Region:Global

Author(s):Dev

Product Code:KRAC0428

Pages:96

Published On:August 2025

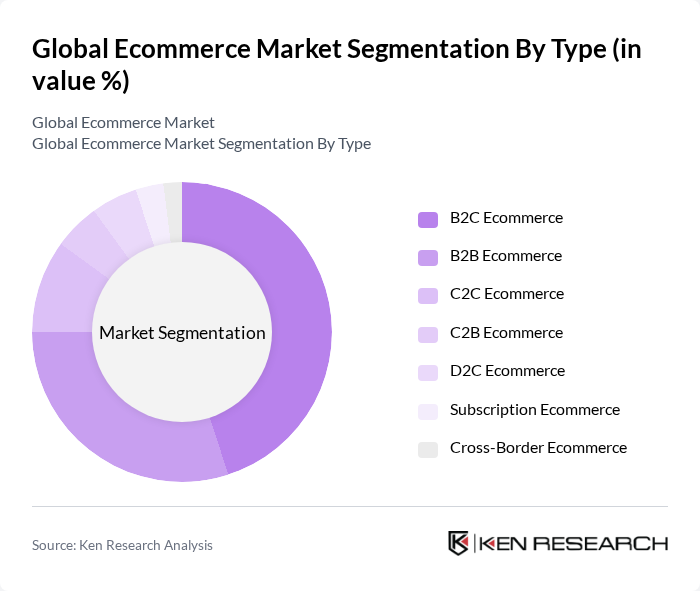

By Type:The ecommerce market can be segmented into B2C, B2B, C2C, C2B, D2C, Subscription, and Cross-Border Ecommerce. B2C Ecommerce is widely recognized as the largest segment by sales given the sheer scale of consumer online retail, while B2B Ecommerce is also substantial as companies digitize procurement and sales. Growth is further fueled by mobile commerce, social commerce, and integrated digital payments that reduce friction across customer journeys ; .

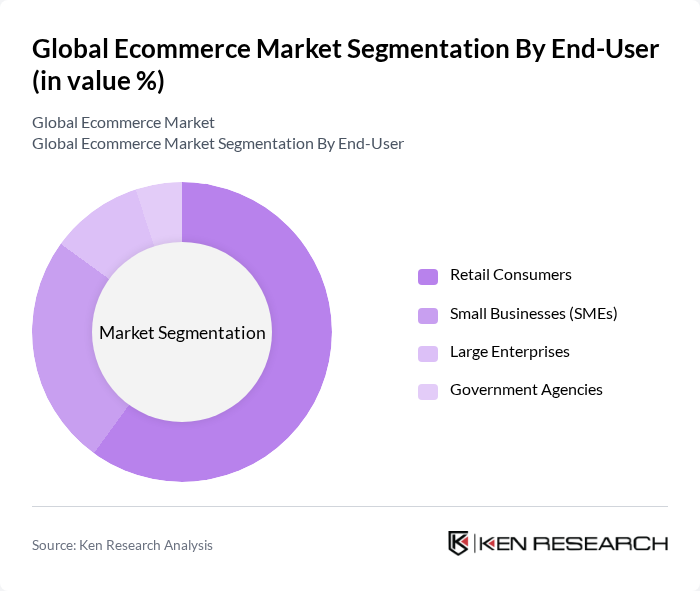

By End-User:The ecommerce market can also be segmented by end-users, including Retail Consumers, Small Businesses (SMEs), Large Enterprises, and Government Agencies. Retail Consumers represent the largest segment due to the convenience and breadth of online retail. SMEs and large enterprises increasingly use ecommerce for reach and efficiency, while government agencies apply digital procurement and service delivery models, aided by secure payments and compliance tooling .

The Global Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.com, Inc., Alibaba Group Holding Limited, eBay Inc., Shopify Inc., Walmart Inc., Rakuten Group, Inc., JD.com, Inc., Zalando SE, Target Corporation, Best Buy Co., Inc., Wayfair Inc., Flipkart Internet Private Limited, MercadoLibre, Inc., ASOS Plc, Etsy, Inc., Pinduoduo Inc. (PDD Holdings), Sea Limited (Shopee), Coupang, Inc., Otto Group, Noon.com, Jumia Technologies AG, Allegro.eu SA, Bukalapak.com Tbk, Lazada Group, Myntra Designs Private Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the ecommerce market appears promising, driven by technological advancements and changing consumer preferences. As businesses increasingly adopt artificial intelligence and automation, operational efficiencies will improve, enhancing customer experiences. Additionally, the integration of augmented reality in online shopping is expected to revolutionize product visualization, further engaging consumers. The focus on sustainability will also shape ecommerce strategies, as companies strive to meet the growing demand for eco-friendly practices and products, ensuring long-term viability in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Ecommerce B2B Ecommerce C2C Ecommerce C2B Ecommerce D2C Ecommerce Subscription Ecommerce Cross-Border Ecommerce |

| By End-User | Retail Consumers Small Businesses (SMEs) Large Enterprises Government Agencies |

| By Sales Channel | Online Marketplaces Brand Websites Social Commerce Platforms Mobile Apps |

| By Product Category | Electronics Fashion & Apparel Home & Furniture Health, Beauty & Personal Care Grocery & FMCG Digital Goods & Services Automotive Parts & Accessories |

| By Payment Method | Credit/Debit Cards Digital Wallets (e.g., Apple Pay, Alipay, PayPal) Bank Transfers Cash on Delivery Buy Now, Pay Later (BNPL) |

| By Delivery Method | Standard Shipping Express Shipping Click and Collect (BOPIS) Same-Day/On-Demand Delivery |

| By Customer Demographics | Age Groups Income Levels Urban vs. Rural Digital Adoption & Shopping Preferences |

| By Geography | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retail Market | 120 | E-commerce Managers, Marketing Directors |

| Consumer Electronics E-commerce | 100 | Product Managers, Sales Executives |

| Fashion and Apparel E-commerce | 80 | Brand Managers, Supply Chain Coordinators |

| Grocery Delivery Services | 70 | Operations Managers, Customer Experience Leads |

| Health and Beauty Online Sales | 90 | Category Managers, Digital Marketing Specialists |

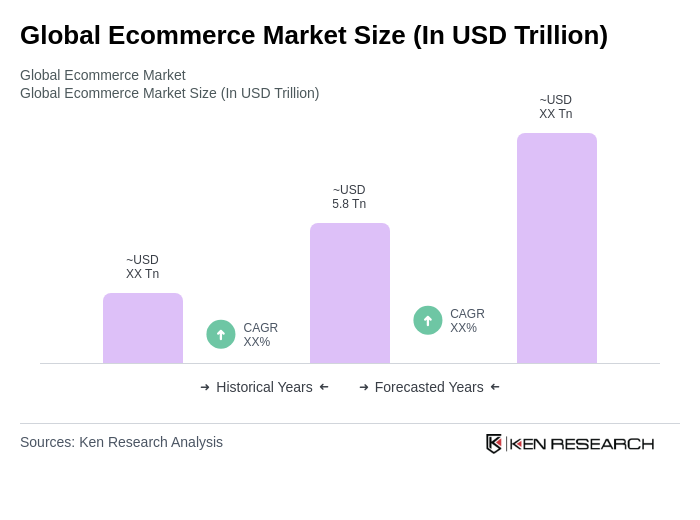

The Global Ecommerce Market is valued at approximately USD 5.8 trillion, reflecting significant growth driven by increased internet access, mobile adoption, and consumer preferences for convenient online shopping experiences.