Germany Fleet Management Market Overview

- The Germany Fleet Management Market is valued at USD 1.7 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for efficient fleet operations, rapid adoption of telematics and IoT technologies, and the need for cost reduction in logistics and transportation sectors. The market is further influenced by the push for sustainability, adoption of electric vehicles, and compliance with stringent emission regulations, which encourage companies to implement advanced fleet management solutions .

- Key cities such as Berlin, Munich, and Frankfurt dominate the market due to their robust transportation infrastructure, high concentration of logistics companies, and significant investments in digital mobility solutions. These urban centers serve as critical hubs for both domestic and international trade, facilitating the growth of fleet management services that cater to diverse industries, including transportation, construction, and public services .

- In 2023, the German government implemented the Mobility Data Act (Mobilitätsdatengesetz), issued by the Federal Ministry for Digital and Transport. This regulation mandates the collection and sharing of mobility data among fleet operators and public authorities, aiming to enhance the efficiency of transportation systems and promote sustainable mobility solutions. The act requires operators to provide standardized, real-time data access to authorized entities, supporting the development of innovative fleet management technologies and services .

Germany Fleet Management Market Segmentation

By Type:The market is segmented into various types of fleet management solutions, including Vehicle Tracking Systems, Fleet Telematics Solutions, Fuel Management Systems, Maintenance Management Software, Driver Management Solutions, Route Optimization Tools, Asset Tracking Solutions, Compliance Management Systems, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency, reducing costs, and ensuring regulatory compliance for fleet operators .

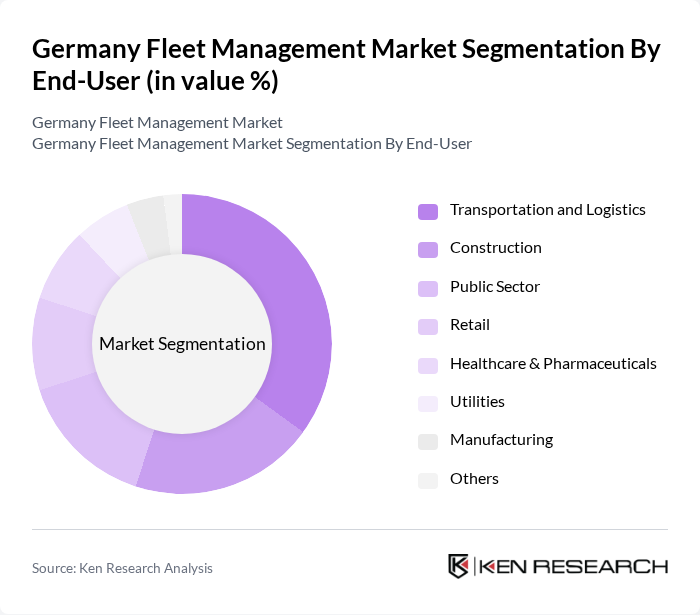

By End-User:The end-user segmentation includes Transportation and Logistics, Construction, Public Sector, Retail, Healthcare & Pharmaceuticals, Utilities, Manufacturing, and Others. Each sector has unique requirements and challenges, driving the demand for tailored fleet management solutions that enhance productivity, safety, and regulatory compliance .

Germany Fleet Management Market Competitive Landscape

The Germany Fleet Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Webfleet Solutions (Bridgestone Mobility Solutions), Daimler Fleet Management (Mercedes-Benz Connectivity Services), Fleet Complete, Geotab Inc., Teletrac Navman, Verizon Connect, Omnicomm, ZF Friedrichshafen AG, TomTom Telematics, Zubie, Fleetio, Samsara, Microlise, Chevin Fleet Solutions, ARI Fleet Management, Gurtam, Inseego, ProFleet contribute to innovation, geographic expansion, and service delivery in this space.

Germany Fleet Management Market Industry Analysis

Growth Drivers

- Increasing Demand for Cost Efficiency:The German fleet management sector is experiencing a surge in demand for cost efficiency, driven by rising operational costs. In future, logistics costs in Germany are projected to reach approximately €110 billion, prompting companies to seek solutions that optimize fuel consumption and reduce maintenance expenses. Fleet management systems can lead to savings of up to €2,200 per vehicle annually, making them an attractive investment for businesses aiming to enhance profitability while managing expenses effectively.

- Adoption of Telematics and IoT Solutions:The integration of telematics and IoT solutions is revolutionizing fleet management in Germany. By future, the telematics market is expected to grow to €1.6 billion, driven by advancements in real-time tracking and data analytics. Companies utilizing these technologies can improve route efficiency by 15%, significantly reducing fuel costs and enhancing delivery times. This technological shift is essential for businesses aiming to stay competitive in a rapidly evolving logistics landscape.

- Regulatory Compliance and Sustainability Initiatives:Germany's stringent regulatory environment is pushing fleet operators to adopt sustainable practices. The government aims to reduce greenhouse gas emissions by 55% in future, which necessitates the adoption of eco-friendly fleet management solutions. In future, it is estimated that 30% of fleets will incorporate electric vehicles, driven by incentives and regulations. This shift not only aids compliance but also enhances corporate social responsibility, appealing to environmentally conscious consumers.

Market Challenges

- High Initial Investment Costs:One of the significant barriers to fleet management adoption in Germany is the high initial investment required for advanced technologies. The average cost of implementing a comprehensive fleet management system can exceed €10,500 per vehicle. This upfront expenditure can deter small and medium-sized enterprises (SMEs) from investing in necessary technologies, limiting their ability to compete effectively in the market and hindering overall industry growth.

- Data Security and Privacy Concerns:As fleet management systems increasingly rely on data collection and analytics, concerns regarding data security and privacy are rising. In future, it is projected that cyberattacks on logistics companies will increase by 25%, leading to potential data breaches. Compliance with the General Data Protection Regulation (GDPR) adds complexity, as companies must ensure that customer and operational data is adequately protected, creating a significant challenge for fleet operators.

Germany Fleet Management Market Future Outlook

The future of the fleet management market in Germany is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As companies increasingly prioritize sustainability, the integration of electric vehicles and green logistics practices will become more prevalent. Additionally, the rise of mobility-as-a-service (MaaS) will reshape traditional fleet operations, encouraging businesses to adopt innovative solutions that enhance efficiency and reduce environmental impact. The focus on real-time data analytics will further empower fleet operators to make informed decisions, optimizing their operations.

Market Opportunities

- Expansion of Electric Vehicle Fleets:The transition to electric vehicles presents a significant opportunity for fleet operators in Germany. With government incentives projected to reach €1.1 billion in future, companies can reduce operational costs while meeting sustainability goals. This shift not only aligns with regulatory requirements but also enhances brand reputation among eco-conscious consumers, driving demand for electric fleet solutions.

- Growth in Demand for Fleet Optimization Software:The increasing complexity of logistics operations is driving demand for advanced fleet optimization software. By future, the market for such software is expected to grow to €850 million, as businesses seek to enhance efficiency and reduce costs. This presents a lucrative opportunity for software developers to create innovative solutions that cater to the specific needs of fleet operators, ultimately improving operational performance.