Region:North America

Author(s):Shubham

Product Code:KRAC0801

Pages:83

Published On:August 2025

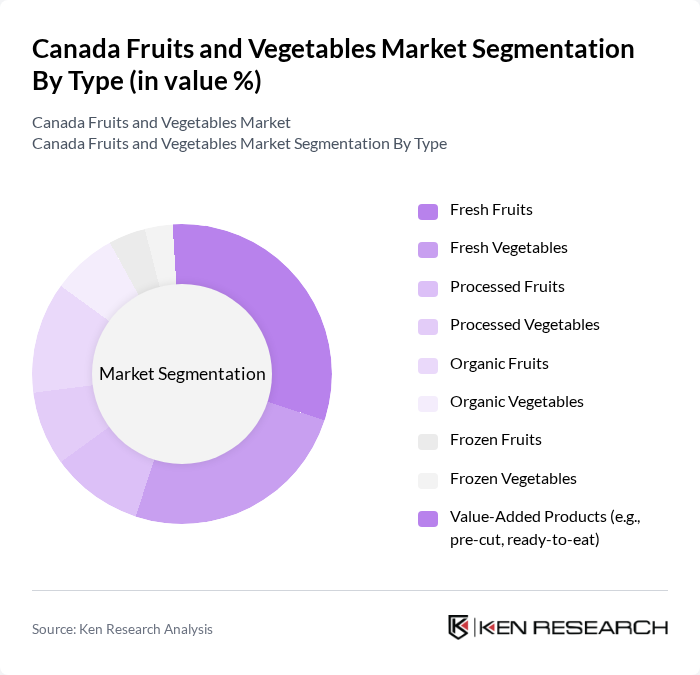

By Type:The market is segmented into various types, including Fresh Fruits, Fresh Vegetables, Processed Fruits, Processed Vegetables, Organic Fruits, Organic Vegetables, Frozen Fruits, Frozen Vegetables, and Value-Added Products (e.g., pre-cut, ready-to-eat). Each sub-segment caters to different consumer preferences and dietary needs, withfresh fruits and vegetablesleading the market due to their health benefits, convenience, and increasing demand for minimally processed foods. Organic and value-added products are also experiencing notable growth, reflecting consumer interest in food safety, traceability, and convenience .

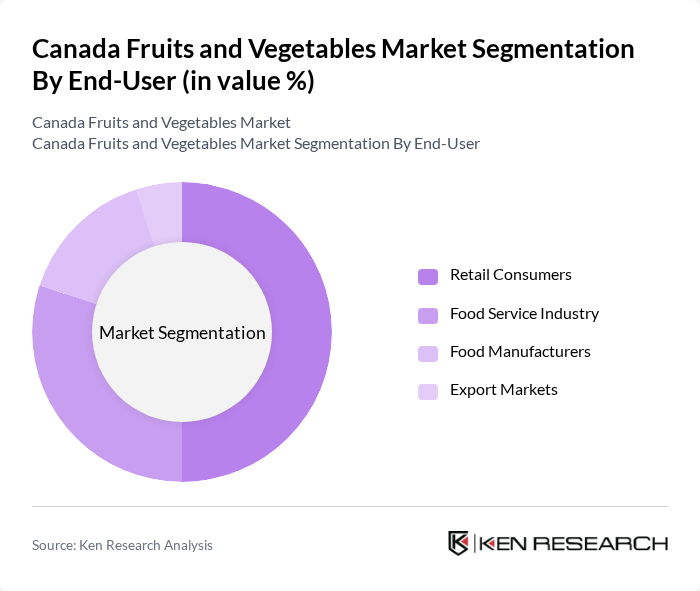

By End-User:The market is segmented by end-users, including Retail Consumers, Food Service Industry, Food Manufacturers, and Export Markets.Retail consumersdominate the market, driven by increasing demand for fresh produce in households, while the food service industry is also significant due to the growing trend of healthy eating in restaurants and cafes. Food manufacturers and export markets are expanding, supported by innovation in processing and packaging .

The Canada Fruits and Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fresh Del Monte Produce Inc., Dole plc, The Green Organic Dutchman Holdings Ltd., Sunfresh Farms Ltd., Highline Mushrooms, Nature Fresh Farms, Ocean Spray Cranberries, Inc., Canada Bread Company, Limited, Bonduelle Americas, Mastronardi Produce Ltd. (SUNSET), The Produce Terminal, Ontario Greenhouse Vegetable Growers, FreshPoint Canada, BC Blueberry Council, Canadian Organic Growers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian fruits and vegetables market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for fresh and organic produce is expected to grow. Additionally, innovations in agricultural technology, such as precision farming and vertical farming, will enhance productivity and sustainability. These trends, coupled with government support for local farmers, will likely create a more resilient and dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Fruits Fresh Vegetables Processed Fruits Processed Vegetables Organic Fruits Organic Vegetables Frozen Fruits Frozen Vegetables Value-Added Products (e.g., pre-cut, ready-to-eat) |

| By End-User | Retail Consumers Food Service Industry Food Manufacturers Export Markets |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Farmers' Markets Wholesale Distributors Direct-to-Consumer (Subscription/Box Schemes) |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Region | Western Canada (British Columbia, Alberta, Saskatchewan, Manitoba) Central Canada (Ontario, Quebec) Eastern Canada (New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island) Northern Canada (Yukon, Northwest Territories, Nunavut) |

| By Price Range | Premium Mid-Range Budget |

| By Product Lifecycle Stage | Introduction Growth Maturity Decline |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fruit Sales | 100 | Store Managers, Category Buyers |

| Wholesale Vegetable Distribution | 80 | Wholesale Distributors, Supply Chain Managers |

| Consumer Purchasing Behavior | 150 | General Consumers, Health-Conscious Shoppers |

| Organic Produce Market | 60 | Organic Farmers, Retailers of Organic Products |

| Export Market Insights | 50 | Export Managers, Trade Analysts |

The Canada Fruits and Vegetables Market is valued at approximately USD 14.1 billion, reflecting a significant growth trend driven by health consciousness, plant-based diets, and sustainable farming practices among consumers.