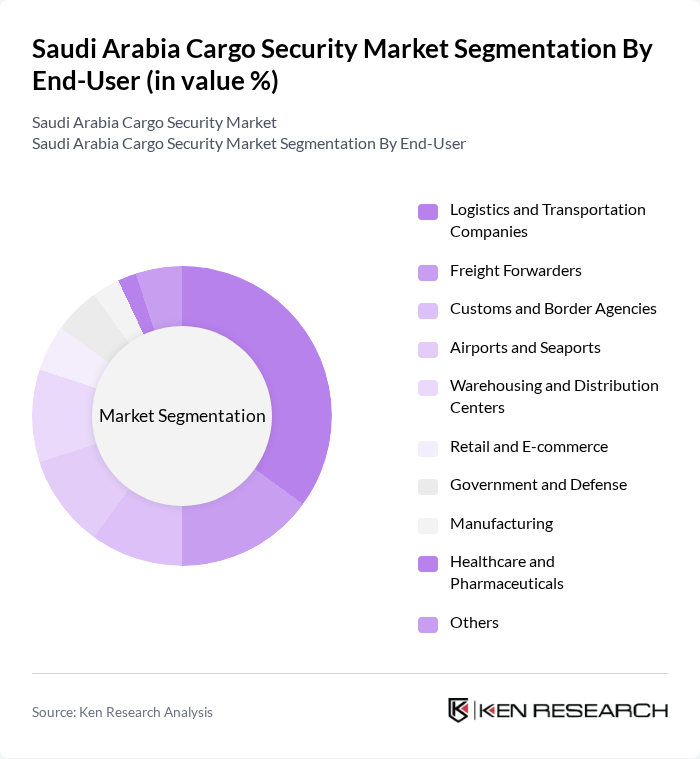

By End-User:The end-user segmentation includes logistics and transportation companies, freight forwarders, customs and border agencies, airports and seaports, warehousing and distribution centers, retail and e-commerce, government and defense, manufacturing, healthcare and pharmaceuticals, and others. Logistics and transportation companies are the leading segment due to the increasing need for secure cargo handling and transportation, as well as the rapid adoption of digital platforms and smart logistics solutions in the sector .

The Saudi Arabia Cargo Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Financial Support Services Company (SANID), Alfareeq Security Services, Metras Security Services, APSG (Arabian Peninsula Security Group), Ferrari Group, G4S Secure Solutions, Securitas AB, Honeywell International Inc., Siemens AG, Axis Communications AB, Bosch Security Systems, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Genetec Inc., Avigilon Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia cargo security market appears promising, driven by technological advancements and increasing regulatory pressures. As businesses seek to enhance their security measures, the integration of artificial intelligence and automation will become more prevalent. Additionally, the growing focus on cybersecurity will necessitate the development of comprehensive security frameworks that address both physical and digital threats, ensuring the protection of cargo throughout the supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Security Solutions (e.g., locks, seals, barriers, armored vehicles) Electronic Security Solutions (e.g., X-ray scanners, metal detectors, intrusion detection) Monitoring and Surveillance Systems (e.g., CCTV, remote monitoring, video analytics) Access Control Systems (e.g., biometric readers, RFID, smart cards) Tracking and Tracing Solutions (e.g., GPS tracking, IoT sensors, geo-fencing) Alarm and Notification Systems Cybersecurity Solutions (for cargo management platforms and IoT devices) Others |

| By End-User | Logistics and Transportation Companies Freight Forwarders Customs and Border Agencies Airports and Seaports Warehousing and Distribution Centers Retail and E-commerce Government and Defense Manufacturing Healthcare and Pharmaceuticals Others |

| By Application | Freight Transportation Security Warehousing Security Customs and Border Protection Supply Chain Visibility and Risk Management Last-Mile Delivery Security Others |

| By Distribution Channel | Direct Sales System Integrators Distributors and Resellers Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Service Type | Installation Services Maintenance & Support Services Consulting & Compliance Services Monitoring Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Cargo Security | 100 | Security Managers, Operations Directors |

| Maritime Cargo Security | 80 | Port Authorities, Logistics Coordinators |

| Land Transport Security | 70 | Fleet Managers, Safety Officers |

| Customs and Regulatory Compliance | 50 | Customs Officials, Compliance Managers |

| Technology Solutions in Cargo Security | 60 | IT Managers, Security Technology Providers |

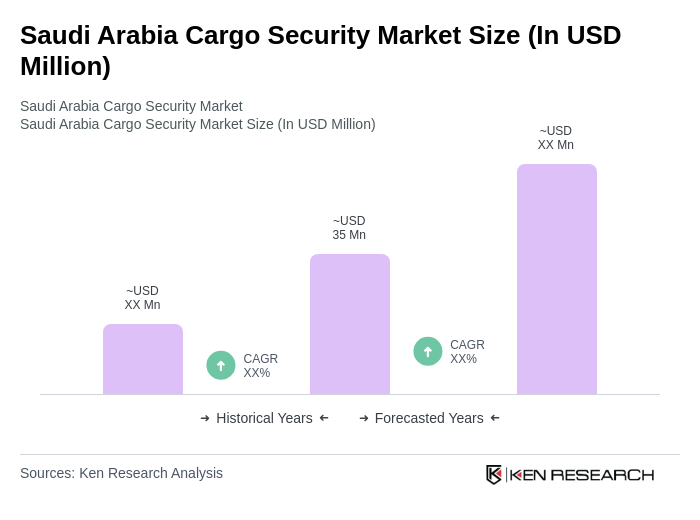

The Saudi Arabia Cargo Security Market is valued at approximately USD 35 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for secure logistics solutions and heightened awareness of cargo theft.