Region:Global

Author(s):Shubham

Product Code:KRAA0897

Pages:97

Published On:August 2025

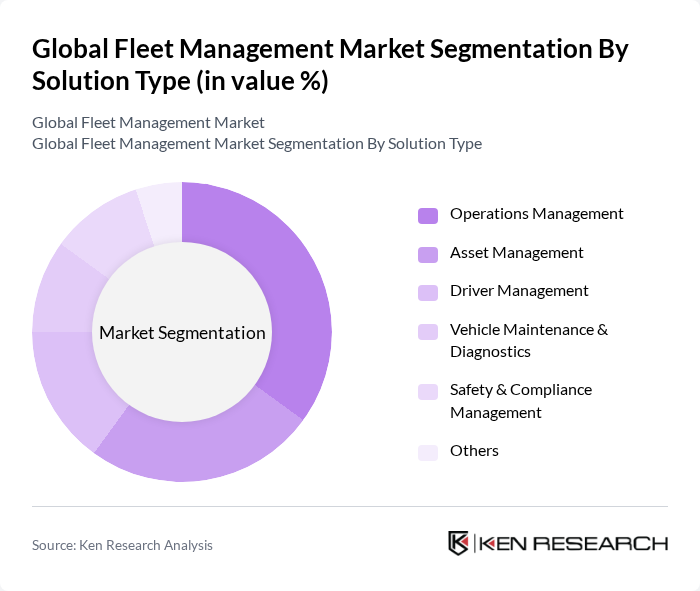

By Solution Type:The solution type segmentation includes various subsegments such as Operations Management, Asset Management, Driver Management, Vehicle Maintenance & Diagnostics, Safety & Compliance Management, and Others. Among these, Operations Management is the leading subsegment, driven by the increasing need for real-time tracking, route optimization, and digitalization of fleet operations. Companies are increasingly adopting solutions that enhance operational efficiency, reduce costs, and improve service delivery. The growing trend of digital transformation in logistics and transportation, as well as the integration of telematics and IoT devices, further supports the dominance of this subsegment .

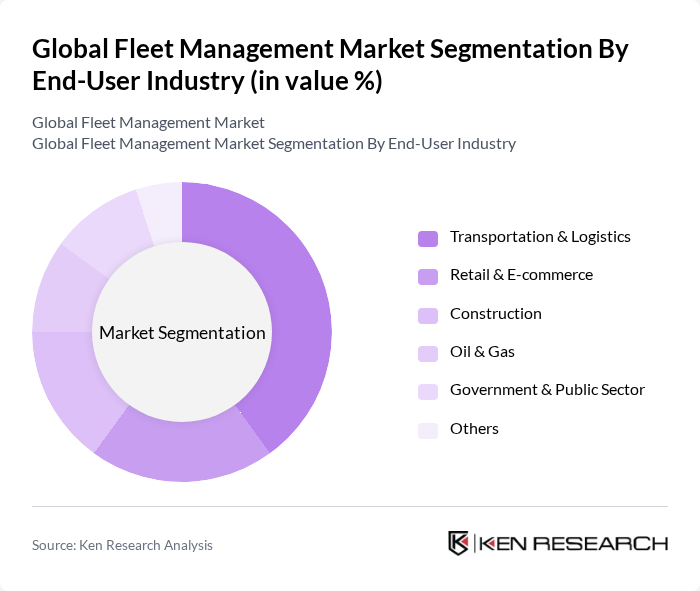

By End-User Industry:The end-user industry segmentation encompasses Transportation & Logistics, Retail & E-commerce, Construction, Oil & Gas, Government & Public Sector, and Others. The Transportation & Logistics sector is the dominant subsegment, fueled by the rapid growth of e-commerce, last-mile delivery, and the increasing demand for efficient supply chain solutions. Companies in this sector are leveraging fleet management solutions to enhance operational efficiency, reduce costs, improve regulatory compliance, and increase customer satisfaction. The ongoing digital transformation and the need for real-time data analytics further bolster the growth of this subsegment .

The Global Fleet Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab Inc., Verizon Connect, Samsara Inc., Trimble Inc., Omnitracs LLC, Teletrac Navman, Fleet Complete, MiX Telematics Ltd., TomTom Telematics (Bridgestone Mobility Solutions), Motive Technologies Inc. (formerly KeepTruckin), Chevin Fleet Solutions, ARI Fleet Management (Holman Inc.), Element Fleet Management Corp., Donlen Corporation, Wheels, Inc., GPS Insight, Gurtam, Solera Holdings LLC, Avrios International AG, JSC Teltonika contribute to innovation, geographic expansion, and service delivery in this space.

The future of fleet management is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly prioritize sustainability, the adoption of electric and hybrid vehicles is expected to rise, reshaping fleet compositions. Additionally, the integration of AI and advanced analytics will enhance operational efficiencies, enabling predictive maintenance and optimized routing. These trends indicate a shift towards more intelligent, eco-friendly fleet management solutions that align with global sustainability goals and operational demands.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Operations Management Asset Management Driver Management Vehicle Maintenance & Diagnostics Safety & Compliance Management Others |

| By End-User Industry | Transportation & Logistics Retail & E-commerce Construction Oil & Gas Government & Public Sector Others |

| By Fleet Size | Small Fleet (1-50 Vehicles) Medium Fleet (51-200 Vehicles) Large Fleet (201+ Vehicles) |

| By Deployment Mode | On-Premise Cloud-Based |

| By Vehicle Type | Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) Passenger Cars Others |

| By Geography | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transportation Fleets | 80 | Transit Authority Officials, Fleet Supervisors |

| Construction Vehicle Fleets | 60 | Project Managers, Equipment Managers |

| Corporate Fleet Operations | 50 | Corporate Fleet Managers, Procurement Officers |

| Technology Adoption in Fleet Management | 40 | IT Managers, Software Implementation Specialists |

The Global Fleet Management Market is valued at approximately USD 29 billion, driven by the increasing demand for operational efficiency, cost reduction, and enhanced safety measures in fleet operations.