Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2026

Pages:93

Published On:August 2025

By Solution Type:The solution type segmentation includes various technologies and systems designed to enhance cargo security. The subsegments are Physical Security Devices (Locks, Seals, Barriers), Electronic Security Devices (CCTV, Alarms, Sensors), Tracking & Monitoring Solutions (GPS, RFID, IoT Sensors), Access Control Systems, Security Software & Platforms (Fleet Management, Analytics), and Integrated Security Systems. Each of these subsegments plays a crucial role in addressing specific security challenges faced by the logistics and transportation sectors. Hardware solutions and tracking platforms are increasingly adopted to improve container security and reduce theft, while software offerings are gaining traction for operational efficiency .

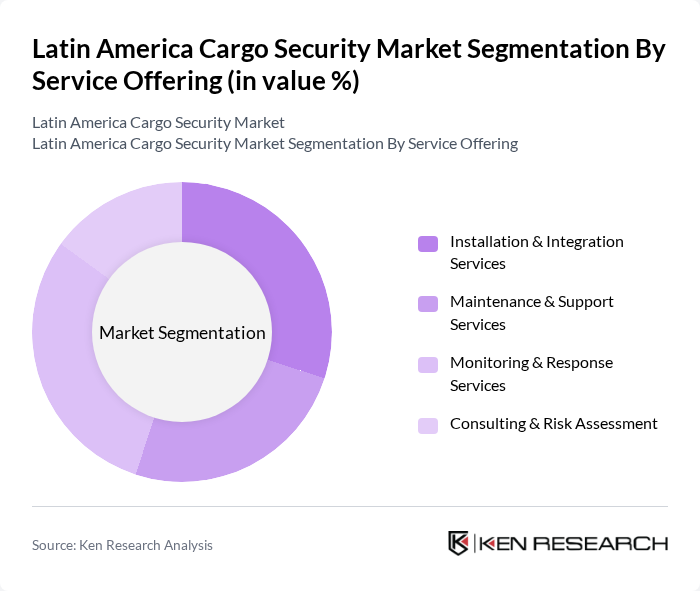

By Service Offering:This segmentation focuses on the various services provided to enhance cargo security. The subsegments include Installation & Integration Services, Maintenance & Support Services, Monitoring & Response Services, and Consulting & Risk Assessment. These services are essential for ensuring that security systems are effectively implemented and maintained, thereby maximizing their effectiveness in protecting cargo. Service offerings such as installation and maintenance are critical for the reliability of tracking systems, especially in regions with varying infrastructure quality .

The Latin America Cargo Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as G4S plc, Securitas AB, Prosegur Compañía de Seguridad, S.A., Brink's Company, Grupo Protege S/A, Seguritech Privada S.A. de C.V., Johnson Controls International plc, Bosch Security Systems, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Honeywell International Inc., Sensitech Inc., Cargo Tracck (Brazil), SecureTech Solutions contribute to innovation, geographic expansion, and service delivery in this space. Major players are focusing on technology adoption, including IoT, AI, and real-time tracking, to enhance security and operational efficiency .

The future of the cargo security market in Latin America appears promising, driven by technological advancements and increasing trade activities. As businesses prioritize security, the integration of IoT and AI technologies will become more prevalent, enhancing real-time monitoring capabilities. Additionally, the growing emphasis on sustainability will influence security practices, leading to eco-friendly solutions. Stakeholders must adapt to evolving regulations and invest in innovative technologies to remain competitive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Physical Security Devices (Locks, Seals, Barriers) Electronic Security Devices (CCTV, Alarms, Sensors) Tracking & Monitoring Solutions (GPS, RFID, IoT Sensors) Access Control Systems Security Software & Platforms (Fleet Management, Analytics) Integrated Security Systems |

| By Service Offering | Installation & Integration Services Maintenance & Support Services Monitoring & Response Services Consulting & Risk Assessment |

| By End-User Industry | Logistics & Transportation Companies Freight Forwarders Shipping Lines & Port Operators Retail & E-commerce Manufacturing Government & Customs Authorities |

| By Mode of Transportation | Road Rail Air Sea |

| By Security Level | Basic Security Solutions Advanced Security Solutions Comprehensive/Integrated Security Solutions |

| By Country | Brazil Mexico Argentina Chile Colombia Peru Rest of Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Sector Cargo Security | 120 | Logistics Managers, Security Officers |

| Cargo Insurance Market Insights | 90 | Insurance Underwriters, Risk Managers |

| Government Regulatory Impact | 60 | Policy Makers, Regulatory Compliance Officers |

| Technology Adoption in Cargo Security | 50 | IT Managers, Security Technology Specialists |

| Impact of Cargo Theft on Supply Chains | 70 | Supply Chain Analysts, Operations Directors |

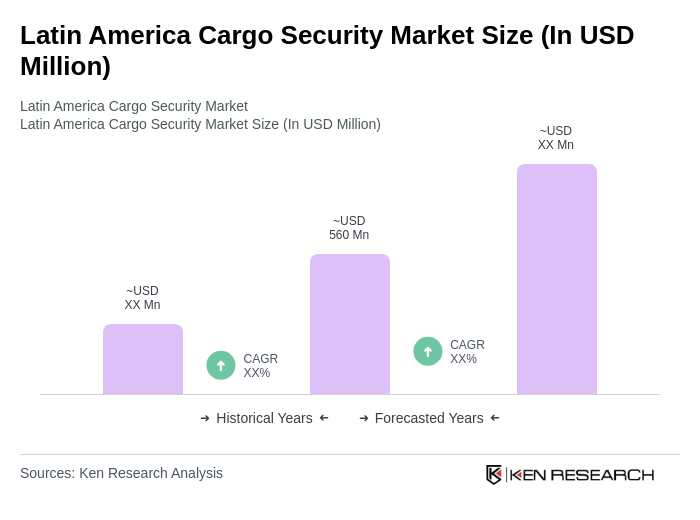

The Latin America Cargo Security Market is valued at approximately USD 560 million, driven by the increasing need for secure transportation of goods, rising cargo theft incidents, and the growth of e-commerce requiring enhanced security measures throughout the supply chain.