Region:Global

Author(s):Shubham

Product Code:KRAA0902

Pages:81

Published On:August 2025

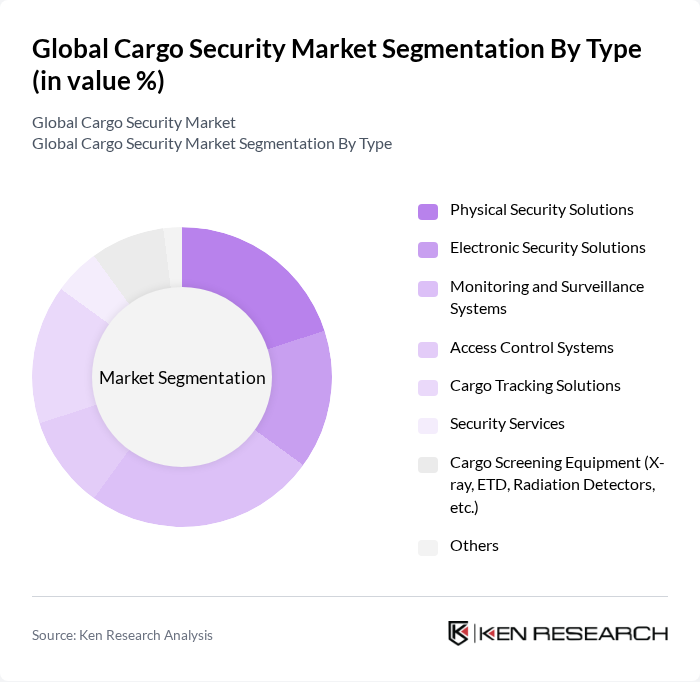

By Type:The cargo security market can be segmented into various types, including Physical Security Solutions (such as locks, barriers, and seals), Electronic Security Solutions (including alarms and sensors), Monitoring and Surveillance Systems (CCTV, remote monitoring), Access Control Systems (biometric and card-based entry), Cargo Tracking Solutions (GPS, RFID), Security Services (guarding, patrolling), Cargo Screening Equipment (X-ray, Explosive Trace Detection, Radiation Detectors), and Others. Each of these subsegments plays a crucial role in ensuring the safety and integrity of cargo during transportation by addressing specific threat vectors and operational requirements .

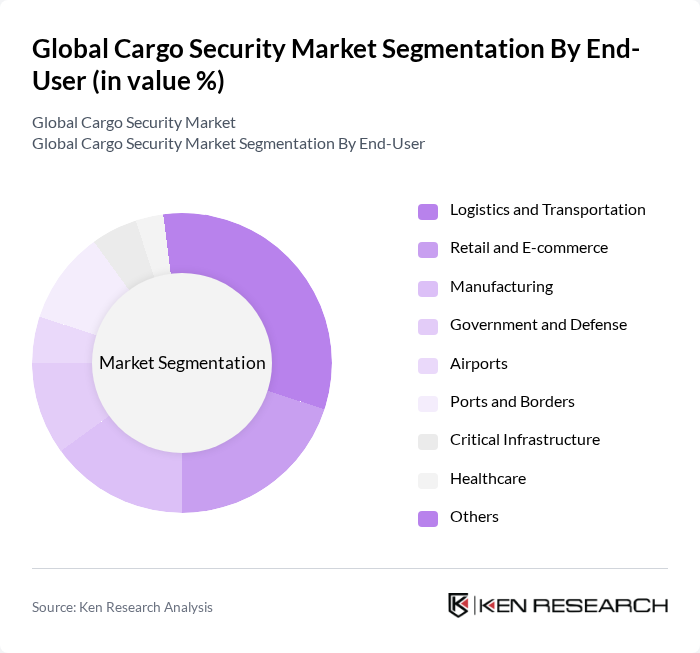

By End-User:The end-user segmentation includes Logistics and Transportation (freight forwarders, third-party logistics providers), Retail and E-commerce (online and brick-and-mortar retailers), Manufacturing (industrial and consumer goods producers), Government and Defense (customs, border security, military logistics), Airports (airport authorities and cargo handlers), Ports and Borders (port operators, customs agencies), Critical Infrastructure (energy, utilities, telecom), Healthcare (pharmaceutical and medical device logistics), and Others. Each end-user segment has unique security needs that drive the demand for tailored cargo security solutions, such as compliance with sector-specific regulations, protection of high-value or sensitive goods, and integration with broader supply chain security frameworks .

The Global Cargo Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smiths Detection Group Ltd., Leidos Holdings, Inc., OSI Systems, Inc. (Rapiscan Systems), Nuctech Company Limited, Securitas AB, G4S plc, ADT Inc., Honeywell International Inc., Siemens AG, Bosch Security Systems, Axis Communications AB, Hikvision Digital Technology Co., Ltd., Johnson Controls International plc, FLIR Systems, Inc., Genetec Inc., Avigilon Corporation (Motorola Solutions), Zebra Technologies Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cargo security market appears promising, driven by the increasing integration of advanced technologies and the growing emphasis on supply chain resilience. As businesses prioritize security in logistics, investments in IoT and AI solutions are expected to rise significantly. Additionally, the ongoing expansion of e-commerce logistics will further fuel demand for innovative security measures, ensuring that cargo remains protected throughout the supply chain. This trend will likely lead to a more secure and efficient cargo transport environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Security Solutions Electronic Security Solutions Monitoring and Surveillance Systems Access Control Systems Cargo Tracking Solutions Security Services Cargo Screening Equipment (X-ray, ETD, Radiation Detectors, etc.) Others |

| By End-User | Logistics and Transportation Retail and E-commerce Manufacturing Government and Defense Airports Ports and Borders Critical Infrastructure Healthcare Others |

| By Application | Air Cargo Security Sea Cargo Security Land Cargo Security Warehousing Security Vehicle Screening Others |

| By Distribution Channel | Direct Sales Online Sales Distributors and Resellers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| By Security Level | High Security Medium Security Low Security Others |

| By Price Range | Premium Mid-range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Cargo Security Measures | 60 | Security Managers, Compliance Officers |

| Maritime Cargo Theft Prevention | 50 | Port Security Directors, Logistics Coordinators |

| Land Transport Security Protocols | 45 | Fleet Managers, Risk Assessment Analysts |

| High-Value Cargo Protection Strategies | 55 | Insurance Underwriters, Security Consultants |

| Technology Adoption in Cargo Security | 40 | IT Managers, Operations Directors |

The Global Cargo Security Market is valued at approximately USD 2.9 billion, driven by the increasing need for secure transportation of goods and advancements in technology such as automated screening and AI-based threat detection.