Region:Central and South America

Author(s):Shubham

Product Code:KRAA0877

Pages:90

Published On:August 2025

By Type:The market is segmented into various types of fleet management solutions, including GPS Fleet Tracking, Fleet Maintenance Software, Fuel Management Solutions, Driver Management Systems, Telematics Solutions, Fleet Safety Solutions, Route Optimization Solutions, Compliance Management Solutions, and Others. Each of these sub-segments is essential for enhancing operational efficiency, regulatory compliance, and cost reduction for fleet operators. GPS Fleet Tracking and Telematics Solutions are particularly prominent, reflecting the market’s focus on real-time monitoring and data-driven optimization .

By End-User:The end-user segmentation includes Transportation and Logistics, Construction, Public Sector (Municipal Fleets, Police, Emergency Services), Retail and Distribution, Oil & Gas and Mining, Utilities and Field Services, Healthcare, and Others. Each sector has distinct operational needs, with Transportation and Logistics leading due to the high volume of commercial vehicles and the critical importance of timely delivery. The Construction and Public Sector segments also represent significant demand, driven by the need for asset tracking, safety, and regulatory compliance .

The Colombia Fleet Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab, MiX Telematics, Omnitracs, Verizon Connect, Pointer by PowerFleet, CarSync, Webfleet (Bridgestone), FleetUp, Trimble, Gurtam, TomTom Telematics, Fleet Complete, Inseego, GPS7000 (Colombia), and Satelital Colombia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Colombian fleet management market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt electric vehicles, the demand for innovative fleet management solutions will rise. Additionally, the integration of AI and IoT technologies is expected to enhance operational efficiency and safety. With government support for green initiatives, the market is poised for significant transformation, aligning with global trends towards sustainable transportation solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | GPS Fleet Tracking Fleet Maintenance Software Fuel Management Solutions Driver Management Systems Telematics Solutions Fleet Safety Solutions Route Optimization Solutions Compliance Management Solutions Others |

| By End-User | Transportation and Logistics Construction Public Sector (Municipal Fleets, Police, Emergency Services) Retail and Distribution Oil & Gas and Mining Utilities and Field Services Healthcare Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) Enterprise Fleets (200+ Vehicles) Others |

| By Service Type | Subscription-Based Services One-Time Purchase Solutions Managed Services Consulting and Integration Services Others |

| By Geographic Coverage | Urban Areas Rural Areas National Coverage Cross-Border Fleets Others |

| By Technology Integration | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions AI-Enabled Solutions IoT-Integrated Solutions Others |

| By Pricing Model | Pay-As-You-Go Tiered Pricing Flat Rate Usage-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Fleet Management | 100 | Fleet Managers, City Transport Officials |

| Logistics and Delivery Services | 80 | Operations Managers, Logistics Coordinators |

| Corporate Fleet Operations | 60 | Fleet Administrators, Procurement Managers |

| Technology Providers in Fleet Management | 40 | Product Managers, Business Development Executives |

| Vehicle Leasing and Rental Services | 70 | Sales Managers, Customer Service Representatives |

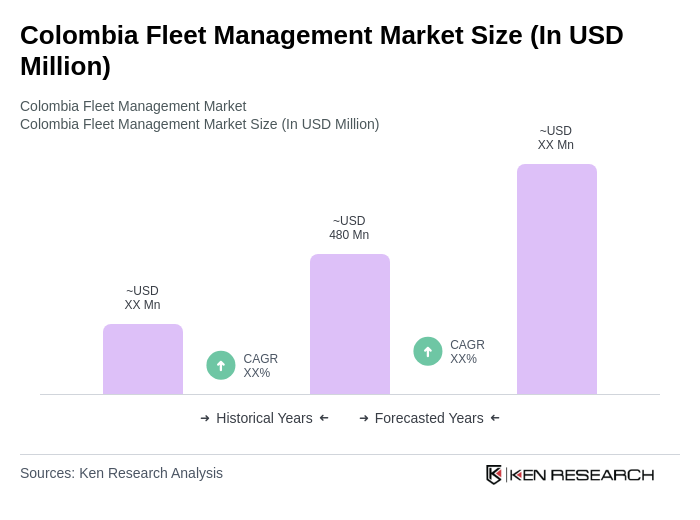

The Colombia Fleet Management Market is valued at approximately USD 480 million, reflecting a significant growth driven by the demand for efficient logistics, the expansion of e-commerce, and the adoption of advanced technologies like telematics and GPS tracking.