Region:Europe

Author(s):Shubham

Product Code:KRAA1072

Pages:85

Published On:August 2025

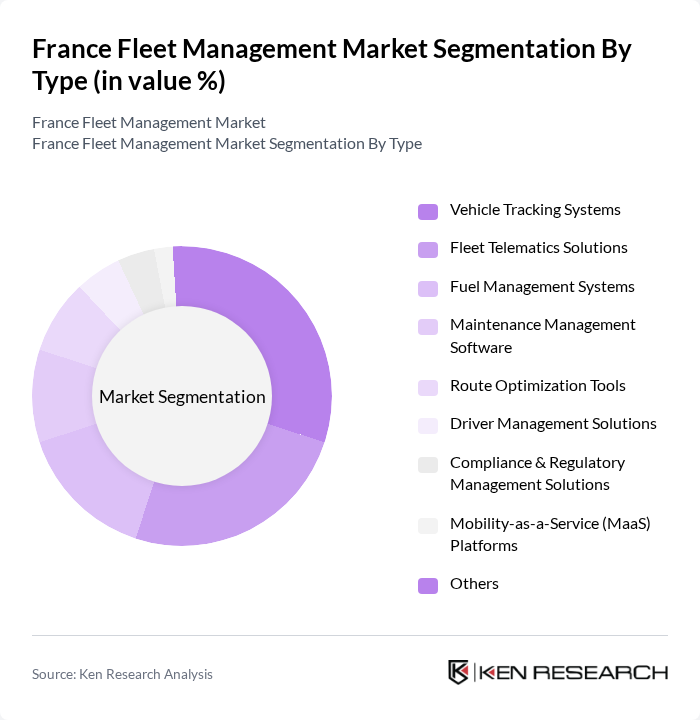

By Type:The market is segmented into various types of fleet management solutions, including Vehicle Tracking Systems, Fleet Telematics Solutions, Fuel Management Systems, Maintenance Management Software, Route Optimization Tools, Driver Management Solutions, Compliance & Regulatory Management Solutions, Mobility-as-a-Service (MaaS) Platforms, and Others. Among these, Vehicle Tracking Systems and Fleet Telematics Solutions are leading the market due to their critical role in enhancing operational efficiency, reducing costs, and enabling real-time data-driven decision-making. Businesses increasingly rely on these technologies to monitor vehicle locations, optimize routes, manage driver behavior, and improve overall fleet performance .

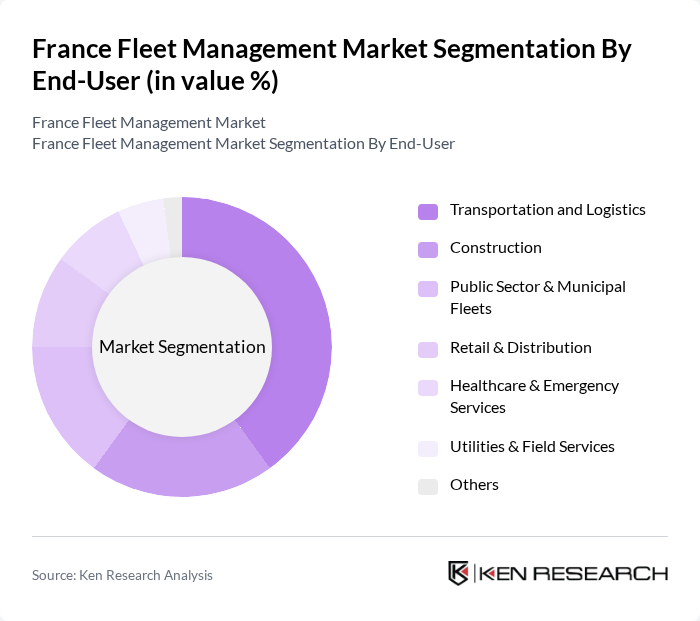

By End-User:The end-user segmentation includes Transportation and Logistics, Construction, Public Sector & Municipal Fleets, Retail & Distribution, Healthcare & Emergency Services, Utilities & Field Services, and Others. The Transportation and Logistics sector is the dominant segment, driven by the increasing demand for efficient delivery services, real-time tracking, and comprehensive fleet management. Companies in this sector are adopting advanced telematics and analytics solutions to enhance operational efficiency, ensure regulatory compliance, and meet evolving customer expectations .

The France Fleet Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab, Teletrac Navman, Fleet Complete, Verizon Connect, Webfleet (Bridgestone Mobility Solutions), Masternaut (a Michelin Group Company), GEFCO (now part of CEVA Logistics), Microlise, Gurtam, Fleetonomy (acquired by Via), Samsara, Chevin Fleet Solutions, ABAX, Inseego, ProFleet (France) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fleet management market in France appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly prioritize eco-friendly practices, the shift towards electric vehicles is expected to gain momentum, supported by government incentives. Additionally, the rise of Mobility-as-a-Service (MaaS) will reshape transportation dynamics, encouraging fleet operators to innovate and adapt. These trends will likely foster a more integrated and efficient fleet management ecosystem, enhancing operational capabilities and customer satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Vehicle Tracking Systems Fleet Telematics Solutions Fuel Management Systems Maintenance Management Software Route Optimization Tools Driver Management Solutions Compliance & Regulatory Management Solutions Mobility-as-a-Service (MaaS) Platforms Others |

| By End-User | Transportation and Logistics Construction Public Sector & Municipal Fleets Retail & Distribution Healthcare & Emergency Services Utilities & Field Services Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) |

| By Service Type | Software as a Service (SaaS) Managed Services Consulting & Integration Services |

| By Deployment Mode | On-Premises Cloud-Based |

| By Geographic Coverage | National Coverage Regional Coverage |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transport Fleet Optimization | 60 | Transport Planners, Fleet Supervisors |

| Construction Vehicle Management | 50 | Project Managers, Equipment Managers |

| Corporate Fleet Leasing | 40 | Leasing Managers, Financial Analysts |

| Telematics and Fleet Technology | 45 | IT Managers, Technology Officers |

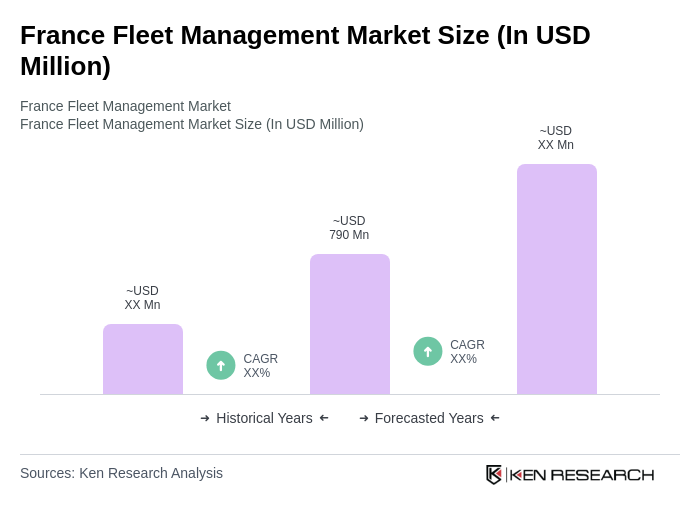

The France Fleet Management Market is valued at approximately USD 790 million, reflecting a significant growth driven by the increasing demand for operational efficiency, cost reduction, and enhanced vehicle utilization among businesses, particularly in e-commerce and logistics sectors.