Region:North America

Author(s):Shubham

Product Code:KRAA0708

Pages:87

Published On:August 2025

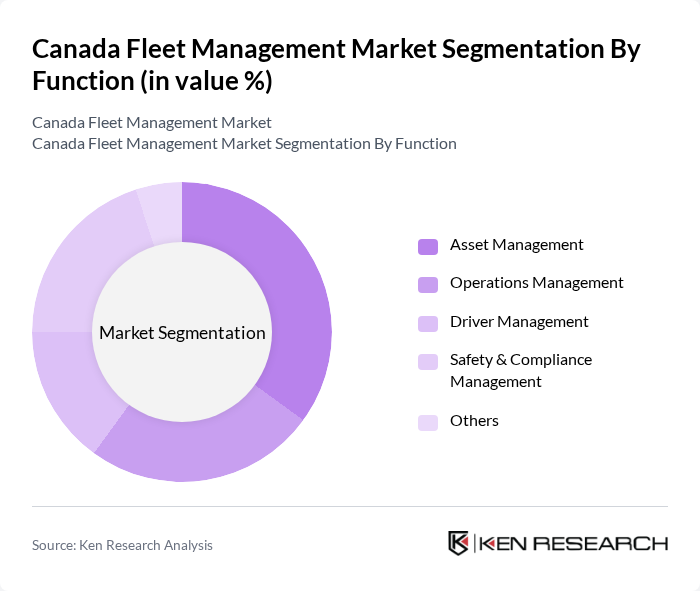

By Function:The fleet management market is segmented into various functions that cater to different operational needs. The primary functions include Asset Management, Operations Management, Driver Management, Safety & Compliance Management, and Others. Each of these functions plays a crucial role in enhancing the efficiency and effectiveness of fleet operations. Among these, Asset Management is particularly dominant as companies increasingly focus on optimizing their fleet assets to reduce costs and improve service delivery .

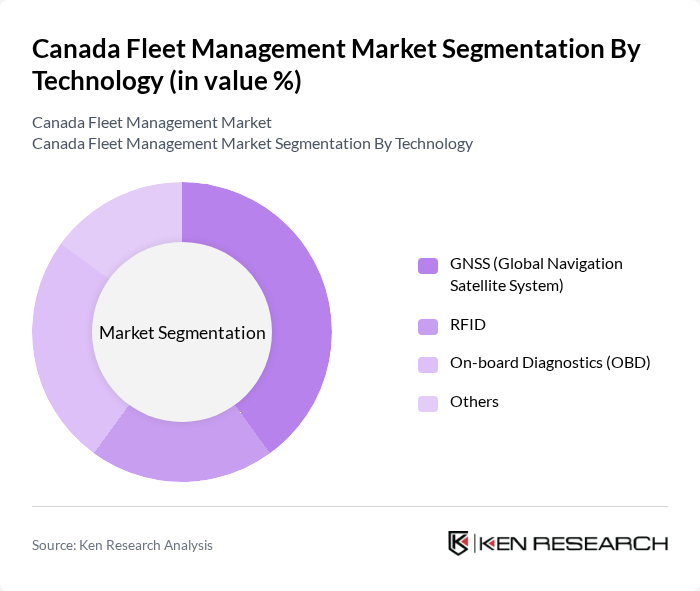

By Technology:The technology segment of the fleet management market includes GNSS (Global Navigation Satellite System), RFID, On-board Diagnostics (OBD), and Others. The integration of advanced technologies is essential for enhancing fleet visibility and operational efficiency. GNSS technology is leading this segment, as it provides real-time tracking and monitoring capabilities, which are critical for fleet optimization and management .

The Canada Fleet Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab Inc., Fleet Complete, Verizon Connect, Teletrac Navman, Trimble Transportation, Samsara, Zonar Systems, Omnitracs, Webfleet Solutions (Bridgestone), KeepTruckin (Motive), Fleetio, Telemetry Solutions, Gurtam, Inseego Corp., Chevin Fleet Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian fleet management market appears promising, driven by technological innovations and a growing emphasis on sustainability. As companies increasingly adopt electric vehicles, the market is expected to witness a shift towards greener fleet solutions. Furthermore, the integration of artificial intelligence and machine learning will enhance operational efficiencies, enabling real-time decision-making. These trends will likely reshape the competitive landscape, encouraging investment in advanced fleet management technologies and sustainable practices.

| Segment | Sub-Segments |

|---|---|

| By Function | Asset Management Operations Management Driver Management Safety & Compliance Management Others |

| By Technology | GNSS (Global Navigation Satellite System) RFID On-board Diagnostics (OBD) Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid Others |

| By Vehicle Type | Light Commercial Vehicles Heavy Commercial Vehicles Passenger Cars Others |

| By Industry | Transportation & Logistics Construction Government & Public Sector Retail & E-commerce Healthcare Oil & Gas Utilities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Sector Fleet Management | 100 | Fleet Managers, City Transportation Officials |

| Construction Industry Fleets | 60 | Project Managers, Equipment Supervisors |

| Logistics and Delivery Fleets | 110 | Operations Directors, Logistics Coordinators |

| Corporate Fleet Management | 80 | Procurement Managers, Fleet Analysts |

| Technology Adoption in Fleet Management | 50 | IT Managers, Fleet Technology Specialists |

The Canada Fleet Management Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by the demand for efficient fleet operations, safety measures, and advanced technologies like telematics and GPS tracking.